If I had to nominate the most Frequently Asked Question I’ve fielded in 36 years of financial advising, it’s no contest.

“Should I switch my investment mix?”

And nearly always to something more conservative.

And nearly always, the answer is “No”. Whether or not the clients ended up heeding the advice. Why? Two reasons.

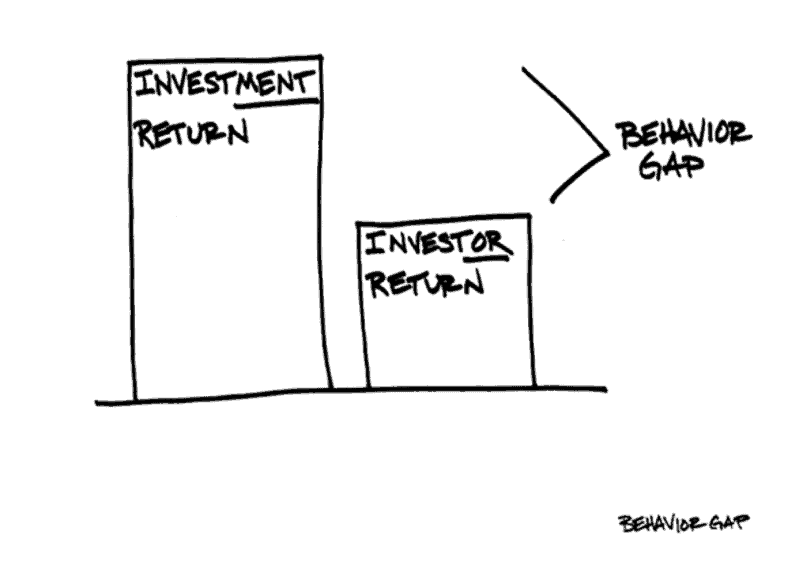

1.The Behaviour Gap.

A US-based adviser named Carl Richards is credited with coining the term “Behaviour Gap”. It describes the phenomenon whereby investor behaviour actually erodes the return being generated by the investment they are in, through ill-advised and ill-timed switching.

Typically when someone is worried about their investment and thinking of switching to something more conservative, it’s because markets have already got the wobbles and fallen. Switching at a time like that only serves to crystallise a loss and actually destroys wealth, as opposed to riding it out and letting things recover. Furthermore, if you make the call to switch out, you create a second decision for yourself – when do I go back in? Again, to be satisfied that the worst is over, typically the switcher will want to see evidence in the form of price recovery – which by definition they just missed out on.

Over the years many studies have borne this out, by collating the returns that individual investors have experienced with their fund and comparing it with what the fund actually returned for the same period. The former is consistently lower than the latter.*1 Other studies of flows in and out of investment funds confirm that a higher rate of inflows tends to occur after a strong period of returns, while a higher rate of outflows occurs after markets have already fallen.*2

It’s been likened to a full bucket of water. Leave it alone and it stays full. Pick it up, move it around and generally fiddle with it and chances are some will slop over the side and you even risk tipping the thing over and losing half your water. Best to resist the temptation.

2. Chances are you’re worrying about the wrong thing

We discuss this at some length here (The Simple Truth About Investment Risk for Retirees and How to Manage it) but in a nutshell:

- Investments typically provide a return in two ways:

- Capital growth – i.e. change in market value, or price

- Income – eg dividends, rent, interest.

- Investments that are regarded as risky and that spook people into wanting to switch, such as shares, typically exhibit a high degree of volatility in their price movements, but surprisingly little variation in their income, particularly if appropriately diversified. In fact share dividends on the whole have a wonderful history of stable, growing income – just the ticket for retirees.

- Price only matters on the day you buy and the day you sell. What happens in between is of no real consequence.

- If the income you earn is sufficient to meet your needs and you don’t have to sell anything, you are at no risk from price fluctuation. However, in retirement many of us will have to sell things from time to time to make ends meet.

- In which case you want to make sure things are set up so that you sell at the right time, not the wrong time. This means:

- Understanding your cash flow position, not just in the near future but years ahead

- This is to understand if, when, and in what quantity it will be necessary to sell assets to meet your spending requirements. This is the absolute essence of investment and risk management for retirees.

- Having enough in safe, stable investments to meet your cash needs for the immediate future, so you can ride out price volatility in the short term.

- The balance you can commit to the heavy lifters like shares, without having to worry about price fluctuation.

So, that switch question? Do it when it’s right for you, not when markets have everyone spooked.

Examples here:

*1 https://www.morningstar.in/posts/68952/the-gap-between-investor-return-and-investment-return.aspx

*2 Dalbar: Quantitative Analysis of Investor Behaviour – 2020 QAIB Report