The dilemma is this:

- Finding the right investment mix to provide us with enough money for a comfortable retirement, now that the employment income tap has been turned off

- Without taking risks that might completely derail our plans.

So we read the papers, listen to the news and watch the talking heads on TV. And you know what the problem with that is? They talk endlessly about precisely the wrong thing!

Every day it’s “The stock market was down (or up) 1.2% today” or “property prices down (or up)”, or “billions wiped off super funds”.

Maybe that sells papers and satisfies the demands of the daily news cycle, but that is the last thing you should be worried about!

Why is that?

Well, at the risk of stating the obvious, investments generally pay a return in two ways:

- Income – Shares pay dividends, property pays rent, bank deposits pay interest;

- Capital gain (or loss) – In other words, the change in the price of what you own. That’s what the finance gurus talk about day in day out. That’s probably because prices change every day, so there’s always something to talk about, whereas the income story tends to play out slowly and steadily. Too boring!

But the fact is, unless you’re a day trader or hedge fund manager, or simply must sell something today, day to day prices are irrelevant.

What retirees actually need is a stable, secure income stream, preferably one that grows, and a sense that if they do have to sell something to meet their cash needs, it is at a time and price that suits them.

The conventional wisdom says that an investment like shares, for example, can provide a good long term return, but they are risky and very volatile. The daily media portrayal serves to reinforce this view.

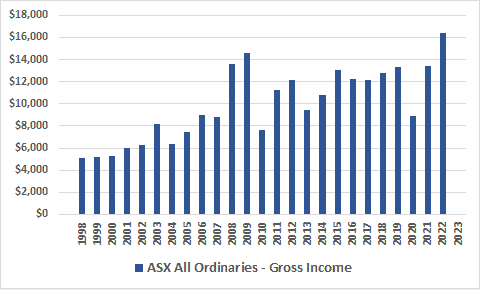

OK, let’s examine this in the light of the components of return referred to above. Here is a chart of the gross income return generated over a period of 25 years by a hypothetical investment of $100,000 made into the Australian share market at the beginning of 1998.

Data source: Australian Taxation Office

Well, that doesn’t look too risky. In fact it ticks just about every box the retiree could want. Steady, stable, growing.

What about the other part – capital gain (or loss)?

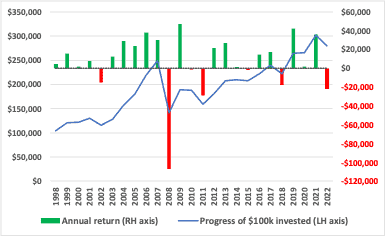

ASX All Ordinaries – annual return from price movement

Whoa! Different picture! While the long term trend – which is the blue line – is positive, some years there was hardly any return, about one year in four the value went backwards, including one year where the “loss” was over $100,000!

Uncomfortable, yes. But is it really a problem? As we alluded to earlier, only if you have to sell at a bad time.

This is the essence of investment risk for retirees. The risk around the quantity and timing of the sale of assets to supplement your income.

By its very nature, retirement for many of us will involve systematically drawing down on our nest egg over many years, to support our lifestyle. The key to managing your money prudently in retirement is to ensure that these sales of assets take place at a time and price that works for you, and that doesn’t erode your wealth unnecessarily.

In time your portfolio value will recover – you can be quite confident about that because of the relationship between the income part of the return and the capital value. We look at this further elsewhere. (See The best financial advice I ever received or What’s the market gonna do?).

The answer is not to avoid investments like shares, just because they display short term price volatility. That would just be sacrificing future returns and unnecessarily compromising your living standard in retirement.

Rather, some simple tips to managing your retirement income include these:

- First and foremost, know and understand your cash flow position. Not just for the coming week, but how you are positioned for the future. Retirement is all about cash flow – you really need to get a good handle on it.

- Importantly, understand how much of your spending requirements will be met by the income part of the return, plus other sources like the age pension, and as a result, how much will require actually selling stuff.

- Set up your portfolio so that your immediate and near term cash needs are covered by your income plus an appropriate level of cash and very stable reserves. This will help you ride through those awkward times when prices are unfavourable.

- The balance can be directed towards investments designed to do the long term heavy lifting, like shares. You will be comfortable in the knowledge that with short–medium term needs covered, you can manage the timing and quantity of asset sales to suit, according to how things unfold.

Doing this should be the ticket to the best of both worlds. A decent return, and a good night’s sleep!

And a final tip? Take the daily finance report with a grain of salt. Or not at all.