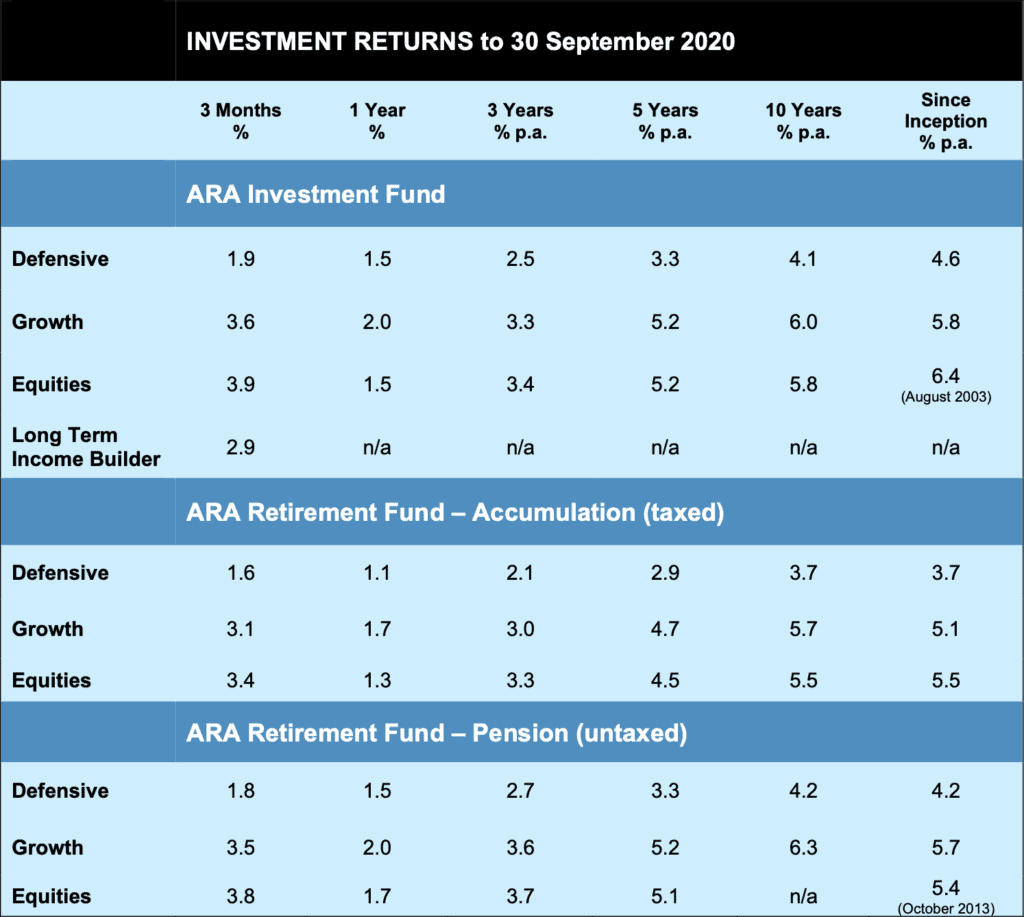

Happily, another solid quarter, although things slowed down a bit in September. Not surprising for markets to take a breather after two strong quarters. They also had to deal with the uncertainty of a forthcoming Federal Budget – which proved to be stimulatory – and the election in the USA which is shaping up like nothing we’ve ever seen.

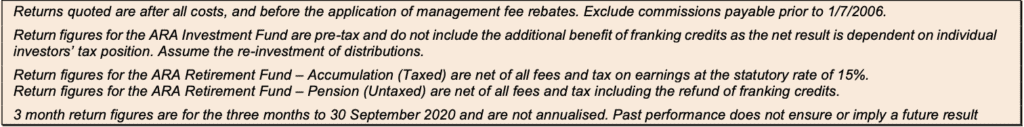

But it’s good to see the numbers for all portfolios back in the black. Our share fund managers are near the top of our Christmas card list for some outstanding recent results.

Those results underpinned outcomes which by industry standards were strong in a year that included the biggest upheaval since the GFC, while maintaining a relatively low risk profile.

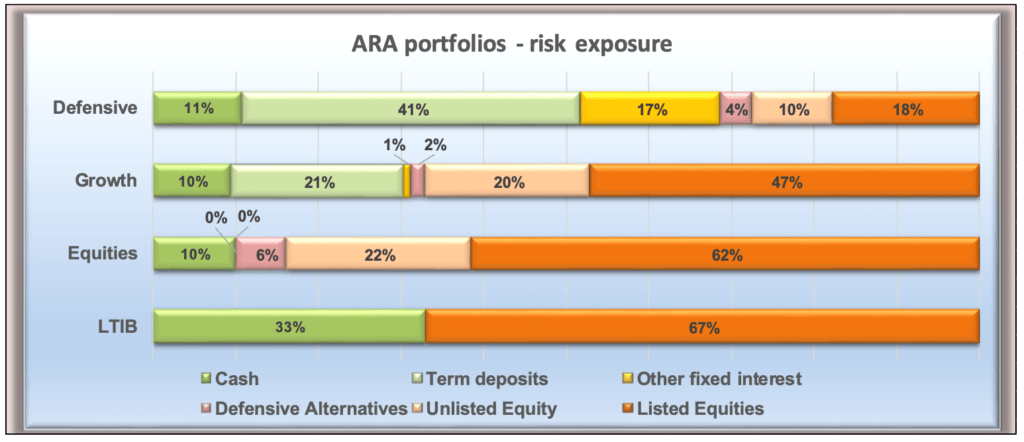

Even after recently rebounding, share markets outside of the US still look reasonable value – maybe not compelling enough to “back up the truck”, but not expensive to the point of selling off more than we already have. So the risk exposure chart below tells a story of “steady as she goes”, at least for now.

Long Term Income Builder?

Alert readers will have noticed a new portfolio option in the returns table above.

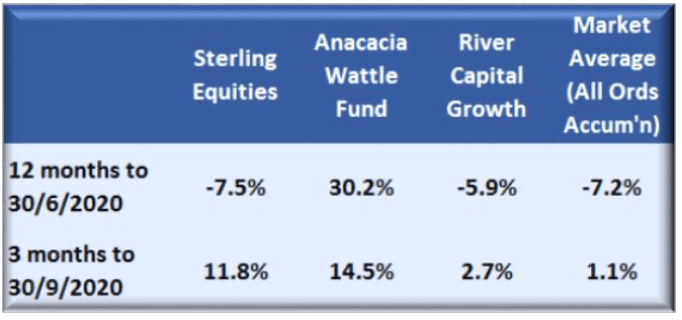

We have previously referred to interest rates which have been on a downward trend for years, to the point where they are now pretty much zero – less after inflation! And with global economies – some not all that healthy to begin with – now reeling from the effect of the coronavirus, stimulus measures abound and interest rates are likely to stay lower for longer.

We highlighted the following chart last time, noting that after inflation interest rates are now well and truly negative.

Not surprisingly, many investors are searching for alternatives.

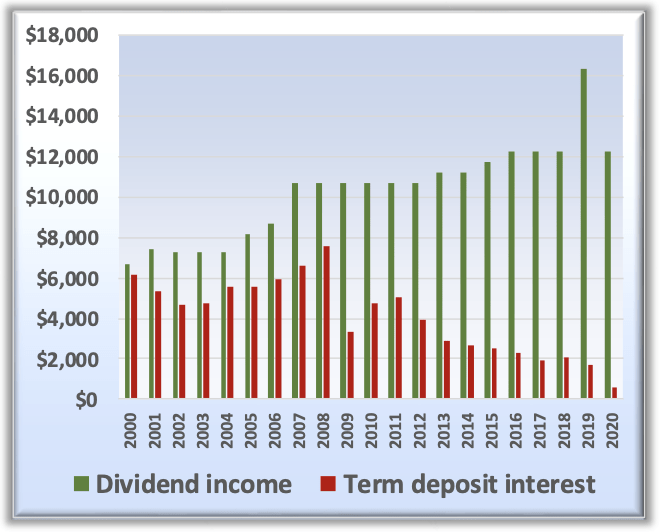

One answer might be dividend income from cash-generative companies listed on the local Stock Exchange – the focus of the Long Term Income Builder. Dividend income has proven to be quite stable, even in times of economic upheaval, and in fact tends to grow over time. The chart below, covering the same period as the one above, models the actual pre-tax income you would have received from investing $100,000 in 180-day bank deposits, compared with the dividend stream from investing in a diversified portfolio of, mainly industrial and service company, shares.

Of course it’s not for everyone, as underlying share values can be very volatile and you need to be able to cope with that – and have a long term, income-oriented focus. But with term deposit rates where they are now, maybe it’s timely to consider this option.

Lots more to come on this one. In the meantime let us know if this is of interest.

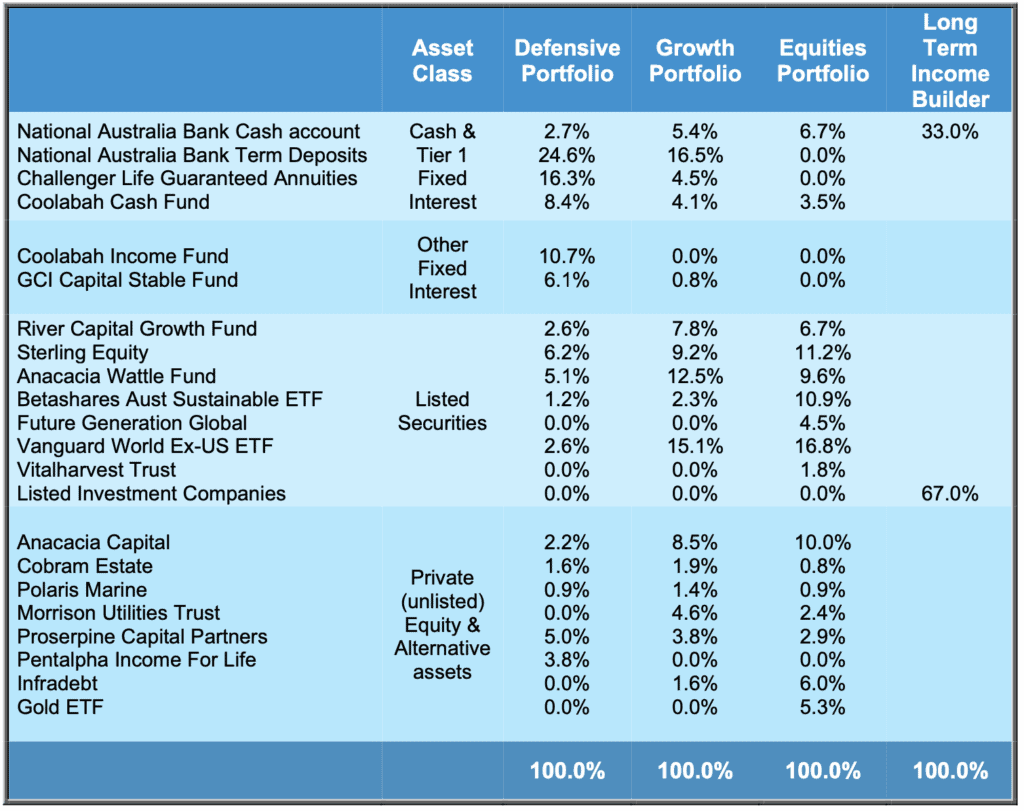

So, who’s got what?

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings

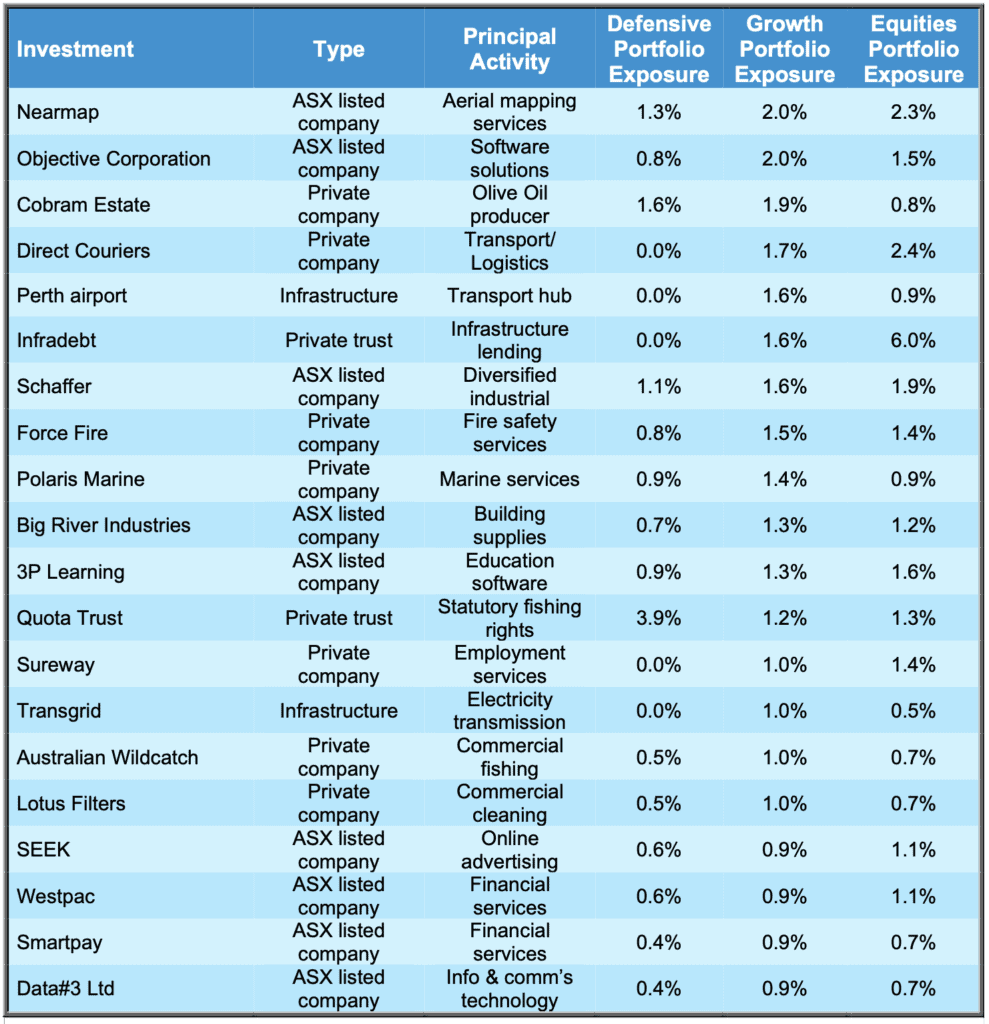

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

If you would like a pdf version of this update for your files you can download it here: October 2020 Investment Update.