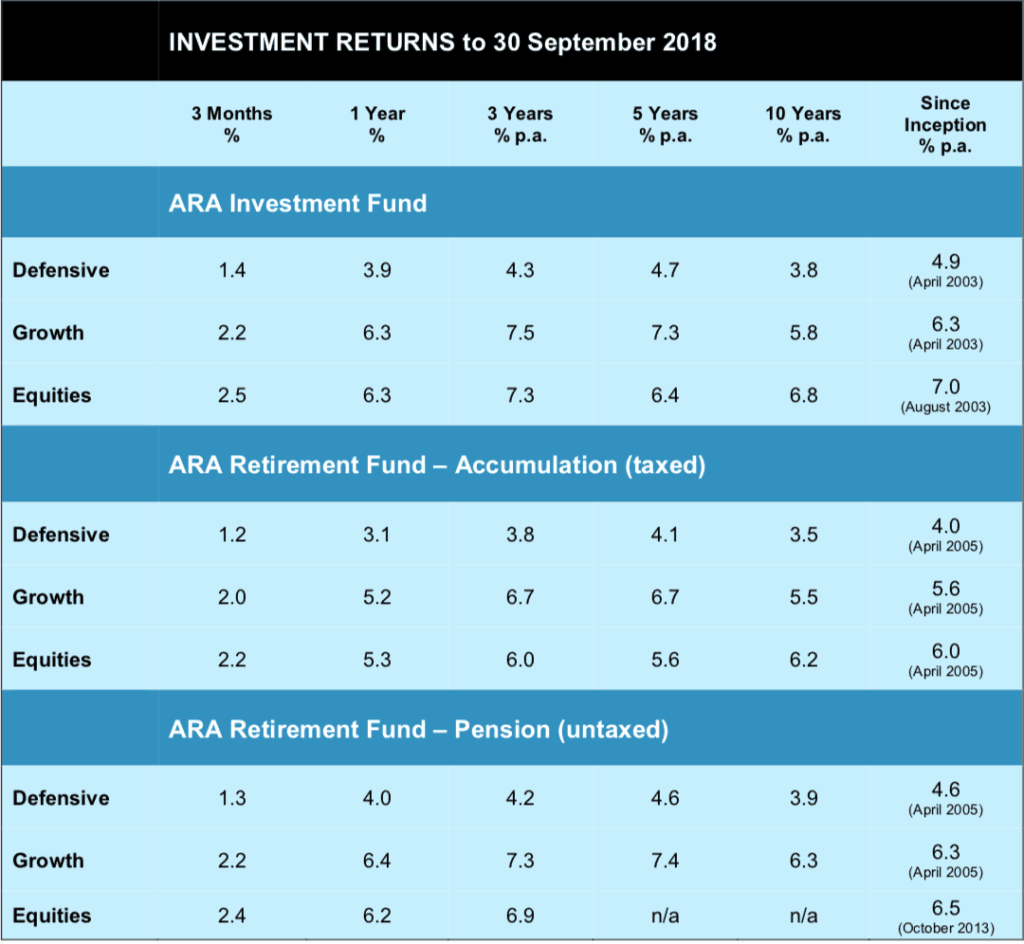

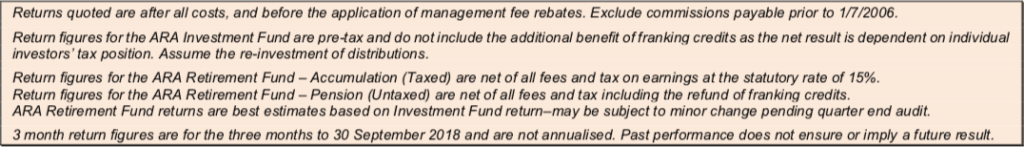

The portfolios started the new financial year in a solid fashion, keeping short and longer term performance well above target. The chart below shows the past five annual returns for each portfolio (to September 30) and five year averages vs their respective targets.

This is quite a happy state of affairs given that all portfolios are carrying substantial cash and term deposits, in the name of protection against downside risk. Something must be going OK, and these things stand out:

ProTen & Yumi’s

These two stalwart investment assets were the subject of successful sale offers during the quarter at prices that were materially higherthan their holding value in the Fund’s books.

Both have been outstanding investments and textbook examples of how private equity investments should work. Buy into a quality business alongside committed management at an attractive price, build the business up, then sell the larger entity on better terms. ProTen returned about 2.5 times our original investment and Yumi’s about 4.4 times, in 3 and 4 years respectively.

The Yumi’s transaction was completed in September, ProTen is expected to proceed in the December quarter. As a result, the Fund will have a large amount of cash to re-deploy. Let’s hope the managers can find a few more like those.

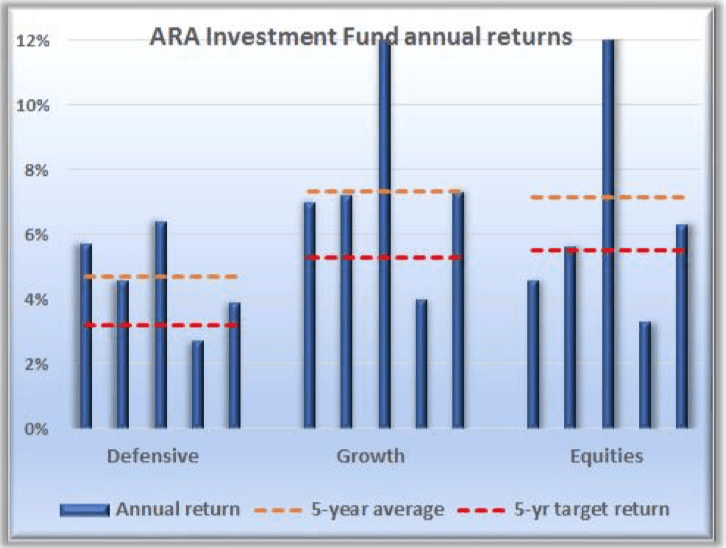

Aussie shares

The sharemarket blinked in September, but is still well up for the year to September 30. Our core managers of Australian shares have gone along for the ride, with Sterling Equities having a blinder of a run!

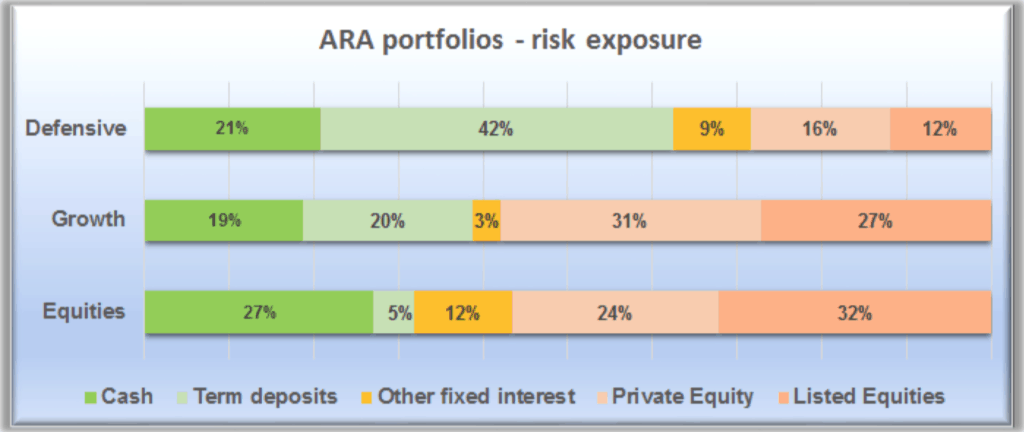

And so, the exposure of the three portfolios to the various asset classes is currently as shown:

Major Holdings

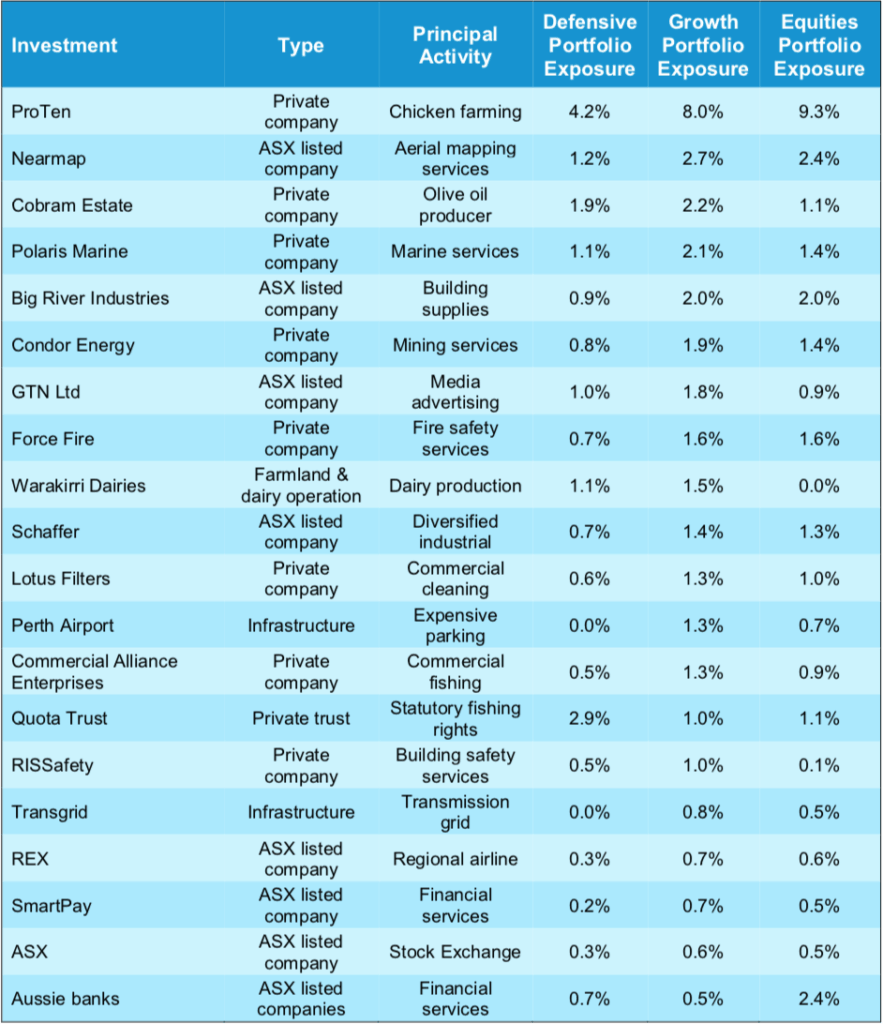

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets, primarily through funds managed by specialist independent firms. If we drill through to the assets selected and overseen by those managers, there are in fact well over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

On yer bike!

You might recall from a previous edition that long time great friend of ARA and AFL legend, David Parkin, is also patron of the oh-so-aptly named Male Bag Foundation.

The MBF is a dedicated band of weekend warriors who raise funds for prostate cancer research and treatment, primarily by riding those iconic red Honda Postie bikes around the countryside.

This year’s ride will see 18 blokes riding over 2,000 kilometres in eight days around rural Victoria and NSW, supported by a hardy team of volunteers.

ARA is proud to sponsor the Male Bag Ride, and this year our intrepid leader, Alan Rimmer, will be among the riders. Probably somewhere near the back.

To date the Foundation has raised over $800,000, to fund research, resources and equipment for the detection and treatment of cancer and care for sufferers. It’s a point of great pride in the Foundation that participants in these rides pay their own way – bikes, accommodation, food and yes, medical expenses – so that funds raised go entirely to this worthy cause.

There are not many families that have not been touched by cancer. I know it’s hard toturn around these days without being asked to put your hand in your pocket, but if by chanceyou’d like to sponsor Alan and the team in thisyear’s ride, the Foundation and its beneficiaries would be most grateful. The link is here.

Aged Care

At our September Client Update meetings we had packed houses in both Melbourne and Shepparton, to hear Jayne Maini talk about negotiating the maze that is Aged Care accommodation.

Jayne is a Director and National Operations Manager of Millennium Aged Care Consultants, and a guru on the subject if ever there was one. It is clearly an area that calls for professional, quality advice and assistance and we have no hesitation in recommending her services. Go to the website at www.millenniumagedcare.com.au , or call on 1300 755 702.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. The information contained in this document is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, ARA does not accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs and reviewing the Product Disclosure Statement. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.