As financial advisers we deal daily in ways to make a positive difference for people, and that is a great way to make a living. I highly recommend it.

It really is very satisfying to unearth a financial benefit that the person didn’t know they were entitled to, like a Centrelink payment or a tax saving. And it’s true that we can nearly always find some immediate benefit for people.

But on a broader level and in the longer run, I think the best thing we provide is stress relief. Money can cause people a disproportionate amount of worry, and being able to relieve that burden is good for everyone.

It can happen in many ways but I’ll single out two main ones.

1. Managing investment risk

Surely a major source of stress is investment risk. But managing it doesn’t mean avoiding it.

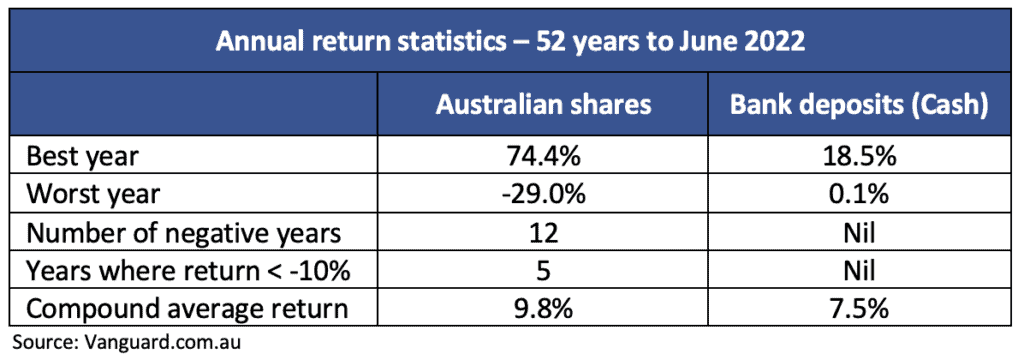

Risky investments as a general rule can and do provide a better long term return, but they can have shocking years along the way and that’s no fun. By way of illustration, here is a very long term comparison between a “risky” investment, namely Australian shares, and a “safe” one, bank deposits:

So nearly one in four years the shares went backwards, including one in ten years that were shockers. And while the cash deposits never reached the heights of shares’ potential, there was not one year where the return was negative.

The difference in the average return doesn’t look that huge, as a price to pay for security. But in reality, the mathematics of compound interest mean that over say a 30 year period, the higher return from the shares would have resulted in an outcome 92% higher than the bank deposits. That’s almost double! Which for the “safe” investor brings a whole different set of risks, namely their money running out sooner, or having to curtail their lifestyle in retirement.

So the key is not to avoid the risks, but to manage them sensibly. We speak at length about this elsewhere, (like here The Simple Truth about Investment Risk for Retirees and How to Manage it and here The Best Financial Advice I Ever Had), but the key points are these:

- You are only at risk from volatile, fluctuating investment returns if you have to sell something at a bad time;

- To avoid this, understand your cash flow position, in order to understand the quantity and timing of asset sales that will be necessary to supplement your income;

- Set up your portfolio so that near term cash requirements are covered by secure, stable investments that are not at risk from volatile markets. The remainder you can devote to things designed to do the portfolio’s heavy lifting, secure in the knowledge that you can safely wait out the stormy seasons.

Long term clients who have become accustomed to this concept live a happy life, not bothered by the common bouts of doom and gloom among investors and the blaring headlines about market crashes.

2. Succession planning

Acquiring and protecting wealth is one thing. Making sure it ends up in the right hands is another. We never stop caring for our families, and that extends to ensuring they are looked after in the way we would most like, even when we’re not around any more.

Planning for family succession is a big part of our role, and we are fortunate to work with a lawyer associate who is an expert in this field and works closely with our clients. Again, it is a load off peoples’ shoulders when they know that their family is being looked after.

Financial planning? Stress relief? Same thing!