The short answer to this question is that there isn’t one.

Even as a kid I was conscious of this unspoken acceptance that you worked until age 65 then retired. When my dad took up a happy opportunity to call time before that age, it was referred to as “early retirement”. But there is nothing anywhere that says that has to be the case.

It’s true that some individual businesses, for example professional partnerships like legal or accounting firms for example, sometimes put stipulations on senior partners to give it away at a particular age, to make way for younger partners to move up the ladder. But this is not indicative of any broader legal requirement.

It boils down to when you want to. And of course there is also the little matter of whether you can afford to! We can certainly help there – plenty of resources in our Retirement Hub. Having said all that, there are a couple of important dates/ages that will come into your calculations.

Preservation Age

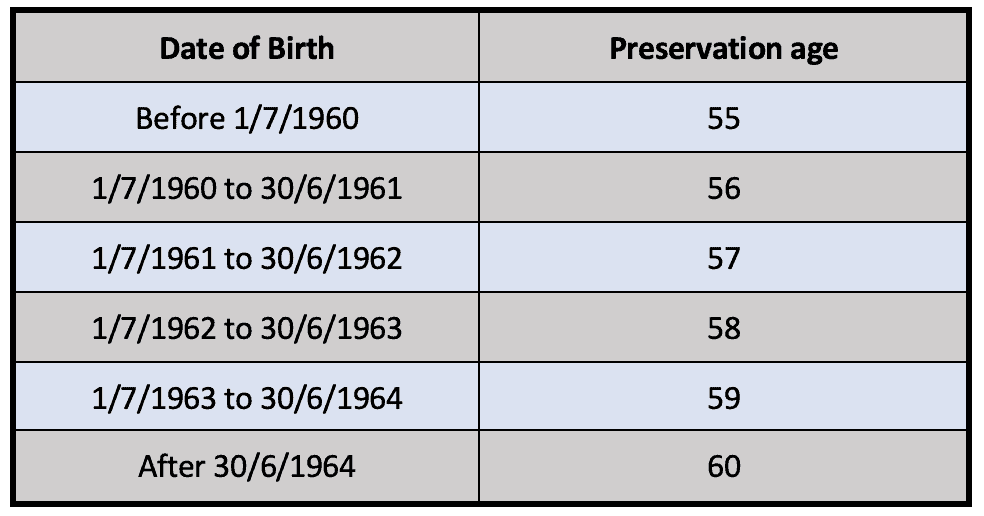

This is the term for the age at which you can access your superannuation. It is likely that is where a fair chunk of your retirement nest egg will reside, so access to it will be a critical piece in your retirement planning.

Firstly, if you reach age 65, then generally you can access your superannuation without restriction, as a lump sum or as an ongoing superannuation pension income stream, and it will be tax free. This is the case whether you are still working or not.

If you are under 65, but reach “preservation age” according to the table below, then:

- If you retire from the workforce, you can access your superannuation without restriction. Retirement in this context involves you making a declaration that you will not work more than ten hours a week in the future.

- If you continue to work (more than the ten hours per week) you can access some of your super by way of a Transition to Retirement Income Stream (TRIS). This is an income stream payable from your fund which must be more than 4% of your balance annually, and less than 10%. Note, once you reach age 65 these restrictions cease and your access to super is unrestricted.

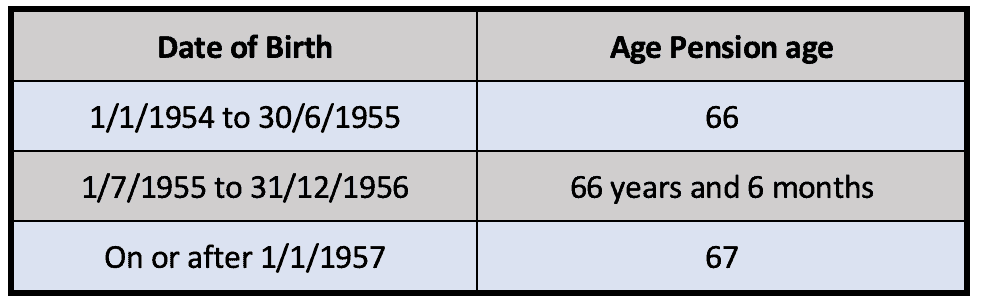

Age Pension age

This is the age at which you become eligible for the most common form of income supplement available to older Australians, the Age pension. The Age pension is subject to means tests on both your income and assets, but can provide valuable additional cash and fringe benefits and so is a critical component of retirement income planning. Eligibility by age is shown below:

So, the answer to the initial question is pretty simple. Putting it into practice is a bit more involved.

Interestingly it all throws up some opportunities that might not be obvious or intuitive. For instance:

- The preservation bit opens up a window whereby you will be eligible to both contribute to and withdraw from super at the same time. This can be used to structure your super for optimum tax and estate planning purposes, and

- If there is a difference in ages between spouses or partners, you might be able to use these rules to legitimately qualify for extra age pension, at least temporarily. Note that you do need to be aware of transaction limits that apply.

For some more light on the subject you might like to refer to these items:

- Click here for more information on the question of whether you can afford to retire

- Or here for a quick overview of the super system (5 simple steps to understanding super).

- Or use our Retirement Projection tool, to get a preview of how your retirement prospects look from a financial standpoint.