Comment.

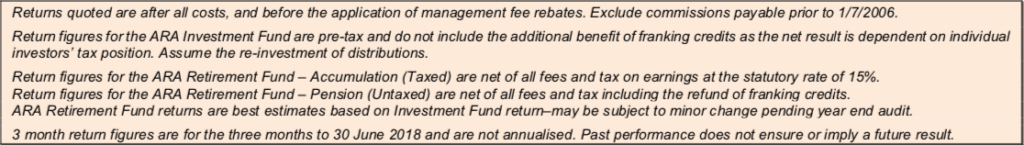

The year ended on a slow but steady note, with full year returns for each portfolio above their targets, despite the Fund holding above average cash levels.

The chart below shows the annual returns for each portfolio for each of the past five financial years. Also shown is the five-year average (orange line) and the five-year target (red line).

So the past year was OK, returns exceeded targets with a very moderate risk profile. That’s what we’re about. The ten-year and longer returns still bear the scars of the GFC and even though recent conditions have been relatively benign we must never take our eye off the risk management responsibilities we bear on your behalf. Protecting the downside in the long run bears more fruit than trying to shoot the lights out when things seem rosy

The good news for the June quarter involved the one trouble spot we have previously highlighted. Mining services company Condor Energy, a substantial holding that was having major cash flow challenges, has secured a large capital injection from an investor aligned with ARA’s interests. This is not only a significant vote of confidence in the business, it also gives the company a healthy working capital account. In the washup we were repaid about 15% of our investment at 100 cents in the dollar plus interest, and are breathing much more easily about the company’s future.

Our good friends at Anacacia Capital have opened a third private equity fund, building on the phenomenal success of Funds 1 & 2. We have committed a substantial amount, which will be drawn down over the coming years. Other than that, with listed equity markets looking fully priced, particularly in the US, and a smorgasbord of economic and political risks to navigate, our inclination is to tread carefully and keep plenty of powder dry.

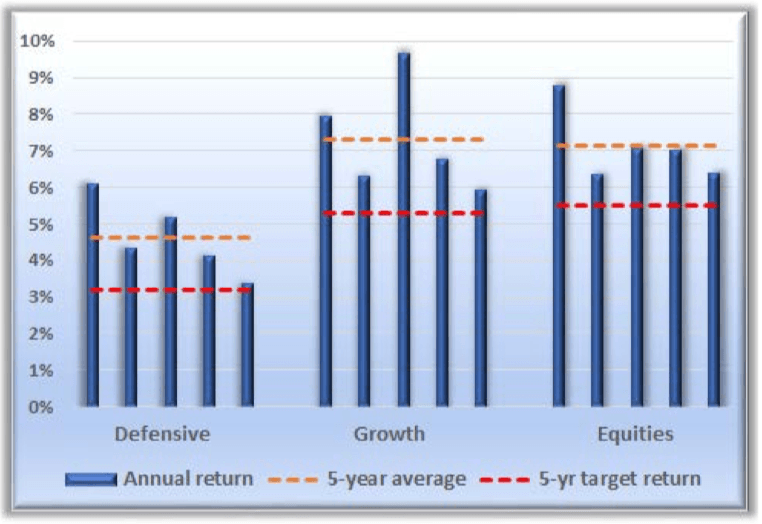

The exposure of the three portfolios to the various asset classes is currently as shown:

Major Holdings

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets, primarily through funds managed by specialist independent firms. If we drill through to the assets selected and overseen by those managers, there are in fact well over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

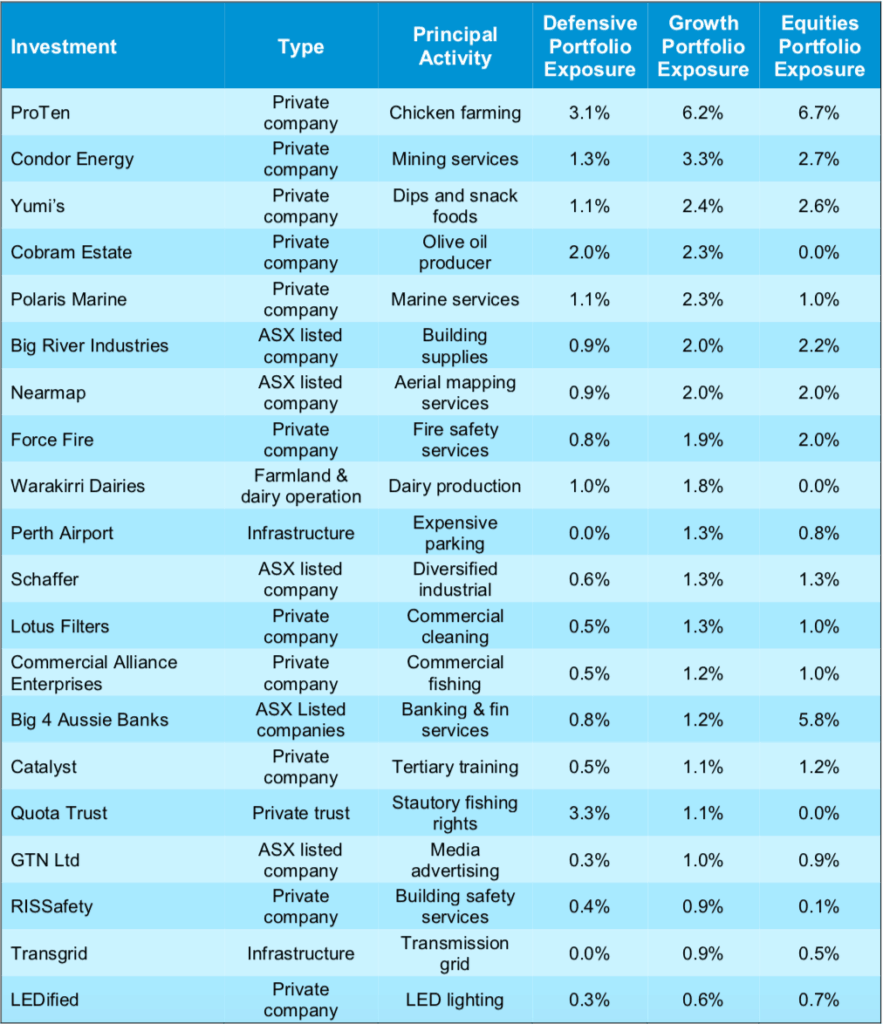

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

Reflections

Against a backdrop that included banks, super funds and financial planners copping a right Royal caning at the hands of the Commission and media (mostly thoroughly deserved), this year ARA and its investment funds quietly celebrated their 15th. birthdays.

It’s a source of immense pride that we now look after the financial interests of 750 families – including in some cases three generations of the same clan. And that, of our first 25 clients, 21 are still with us 15 years on. We now pay out about $20,000,000 a year in pension payments and income distributions to support the lifestyles and retirements of those families. And not a day goes by that we are not humbled by and grateful for the privilege.

Along the way, we abolished all commissions, incoming and outgoing, and reduced overall fees by applying volume fee rebates across aggregate family groups’ balances and across all our investment products. We were, if not the first in the industry to adopt these measures, we were pretty darn close.

We aim to be around for a long while yet, and have a few plans to keep things fresh.

It is our intention to formally implement a Responsible Investment overlay into our investment strategy and governance process. This will have a number of facets including:

-

A negative screening process – to eliminate those activities from which we would not wish to profit. This might include, gambling, armaments manufacture, tobacco, fossil fuels etc.

-

A positive screening – designed to ensure investee companies adopt appropriate policies as to treatment of all stakeholders, including employees, clients (fancy that!), suppliers, the community and the environment

- Exposure to companies whose activities are designed to have a positive impact in sectors deemed desirable – e.g. environment, climate, the socially disadvantaged, water quality, sustainable and regenerative technologies.

The revelations from the Royal Commission, as well as other coverage of the actions of some franchisors, tertiary education firms and others, highlights how important it is to scrutinize the governance practices and ethical behavior of potential investee companies. The reputational damage and the savaging of the business valuations of those who’ve been sprung, highlights the risk of not doing so.

It also puts paid to the complete furphy that a company’s primary fiduciary duty is to maximise financial returns and shareholder value. We’ve worked for businesses that justify all sorts of atrocities and pocket-lining by hiding behind that particular piece of nonsense and want no part of it. Clearly a responsible company’s duty is to all stakeholders including its clients (fancy that!!), employees, suppliers, the community and the environment. Failure to do so, as we’ve seen, ironically puts that company’s shareholders at great risk.

The “Impact” side of a Responsible Investment approach provides the opportunity to re-direct capital to where it can do good as well as earn a return. It’s an extremely happy coincidence that socially worthwhile activities like waste management, recycling, renewables and regeneration, healthcare, water – these are the growth industries of the future and offer enormous investment potential, as well as having the potential to improve the quality – and equality – of life worldwide. Indeed, there is growing support for the notion that for-profit businesses with a social conscience can be more effective in furthering socially responsible aims than traditional philanthropy and not-for-profits.

And to be fair, we can’t get too sanctimonious about responsible corporate governance without proving that we’re prepared to walk the walk as well. Consequently we have commenced a project to obtain certification as a B Corporation.

B Corp certification recognises companies prepared to subject their standards of verified social and environmental performance, public transparency, and legal accountability to independent scrutiny. Further information is available at http://bcorporation.com.au/.

So, here’s to the next 15 years. And Thank You!

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. The information contained in this document is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, ARA does not accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs and reviewing the Product Disclosure Statement. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.