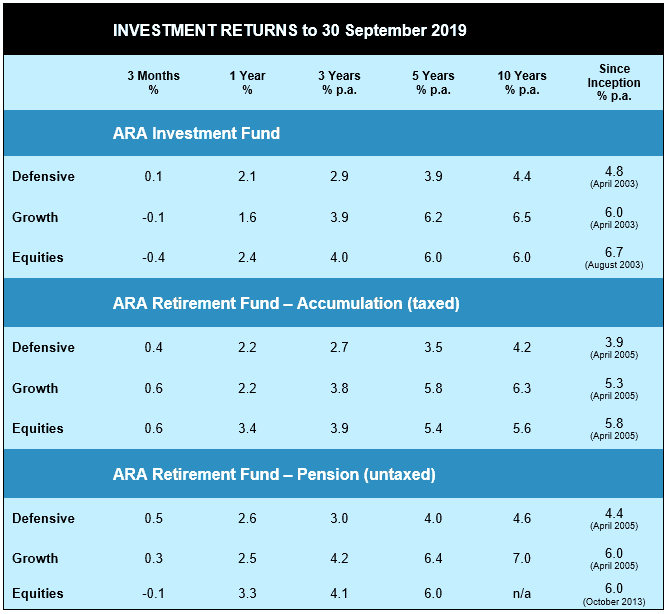

At the risk of stating the obvious, the numbers show a flat quarter and lacklustre twelve months. Times remain challenging for diversified investment funds with one eye firmly on risk management.

The broad themes are the same:

- very choppy investment markets that gyrate almost daily depending mostly on who’s posturing about trade wars; and

- plummeting interest rates.

In our case we’d also note:

Investors would be aware we have material exposure to investments listed on stock markets, and also to private companies that do not trade daily on the market.

The latter are valued periodically and, of course, when sold, which tends to be when the most uplift is earned. As it’s happened, since the successful sale of ProTen and Yumi’s a year ago, there have been no sales of note and very little net contribution from this section of the portfolio.

Also a couple of last year’s stellar performers, notably Nearmap and Polaris Marine, have taken a breather or in fact slipped backwards this financial year, which is not uncommon after a strong run.

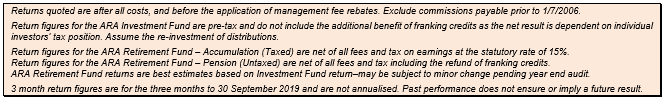

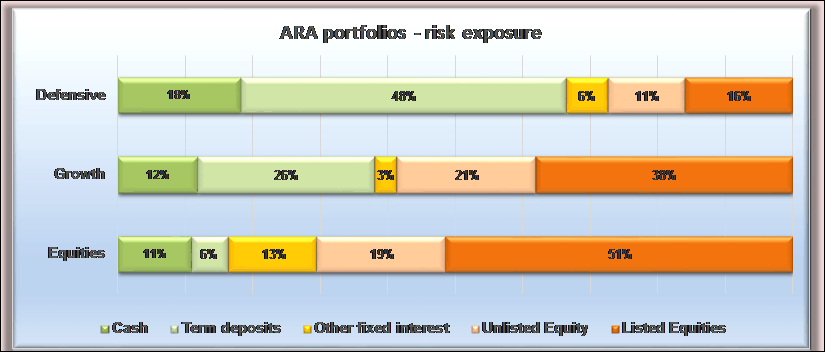

These we believe are short term influences that will even out in due course. The important consideration is whether the portfolios are set up appropriately given the market outlook, and for that let’s re-visit the chart depicting where value lies in key investment markets.

The arrows indicate where each market currently sits relative to an assessment of what is good or poor value.

There is little change from last quarter – i.e. things haven’t moved much. Australian shares still seem to represent good value while the US is looking expensive. Interestingly, world markets excluding the US (i.e. mainly Europe and Asia) look attractive.

As a result, our portfolios are at pretty much standard weighting to Australian shares, while we continue to build a position in international shares excluding the US.

It’s important to note that while this approach includes a forecast of long-term return, it should not be taken to mean that’s what will happen year-in, year-out. Nothing in investment happens in a straight line. There will be bumps and flatlines along the way.

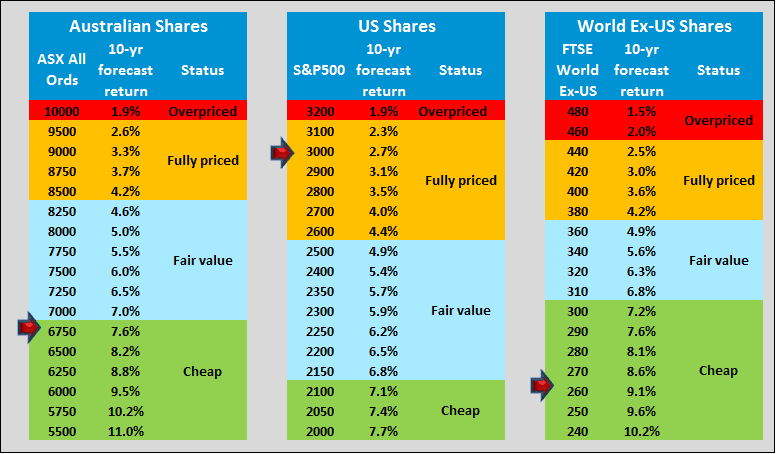

Then there’s the elephant in the room. Interest rates have fallen, from around 7% ten years ago to less than 1% today, and continue to fall. Furthermore there is little or no advantage to be gained by taking out longer term deposits as their rates are effectively no better.

As we discussed at the recent round of investor updates, the performance objectives of each of the portfolios are expressed as a margin above the rate you can get from bank interest. That is, anyone can get a return equivalent to bank interest with effectively no risk. By investing, you aim to achieve a margin above the safe rate, by taking a calculated risk. This margin could be referred to as the risk premium.

By way of illustration, the chart below shows the performance target of the Defensive portfolio, expressed as the bank interest rate in green, plus the risk premium of 1% p.a. in orange.

Regrettably for investors, it is inevitable that as the bank rate drops, so too must the target return of the portfolio. The only alternative is to take more risk.

As stewards of your funds we are torn between the obligation to achieve a satisfactory return for clients, while not compromising on our commitment in respect of managing the risks you face.

We will not be altering the risk/return objectives of any of the portfolios. It is to be expected therefore that returns will be lower consistent with the falling interest rates.

Investors have the option of accepting more risk by moving funds, for example to the Equities portfolio. We know that investors in that option have a long term outlook and a higher tolerance to short term investment volatility. Nonetheless, we would urge investors considering such a change to consult us first as we have modelling tools which can demonstrate the potential impact of any proposed change.

It is pertinent to note, though, that with interest rates at these levels, the income yield alone on certain risk assets now makes them relatively attractive on a risk:return basis.

By way of a heads up, we are investigating the introduction of a fourth portfolio option that may be worthy of consideration. The intention is that it will be designed for investors whose primary consideration is income. Low interest rates are particularly punishing for investors seeking income, so the time seems right to consider such an option.

It will necessarily entail a higher risk tolerance and will therefore be suitable only for those with a long term outlook and whose primary concern is income rather than capital growth – but watch this space, we expect to make an announcement shortly.

One more thing

Alert readers will note that the quarterly returns for the Retirement Fund – Accumulation and Pension – were higher than the Investment Fund. How can this be, when the Retirement Fund invests all its assets in the Investment Fund?

The answer is tax. The Retirement Fund returns are after the impact of tax (including franking credits) whereas for the Investment Fund the tax and credits are passed through to the investor, to be treated according to their own tax position.

As it happened, the Retirement Fund received a larger-than-expected tax refund during the quarter, which gave a boost to the short-term number.

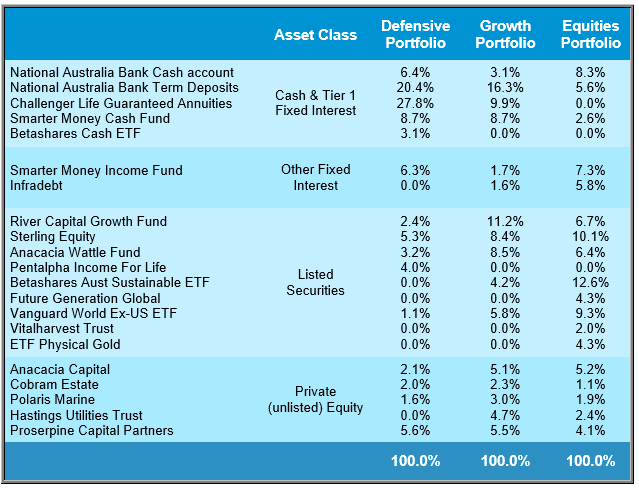

So, who’s got what?

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings

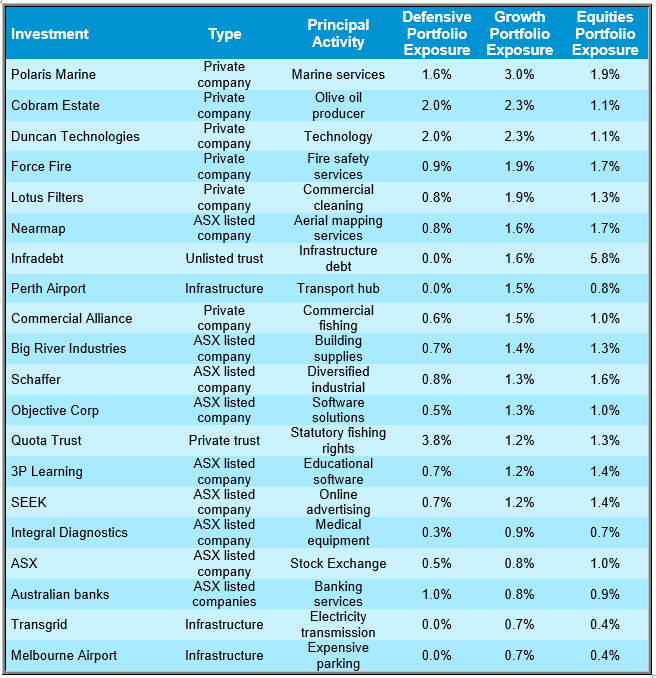

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

We recently met with a person seeking advice about what to do with the proceeds from a termination payment paid to him by his now ex-employer. It was a generous payment, but incurred tax in excess of $100,000.

On investigation we advised that if the payment could be re-structured in a more tax-friendly manner, the tax liability could be reduced (legitimately!) by $80,000. Which is what happened. In fact the company’s bookkeeper liked the idea so much, she applied the same principle to her own and another employee’s termination payments. The devil (and the angel) is often in the detail.

As icing on the cake, we were also able to secure a Carer Payment and Carer Allowance for our client.

Total benefit: over $110,000 in the first year – before he’d invested a cent.

No wonder we love our work!

Welcome

We are delighted to welcome another addition to our planning service team.

Stephanie King brings with her over 17 years’ experience in a variety of financial planning and para-planning roles, and a passion for helping people. She is a fully qualified financial planner and is a welcome addition to our ranks. We’re betting you’ll thoroughly enjoy meeting and working with Stephanie.

The Male Baggers Ride again

In early October, 26 riders of Honda Postie motorbikes (including our very own Alan Rimmer) hit the road for three days, around the Bay, down the Great Ocean Road and through the Otways, raising funds – and awareness – for prostate cancer treatment.

The Male Bag Foundation’s primary aim is to assist in the purchase of state-of-the-art biopsy machines for rural hospitals, so those in outer regions don’t have to travel to the capital cities for modern, safe diagnosis. To date the group has raised over $1.3 million dollars – every bit of which goes to the cause as riders pay their own way to participate.

It was a great ride and will assist with the installation of a biopsy machine in the Barwon Health Centre.

If by chance you’re inclined to support the silly old fools brave, strapping bikies in their efforts, donations can still be made at:

https://themalebagride-2019.everydayhero.com/au/alan-r-male-bag-2019

Thank you!