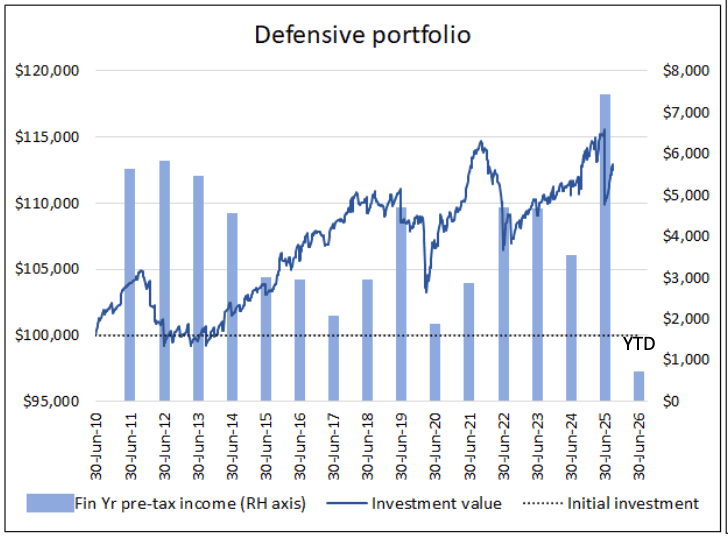

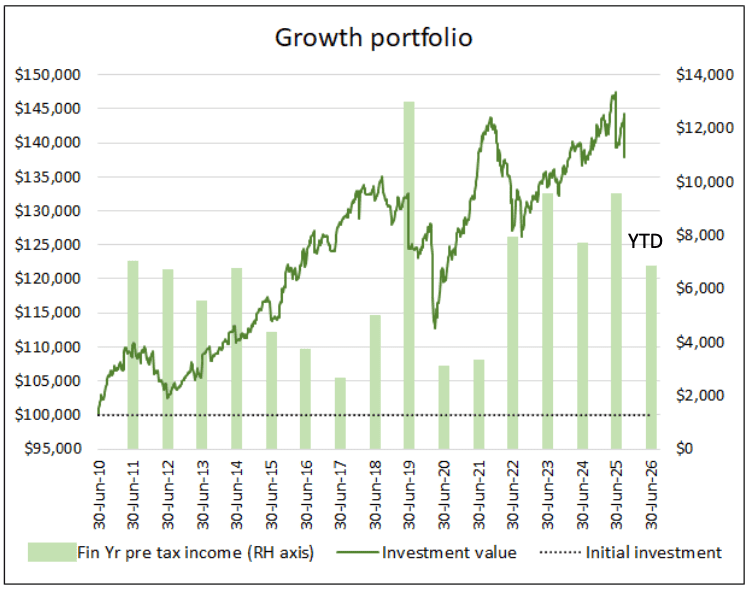

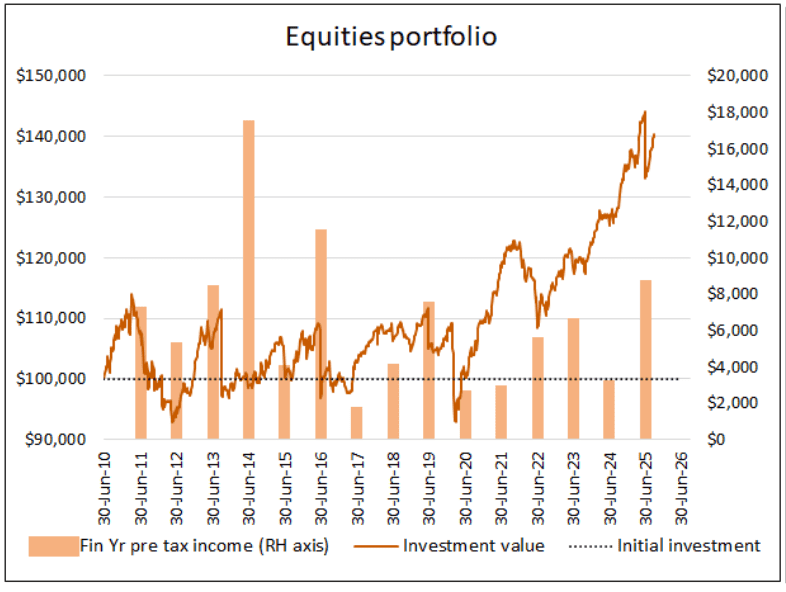

That is another quarter of pretty powerful returns, continuing what’s been a generally good run of late. At the risk of Broken Record Syndrome, to be honest it makes me a bit nervous. Looking at Defensive, for example, a quarterly return of 2.9% is way up the pointy end of expectations, and happy days on the upside have a way of finding their mirror image if you’re not careful.

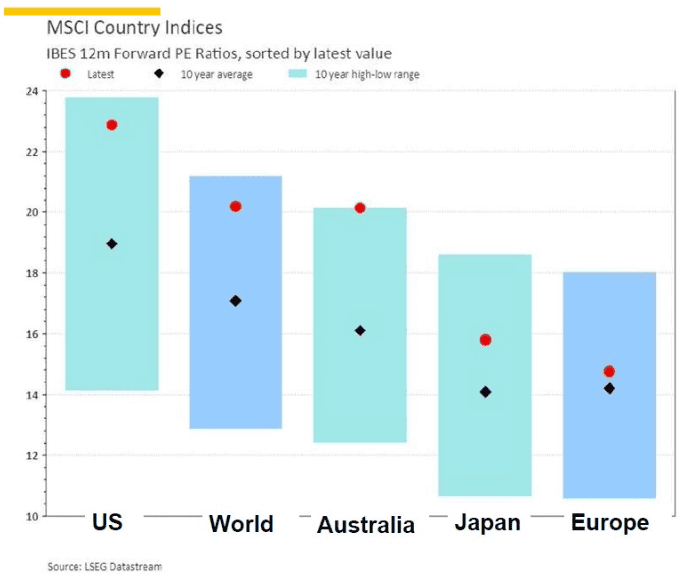

At our recent Investor Updates we saw data from our friends at Context Capital (consulting advisers to ARA) suggesting stock markets around the globe are looking expensive by historical standards. In the chart below for example, the key points to note are:

The coloured vertical bars which represent the value ranges within which various markets have traded over the past ten years

The red dot, which represents where those markets are currently trading.

Bottom line? A few – including Australia, and the rather broad category of “World” – are looking uncomfortably high.

The maths says that it will be harder to extract continuing strong returns from a market that is already expensive, and that risk is elevated.

What we should also keep in mind though is:

This does not imply that a “crash” is imminent (although it’s always possible)

Just because the market average is high doesn’t mean that there are not still good investment opportunities out there. There’s always something doing well, you might just need to look a bit harder and be more vigilant.

An active investment manager should be doing things like:

- Taking some profits off the table

- Ensuring the asset mix is tweaked for the changing value landscape

- Squirrelling away some cash for safety and for new opportunities that may arise.

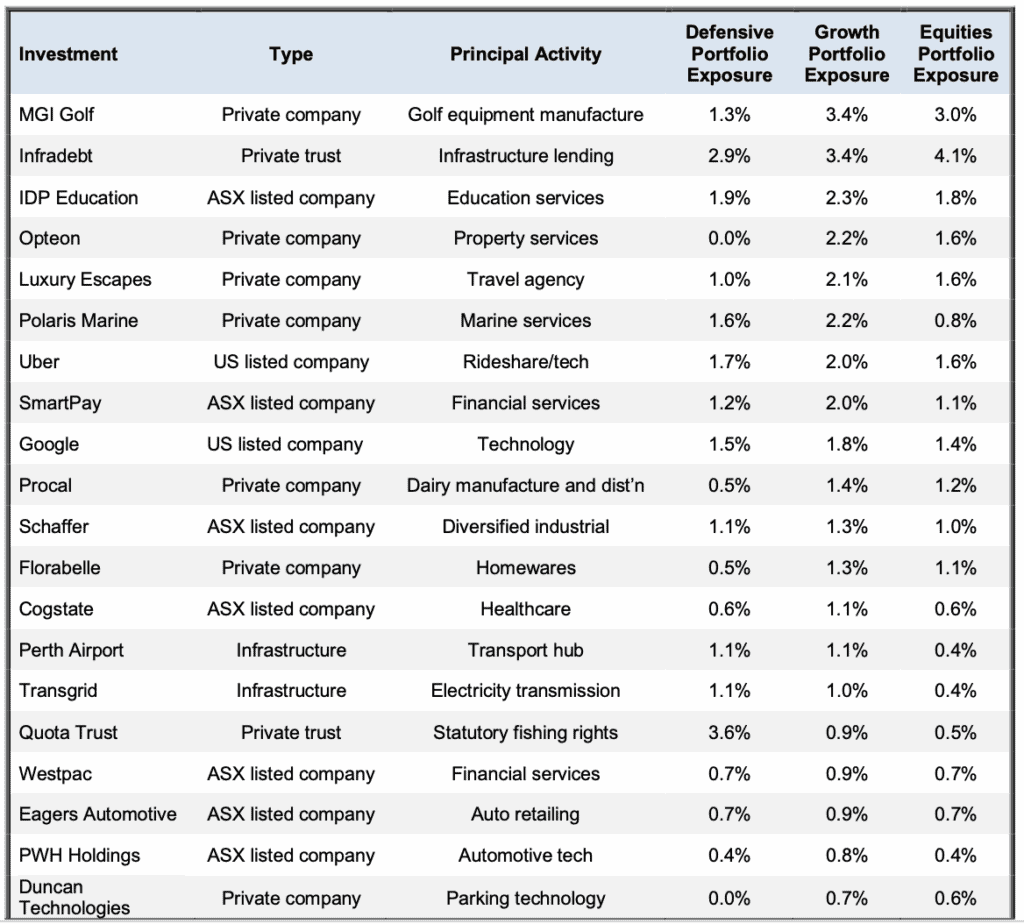

Alert readers might glean from the tables of the Fund’s holdings that it’s been a busy quarter. For example, of the assets listed in the Top 20 holdings in the June report:

3 have been sold and are now out of the mix having delivered substantial profits to investors via Anacacia’s private equity funds – Direct Couriers, RPI Infrastructure, and Big River Industries.

Our interest in listed software company Gentrack was reduced by more than half (which drops it out of the Top 20), and exposure to Westpac reduced by about a quarter. Over the prior two years Gentrack had almost tripled in value and Westpac returned over 80% for that period. From their new elevated levels the respective fund managers concluded some profit- taking was in order and better value may lie elsewhere.

On that note, four new entrants have now hit the Top 20.

- IDP Education – a listed company operating in one of Australia’s largest export industries. (No, they don’t dig things up!). IDP provides placement and support services to students and educational institutions, locally and internationally, including the UK, US, Canada, Ireland and New Zealand.

Procal – privately owned Australian dairy manufacturer and distributor. You’ll see their range of dairy products in McDonalds and Costco among others – Anacacia invested in the company in July to assist further growth.

Eagers Automotive – Operates a network of more than 450 car, truck and bus dealerships across Australia and New Zealand, representing 49 brands. A long history of profit and dividend growth.

PWR Holdings – automotive technology, specialising in advanced cooling systems. Australian based with global reach.

We also added to our holdings in Infradebt – the fund which lends money to developers of infrastructure in the renewable energy sector, notably large scale battery plants and wind/solar farms.

That’s a fair raft of changes in one quarter. There has been other movement in the table largely as a result of the performance of those assets, notably:

- Healthcare provider Cogstate, which jumped a few places after returning about 26% for the quarter, and

- Tourism operator Luxury Escapes, which had an 18% uplift after quite a staggering increase in its bottom line.

It is judged that both of these companies have plenty of investment gas left in the tank.

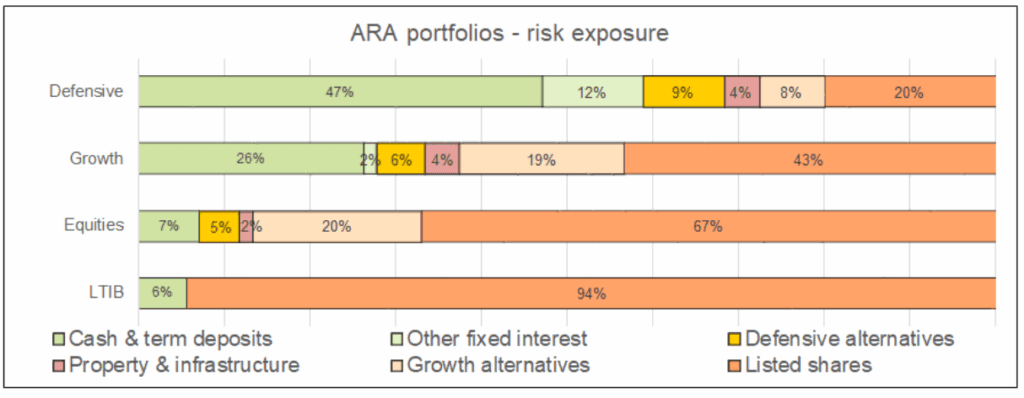

And lastly it is worth noting that liquid cash levels (NAB Cash account + First Sentier Cash Fund) are very healthy, particularly in Defensive and Growth. This provides both a layer of security and the scope to take advantage of other opportunities as they might arise.

So it’s been a busy time, but productive in terms of both results and positioning the fund for the prevailing conditions.

Farewell

After 47 years in financial services, 23 of them with ARA, Debbie Comben rides off into the sunset at the end of October for a well-earned retirement.

Debbie has done just about every job there is to do at ARA and has been a tireless, ever- reliable contributor to our work and culture. We thank Deb from the bottom of our collective hearts and wish her well for this next phase of bucket list fulfilment, which she’ll surely attack with the same passion she brought to our firm. Bon voyage Deb!

So, who’s got what?

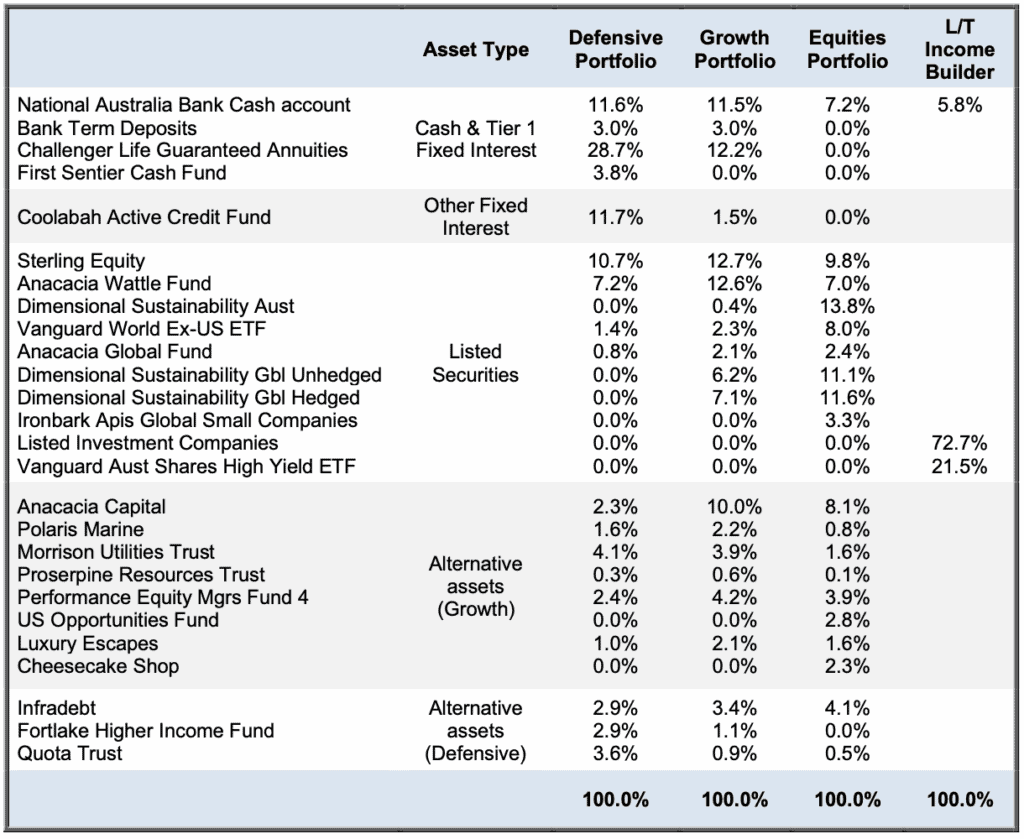

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings – diversified portfolios

Apart from bank deposits and other interest-bearing accounts, Defensive, Growth and Equities portfolios invest in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the portfolios’ returns.

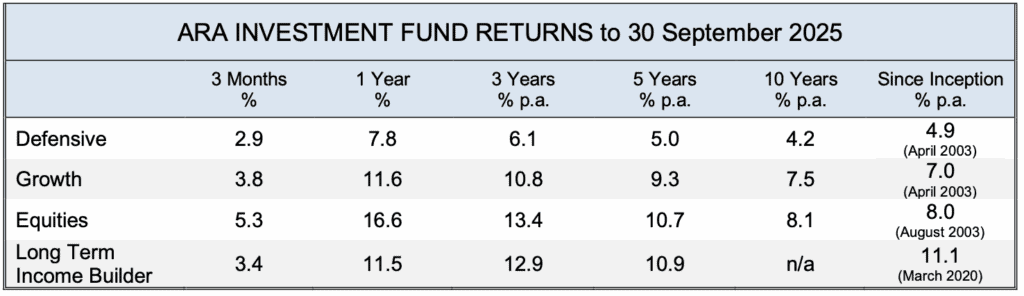

Returns quoted in this report are after all costs, and before the application of management fee rebates. Return figures are pre-tax, and include the value of franking credits from franked dividends. Total return figures assume the re-investment of gross distributions including franking credits. 3-month return figures are for the period to 30 September 2025 and are not annualized. Data source ARA Consultants Pty Ltd & Context Capital (except where indicated)

ARA Consultants Pty Ltd provides this update for the information of its clients and associates. If you do not wish to receive this or other information about ARA in future, please contact us on (03) 9853 1688.

This document has been issued by ARA Consultants Pty Ltd for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). Information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. The PDS and applicable Target Market Determinations are available at www.araconsultants.com.au or by contacting ARA by phone on(03)98531688orbyemailatinfo@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved previously does not guarantee or imply that they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: September 2025 Quarter Investment Update.