Of interest

It seems it’s all about interest rates of late, and what they’re doing to the cost of living, housing affordability and the economy at large. And while it’s not always the case, it’s true that rising interest rates in the past have ushered in some of the more challenging times in investment markets. So it’s worth spending a bit of time looking at interest rates and what they might mean for your ARA investment.

Some of the older folk in the room who vividly remember double-digit mortgage loan rates might scoff into their pinots noir and think “4%? What’s the fuss? Back in my day…….!” But there is a convexity thing happening here. A 2% rise from 2% to 4% is proportionally a far greater interest cost jump than a rise from 11% to 13%.

Most investments don’t like interest rate hikes. For businesses (and therefore shares) it raises the expenses column of the Profit & Loss statement, and for property investors it increases the cost of finance, which underpins so much property investment.

And not quite so obviously, interest rates represent the base line return you can expect on “safe” investment – the benchmark against which other opportunities that involve risk are measured, to assess whether the expected incremental return is worth the risk. If the base line moves up, the expected return on the alternative also has to go up, which usually means the buy-in price has to come down.

So stock markets and property investors don’t like interest rate hikes. But what about interest-bearing investments themselves. Surely they’d be happy?

Well, maybe, maybe not. Let’s think about the “ultra-safe” government bond. If that’s not safe – Lord, help us. Let’s say you own a 10-year government bond. It pays you 4% interest every year for 10 years, then the borrower – the Government – gives you your money back. Surely they’re good for it.

But two years into the contract, rates go up, and when the Government wants to raise some more money because the cost of the North-East link has trebled, the new issue of bonds offers 5% interest. Someone who is in the market for a bond investment would be crazy not to take the new one rather than buy yours. To sell yours, you would have to discount it heavily. So its value falls.

But you’re not selling, right? You’ll hold it to maturity. But here’s the rub. Billions of dollars worth of bonds are traded every day around the world. It’s a bigger market than shares. So institutional holders of bonds, like super funds and managed investments, are obliged to “mark to market” – i.e. reflect in their books the value of the bond as if they were about to sell.

Is that bad? Well, right now it ain’t good. The market for the global risk-free benchmark, namely US ten-year government bonds, is (or was) about $39 trillion – with a “t”. That’s 39 with twelve zeros after it. A trillion is a lot. If you stacked just one trillion dollar coins one on top of the other, the pile would reach to the moon and back for three-and-a-half round trips. (Yes, it’s true. And yes, it was a slow day).

Bloomberg has calculated that about 46% of the value of bonds with maturities of 10 years or more has been wiped out by recent interest rate rises*1. Bank of America says almost a quarter of the value of all bonds on issue has been lost so far*1. That is a crash on par with the stock market plunge during the GFC or the Crash of 1987 (and who knew?).

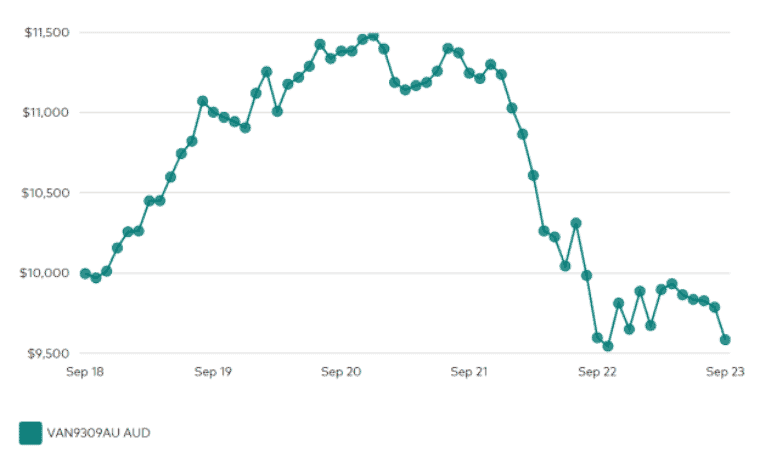

So times have been tough for “traditional” fixed-interest/bond investors. That tends to include large institutional investment and super funds. Not picking on anyone here, but below is a chart of the Vanguard Global Aggregate Bond Index Fund in $A, as an illustration of the headwinds facing investors in “safe” government bonds*2.

*1 Melbourne Age October 9, 2023

*2 www.Vanguard.com.au

As with any “crash”, this really only matters if you have to sell when things are down, and can’t sit it out until the market recovers. But by definition, many retirees in pension phase are routinely drawing down on their capital as a matter of course, and having to draw out at such bad times is a sure-fire way to permanently destroy wealth.

We’ve written extensively in our Retirement Hub on how we manage this risk, in both the investment strategy of our funds, and advice as to portfolio selection for individuals. See www.araconsultants.com.au/retirement-hub/ for more.

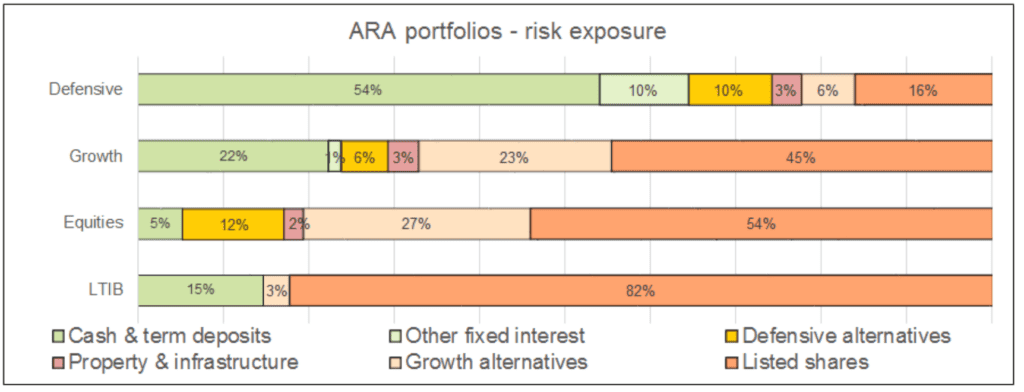

So how does all this gel with the ARA funds?

Firstly, we have had by industry standards very little exposure to the types of fixed- interest investments referred to in the discussion above. A glance at the list of assets in the “Who’s got what?” table will show that the bulk of our interest-bearing investments are in bank term deposits and fixed-term annuities. There is no secondary market as such for these, they are not actively traded and so don’t cop the “mark-to-market” revaluation phenomenon. We just bank the interest.

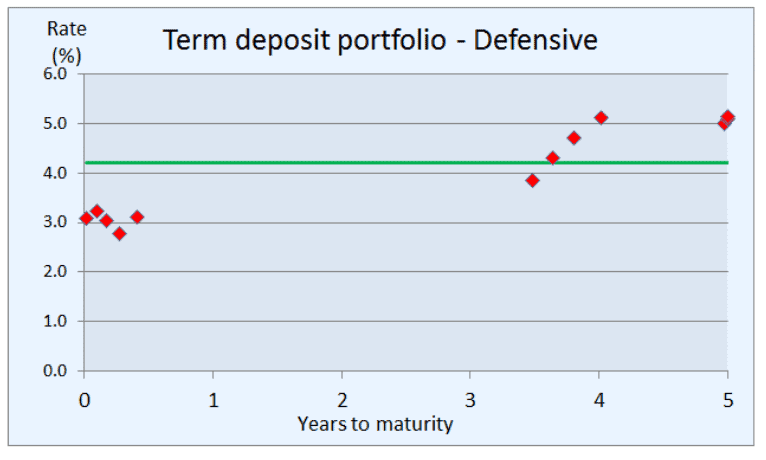

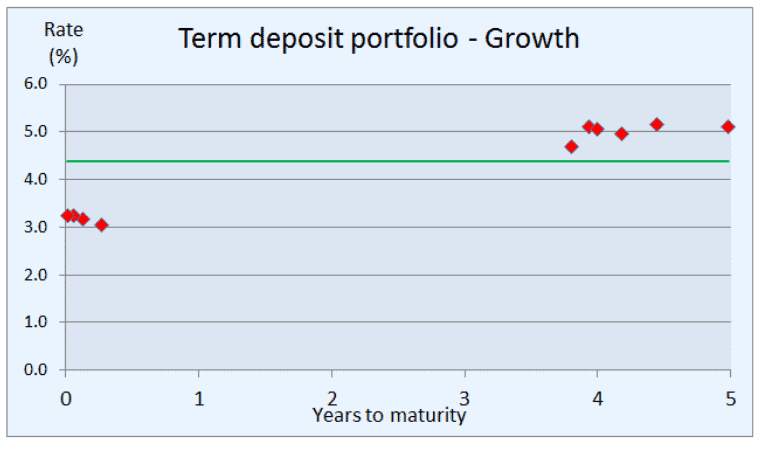

The rising rates in fact present us with an opportunity or two. The following charts show the maturity profile for the term deposits and annuities we currently hold – interest rate on the vertical axis, years until they mature on the horizontal.

The upshot is, in each of the Defensive and Growth portfolios, as deposits mature we are able to roll them over at materially higher rates, raising the average yield of the portfolio in the process. And fortuitously, there are several more deposits due to mature over the coming three to six months.

The other opportunity lies in the bond market we have discussed above. Sooner or later the rate rise cycle will peak, and maybe rates start to come down again. If that happens, the value phenomenon then works in investors’ favour – the value of an existing bond portfolio goes up. So not only do you pick up the interest payments on an extremely secure investment, but you might also pick up some capital gain as well. This is an appealing risk/reward opportunity if and when it happens, and we have cash with which to take advantage.

Welcome

There is a new addition to our service team, one with a familiar surname. Harry Rimmer joined us this month, and in an interesting twist of fate, when Elly returns from maternity leave his big sister will be his boss.

Just like the old days at home, Haz! Welcome to ARA.

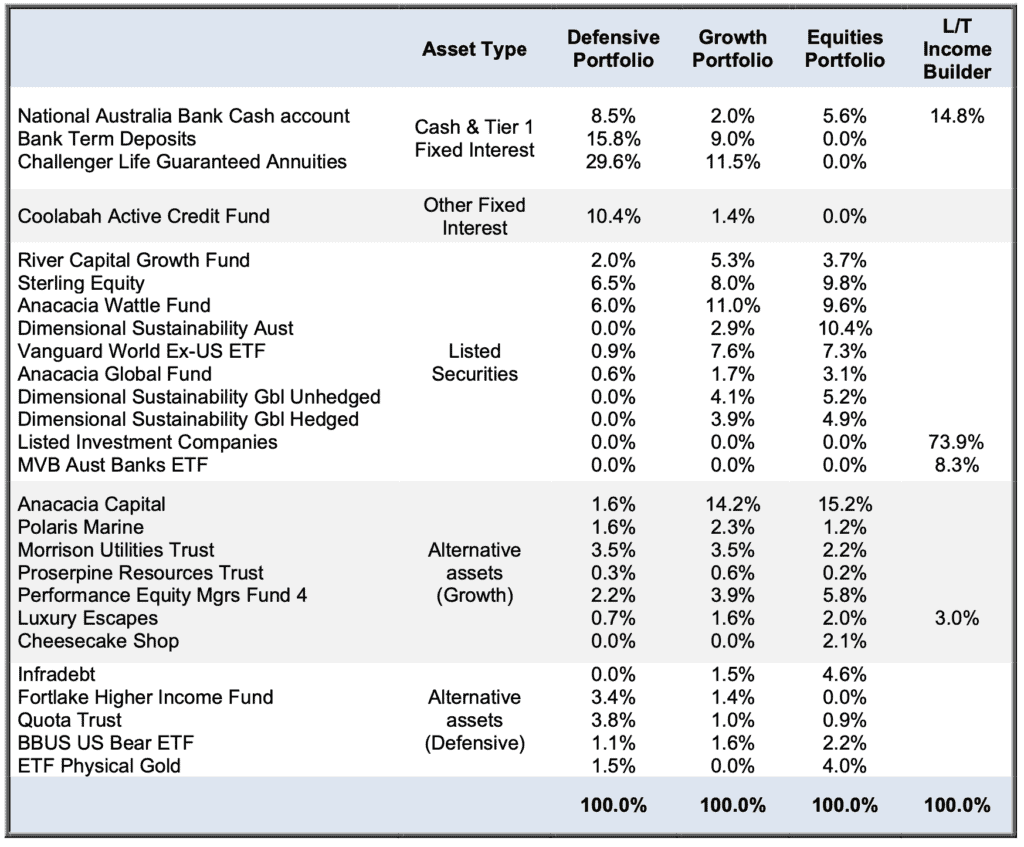

So, who’s got what?

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings – diversified portfolios

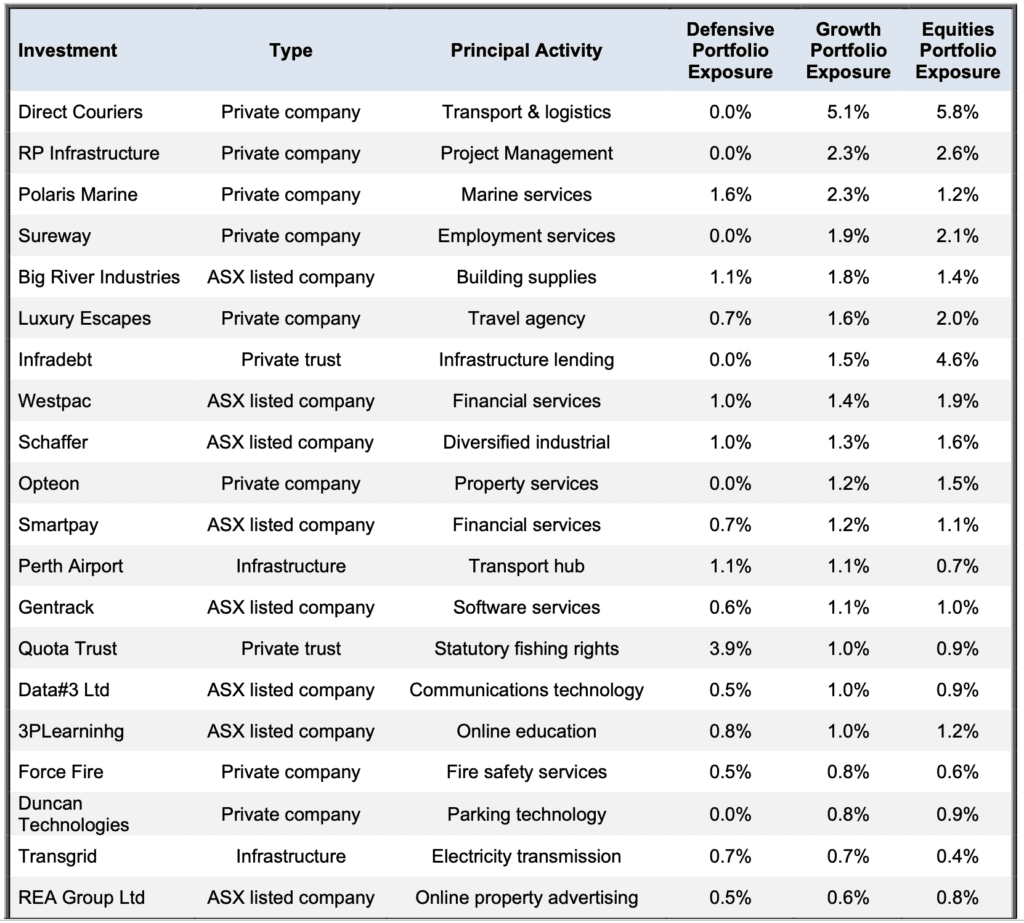

Apart from bank deposits and other interest-bearing accounts, Defensive, Growth and Equities portfolios invest in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the portfolios’ returns.

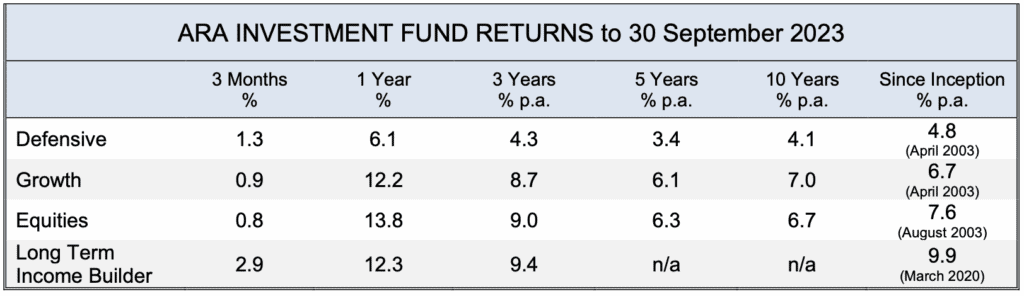

Returns quoted in this report are after all costs, and before the application of management fee rebates. Return figures are pre-tax, and include the value of franking credits from franked dividends. Total return figures assume the re-investment of gross distributions including franking credits. 3-month return figures are for the period to 30 September 2023 and are not annualized.

ARA Consultants Limited provides this update for the information of its clients and associates.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). Information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. The PDS and applicable Target Market Determinations are available at www.araconsultants.com.au or by contacting ARA by phone on (03) 9853 1688 or by email at info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved previously does not guarantee or imply that they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: September 2023 Quarter Investment Update.