I’d love a dollar for every time I’ve heard that question in my 36 years in the business.

Invariably “the market” refers to the Aussie stock market, and the question it seems is largely prompted by the belief that someone actually knows the answer. Which in turn might reflect that every day, in every finance section of every paper, and on every TV bulletin and every “cross to our finance expert”, we hear that “the market” is up or down x% because (delete where applicable):

- The US was up/down

- The market liked/disliked inflation/interest rates

- The market was worried/upbeat about geopolitics/pandemics/economic outlook

- All of the above.

My stock answer used to be “I have no idea”. Given the odds it wasn’t a bad strategy. On 46% of days in the last 17 years the market was down, 54% of days it was up. So the chances of a forecast looking stupid are uncomfortably high.

These days though, my answer is “It will go up. Maybe not today, or tomorrow but it will”. And as it happens I do know why after all.

See, looking at “the market” is looking at the effect, not the cause. Wrong place to look.

Investments typically provide a return in two ways:

- Capital gain (or loss). That is, the change in the price of the investment, according to the whims of investors at the time. This is what people and the media commentators are talking about when they refer to “the market”. The collective movement of prices on any given day

- Income. Bank deposits pay interest, properties earn rent, shares pay dividends. Hardly gets a guernsey in the finance updates, but it should. Because income is the driver, price is the passenger.

If you own shares, you own a portion of a business. And what makes one business worth more than another? Its profit. Or in other words, its income! A business that makes a lot is worth more than a business that makes a little. And it follows therefore that if the income grows, so will the price.

Take the Commonwealth Bank for example. In 2010 its profit was equal to about $3.54 per share. By 2018 its profit had risen to $5.18 per share, an increase of 46%. In the same period its share price also rose from about $50 to $70, a 40% increase. That’s no coincidence. As the income stream grows, the market is prepared to pay a higher price to buy into it.

So to invest for capital growth, you actually want to invest for income growth. And for retirees, this is like double prizes.

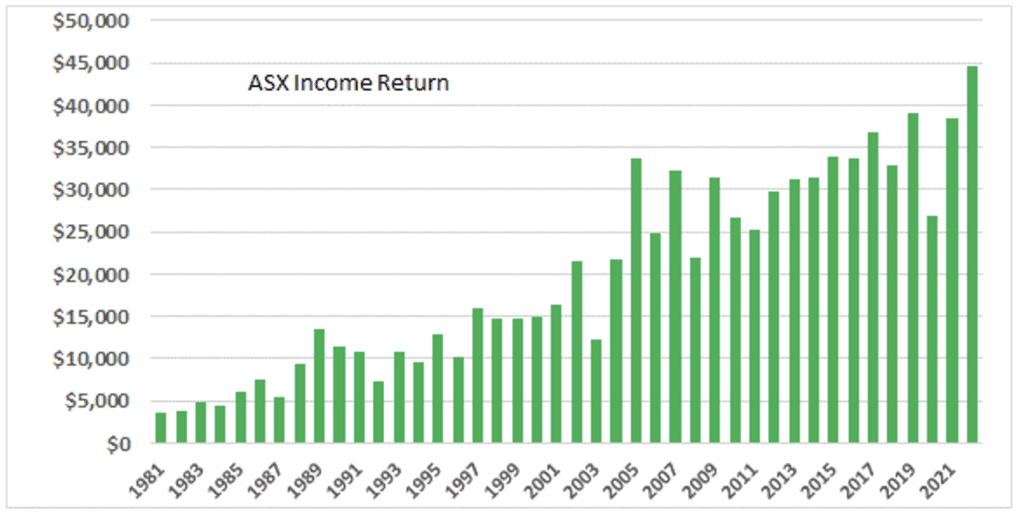

More broadly, here is the picture of dividend income earned each year by a hypothetical investment of $100,000 put into the Australian stock market back in 1981.*1

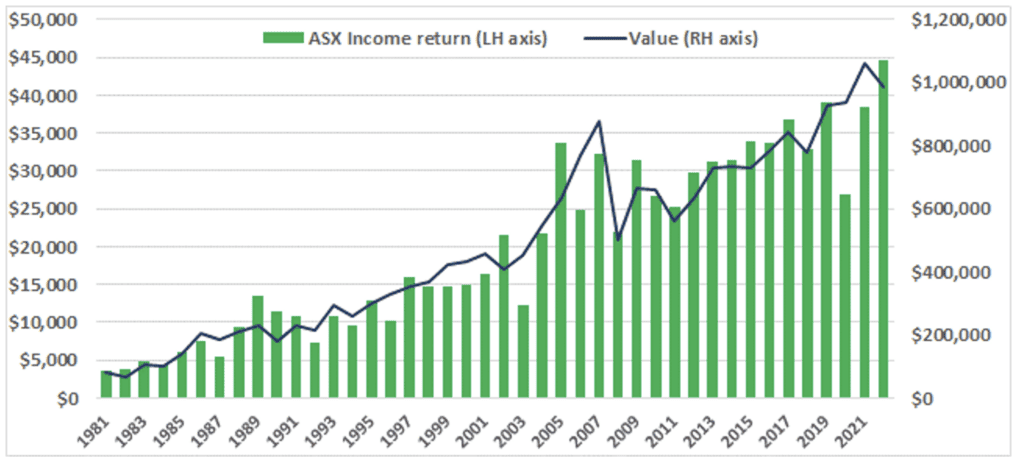

If we superimpose the corresponding movement in the underlying portfolio (i.e. reflecting “the market” movement), it looks like this.

OK, so the market line wobbles around a bit year-on-year, even more so if you were to obsess about daily movements. But the trend and correlation is unarguable. In the 42 years of the chart, the income grew tenfold. So did the original investment of $100,000.

It is really unfortunate that the endless blather about daily market movements so dominates the discussion out there. At best it’s just noise, but at worst it conditions people to look in the wrong place and perhaps make poor decisions.

You have to dig deep to find anything at all about income in the media. Where for example was the big headline in May about ANZ increasing its interim dividend from $0.72 to $0.81 per share? That’s a 12.5% jump over last year. Cause for celebration (particularly as ANZ happens to be one of the top ten holdings in the Long Term Income Builder portfolio!). And it’s sure to help support the share price longer term.

There is one caveat in all this. If you own shares (or any other similar investment for that matter) there is a time when price does matter – that’s if and when you sell. If you are forced into a position where you have to sell something to make ends meet, and it happens to be just after one of those big falls in prices – that’s bad. Very bad. It crystallises what was otherwise an unrealised loss “on paper”,and destroys some of your wealth in the process. And as most retirees living off their nest egg will by definition be systematically drawing down on capital over time, this is an issue that has to be managed.

We have extensively discussed this process and how to manage it elsewhere (see The Simple Truth about Investment Risk for Retirees – and How to Manage it for example), concluding that the key to successful investment management for retirees is a clear picture of your cash flow position. This is to understand if, when, and in what quantity it will be necessary to sell assets to meet your spending requirements. Armed with that insight, you can make a sensible, logical decision as to how much you should allocate to investments that are fit for purpose.

So why am I confident that the “It will go up. Maybe not today, or tomorrow but it will” answer is correct? Because I have no doubt that given a reasonable time horizon, the income generated en masse by the businesses that make up the market will rise. So, therefore, will the prices. And like I say, for retirees that’s double prizes.

While it’s hard to avoid it in my job, I don’t take much notice of “the market” these days. But I do take notice of those dividends!

*1 Source for market data: www.spglobal.com