Stop me if you’ve heard this, but I started in financial planning in August 1987. Two months later came Black Tuesday – the largest one-day fall in the history of the Australian stock market and the beginning of an eventual decline of about 50%. My office was next door to the Stock Exchange building, outside of which during that morning gathered a hushed crowd, watching unheard-of market index numbers roll by on the screen outside the building. Then the TV news crews showed up. It was quite surreal. Much of my first year in the industry was spent dealing with shell- shocked investors whose previous advisers had mysteriously gone AWOL.You reckon that doesn’t leave an impression?

In 2002 when ARA opened for business, world markets had again been through the wringer. The US market for example had fallen 47% in the two years leading up to September 2002, our date of birth, and most markets around the world followed suit. People commented that “it must be a helluva time to start a new financial planning business”. (Actually, at the time people were very open to considering alternatives to what they had).

Then came the Global Financial Crisis. June 2007 to February 2009 was like death by a thousand cuts. Financial markets were in absolute turmoil as the housing and loan markets in the US melted down, at least one major US bank failed, and it was like a financial pandemic that spread across the globe. Industry pundits openly discussed the prospect of the entire world’s financial system completely collapsing.

So rough times come and go in the investment business. And I hate to say it but this feels like another one. Since that confounded virus reared its ugly head in 2020, markets have tried but struggled to overcome a series of hindrances – from the economic impacts of lockdowns, supply chain disruptions, resultant inflation and interest rate hikes, and even an increasingly despicable war. Once again the commentary is being infiltrated by disaster scenarios and talk of Armageddon.

But we’re all still here. We survived those previous shocks and will again. In fact it’s instructive to look back and see what happened in the aftermath of those previous downturns.

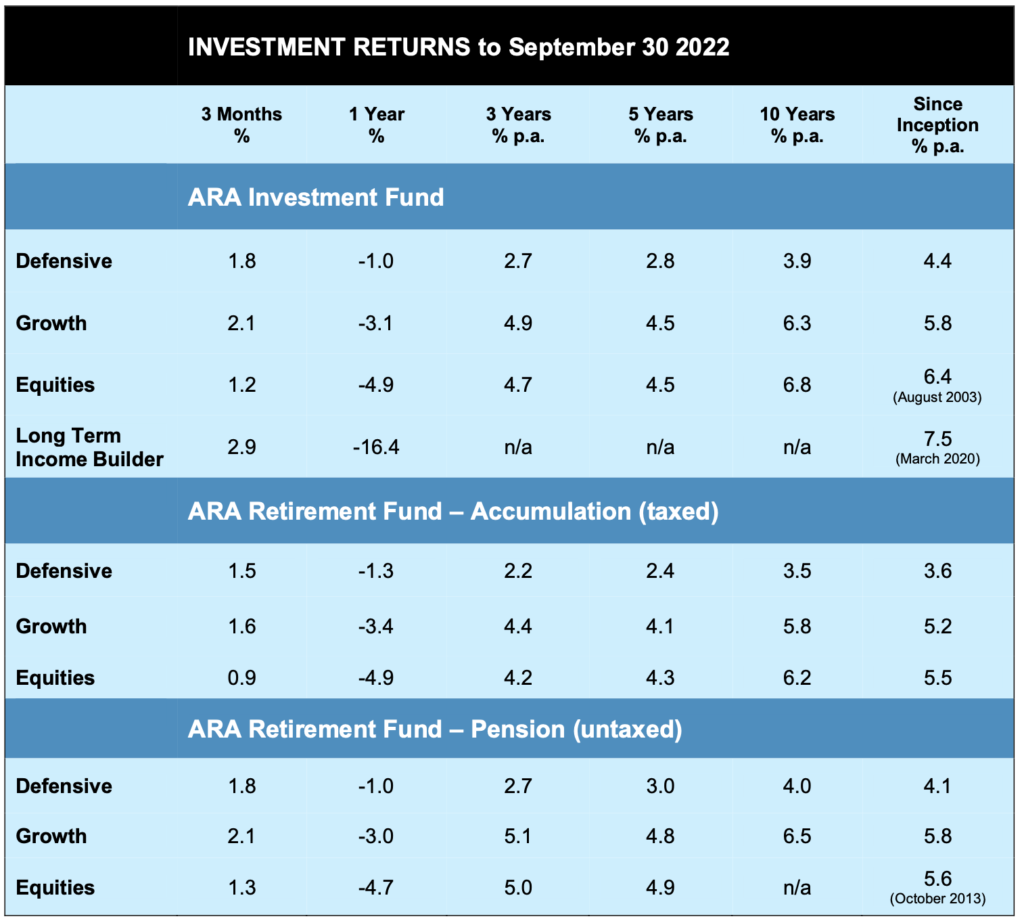

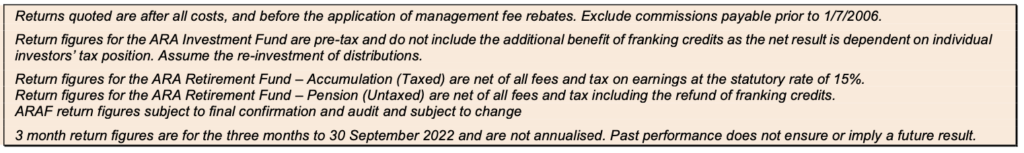

The table shows returns from the Australian stock market after each of these difficult periods had finally bottomed out.

I hope you don’t follow the financial press too intensely. That’s our job – to filter through the noise and try to make sense of it for you. Fact is, the media has a job to do, which is to fill column inches and airtime with content that will sell ads. So it tends to have a very short term and often sensational tone about it. Which is not particularly helpful.

Times like these are not the times to be losing nerve, panicking or selling up. If anything it’s the opposite. As in the cases above, it’s highly likely that in 3 to 5 years we’ll look back and say late 2022 actually wasn’t a bad time to own – better still add to – a portfolio of quality investments at attractive prices.

And while their daily market values might be fluctuating more than usual, the companies whose stocks we own are still paying dividends, properties are still earning rents and fixed interest investments are generating interest returns (that are actually going up).

Selling in down markets turns a paper loss into an actual loss – in an investment that may very well recover its value, and more, quite quickly from these levels.

That’s why we spend time and effort to understand your cash needs in the short, medium and long term – and to structure your portfolio choices so as to avoid the need to sell long term investments at the wrong time.

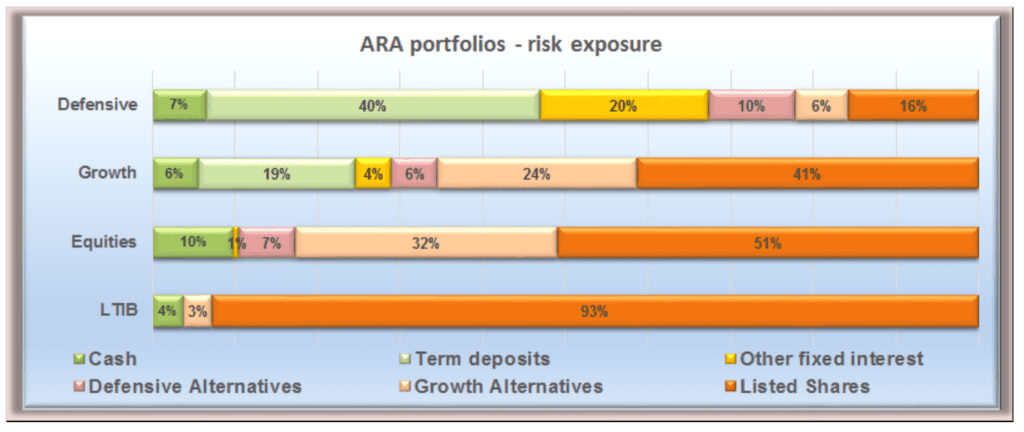

Right now we are holding course on our investment exposures, increasing our allocation to fixed interest investments that are suddenly attractive again, and are poised to buy more “risky” assets at these suddenly reduced prices. It’s what’s worked before, and it will again.

So, who’s got what?

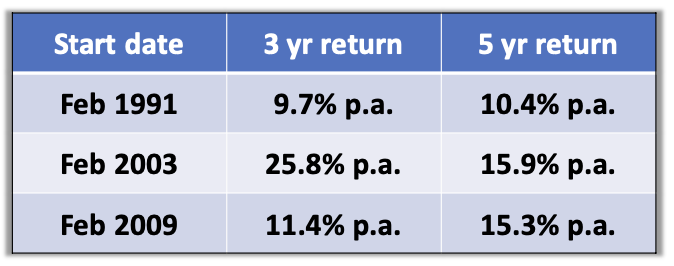

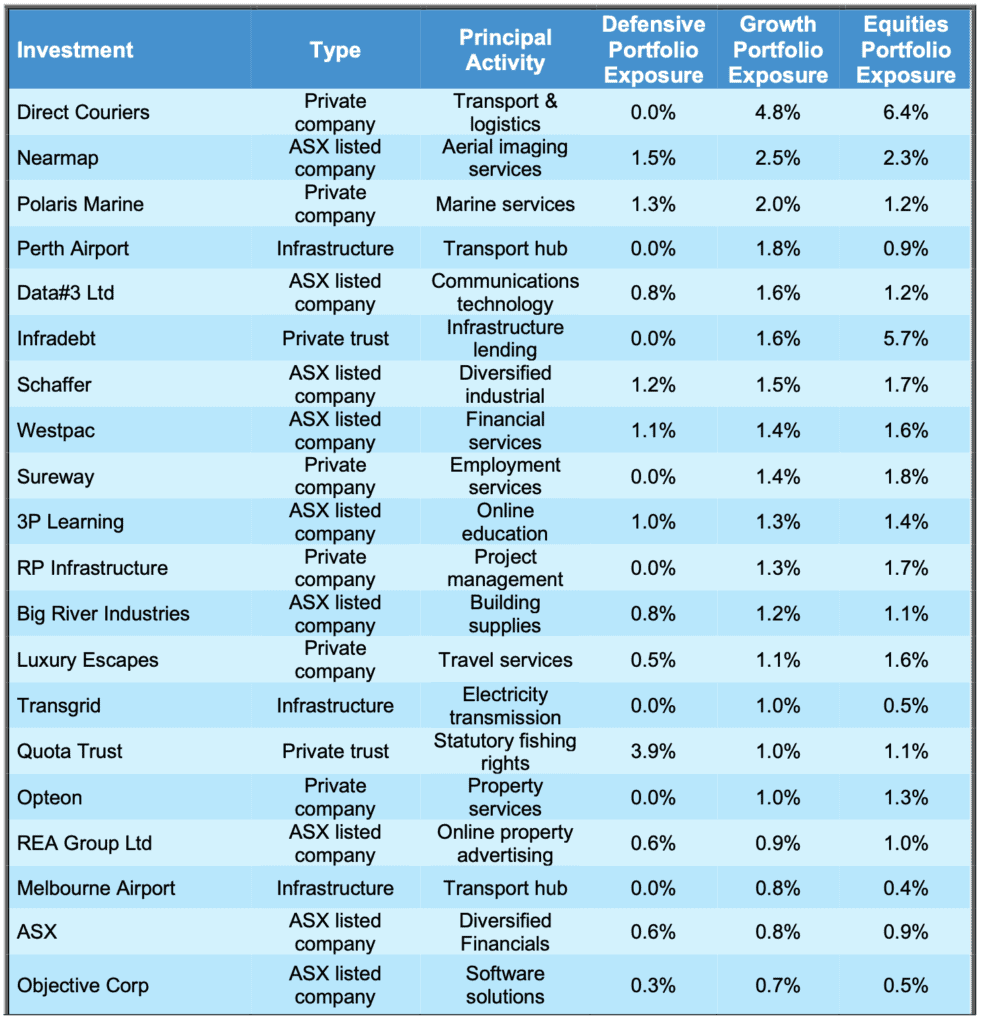

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings – diversified portfolios

Apart from bank deposits and other interest-bearing accounts, Defensive, Growth and Equities portfolios invest in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the portfolios’ returns.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). Information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. You should also refer to the relevant Target Market Determination (TMD) for the product. The PDS and applicable TMDs are available at www.araconsultants.com.au or by contacting ARA by phone on (03) 9853 1688 or by email at info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: October 2022 Investment Update.