In what turned out to be a relatively benign quarter for investment markets, the funds went OK. Nothing went pear-shaped, there were a few standouts, and everything else chugged along without surprises. If you cansay that every quarter, it’s a recipe for ahappy investing experience.

Specifically:

The problem child of recent times, Condor Energy, appears to have stabilized. Whereas a couple of years ago oil and gas prices plummeted, not a day goes by now where we don’t read of the looming energy crisis in Australia. Consequently Condor’s order books have recovered substantially – not out of the woods yet, but there’s cause for cautious optimism.

All the share fund managers had strong results in a relatively flat market

- The standout performer was Anacacia’s Private Equity Fund 2, which delivered over 12% for the quarter. This was helped along by an exceptionally good trading result for Yumi’s, the dips and snack foods manufacturer, and the successful listing of building supplies distributor, Big River Industries.

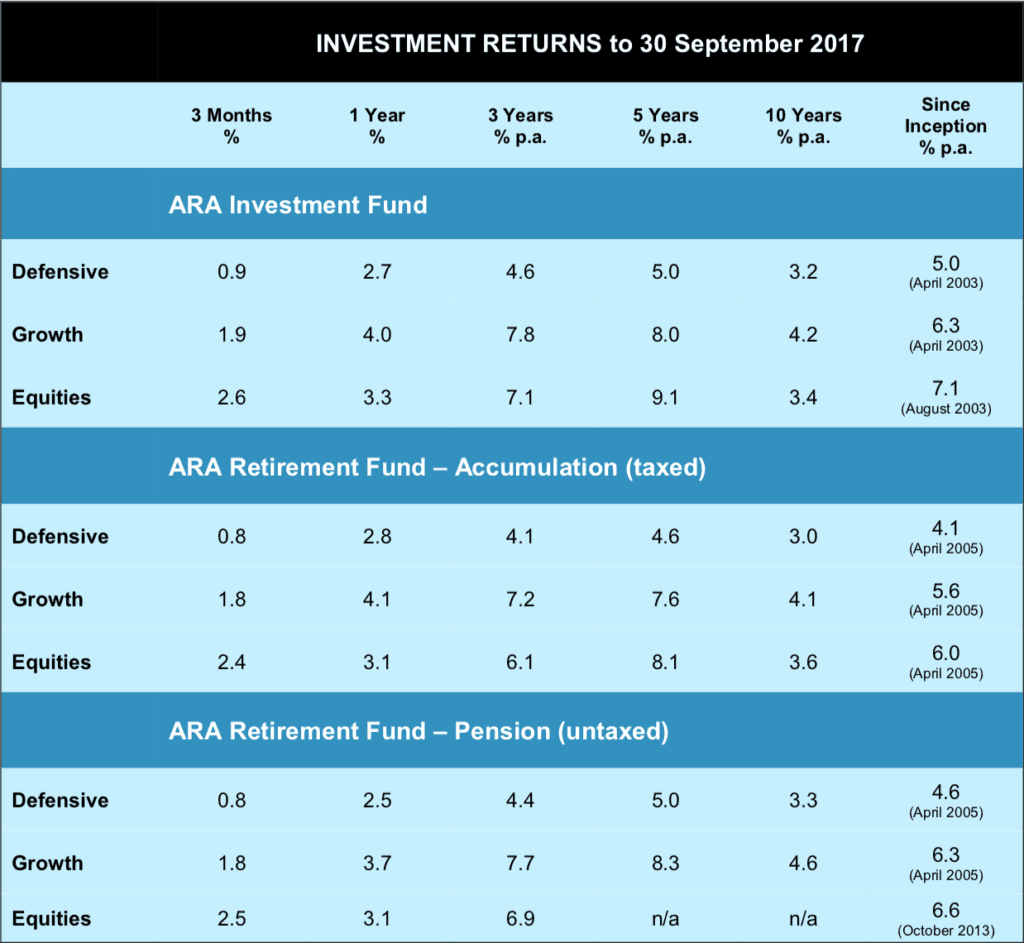

So, astute observers might be wondering, if the quarter’s results were robust, why has the1-year return sagged since last quarter? It’s a quirk of the maths. When it’s a rolling 12-month total, it’s not just the quarter result that gets added on the front that matters, it’s what drops off the back. As it happens, the September quarter last year was a blinder, but it’s now dropped off the 1-year return figures. Happily it lives on in the 3- and 5-year results and beyond.

Something New

At our recent investor update sessions we discussed the gradually declining yield from the portfolio of term deposits held by the fund. While still averaging above 4%, aslonger term deposits mature it’s not possibleto get the same rates as a few years back, so the average yield is edging down.

A reminder – it’s not the role of the TD’s toshoot the lights out on performance. Their key role is security. But every little bit helps. In the hunt for something of similar securitybut that might help hold up the yield, we’verecently approved an investment in a fund managed by Coolabah Capital.

Coolabah is a local specialist manager which invests in a diverse range of Australian bank securities. It aims to add value by accessing securities and rates usually only available to large scale institutional investors, and by actively trading securities for capital gain.

The new investment will appear in the funds in October.

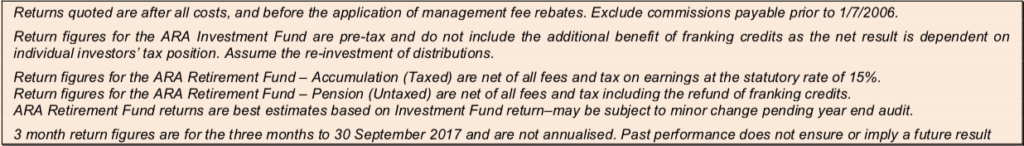

So, who's got what?

The table below shows the ARAIF’s investments as at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings

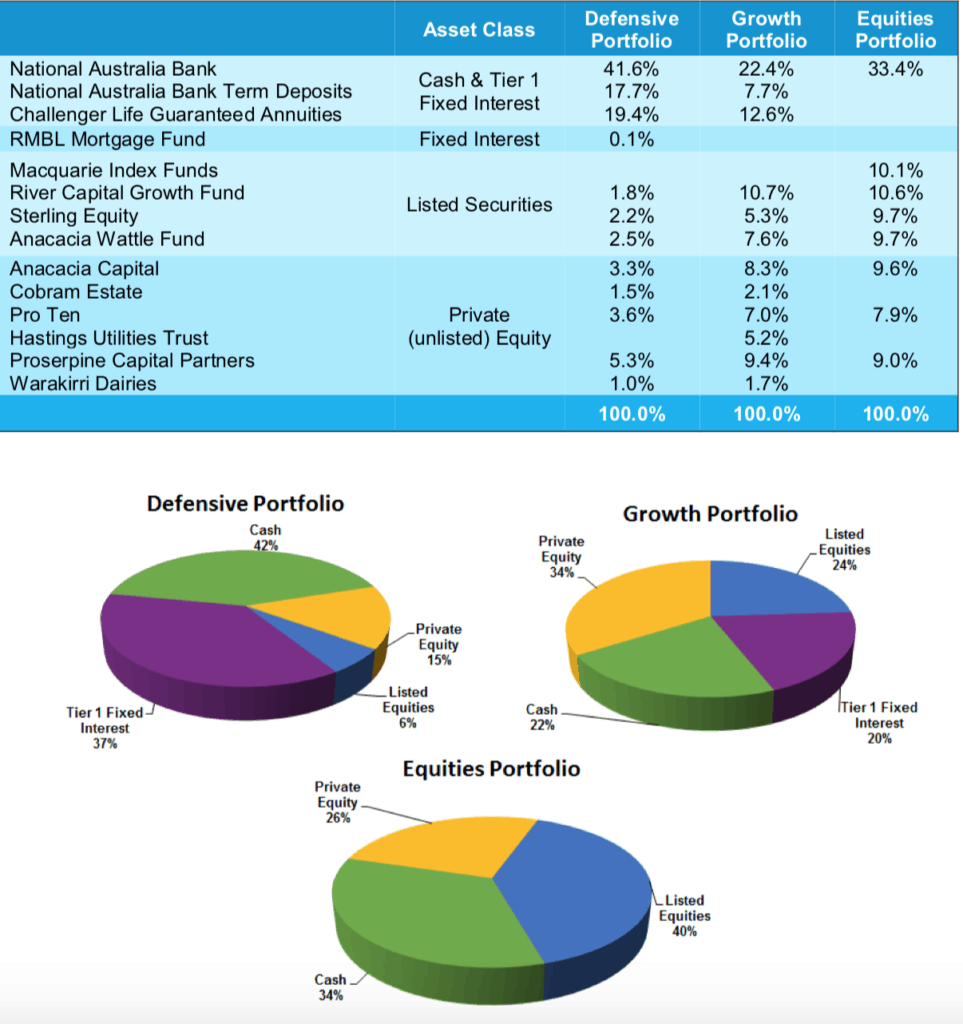

Apart from bank deposits and other fixed-term interest-bearing accounts, the Fund invests in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

Market Musings

Every so often in the investment game comes the temptation to try to make some sense of it all. This is usually a mistake that will end badly – a bit like parring the 17th. hole in an otherwise ordinary round, and thinking thatyou’ve finally got golf figured out.

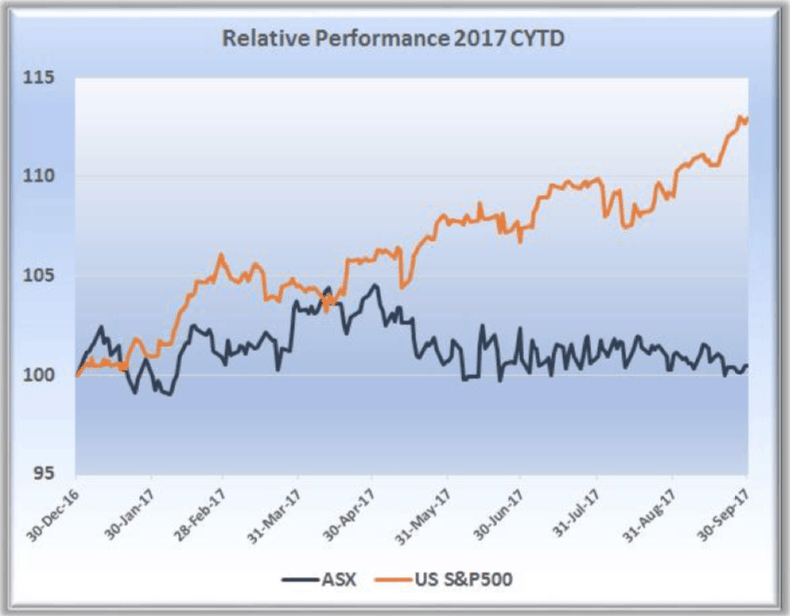

Take this snippet for instance. The chart below shows the relative movements of the Australian sharemarket (dark line) and the US market, this calendar year to date.

Whereas the ASX line has wobbled its way to nowhere, the US has ploughed ahead – up 13% YTD. In fact, it continues to scale new record heights almost daily while the Aussie market remains 16% below the peak it hit almost ten years ago (November 1, 2007).

This despite commentary such as the following, from US funds managerHoisington’s latest quarterly update:

“The worst economic recovery of the post- war period will continue to be restrained by a consumer sector burdened by paltry income growth, a low and falling saving rate, and an increasingly restrictive Federal Reserve policy. Additionally, with the extremely high level of U.S. government debt and deteriorating fiscal situation, the economy is unlikely to benefit from any debt-financed tax changes. Finally, from a longer-term perspective, the recent natural disasters are an additional constraint on economic growth.”

So what do we put this down to? It could be:

a) Just the grumblings of a grumpy money manager in downturn Kew that hasdeliberately avoided the “over-priced” USmarket with best intent, and missed out on handy returns in the process;

b) Record low interest rates in the US (even lower than ours) driving desperate US investors to take ever increasing risk rather than accept low bank interest rates;

c) An already fully-priced US market going over the top; or

d) All of the above.

Whatever the answer, what’s the solution? Keep the head down, and avoid any rash, risky shots, especially on the back nine.

New faces

Some of you may already have met our two newest staff members.

William Cundawan and Hugh Nguyen recently joined our planning team as paraplanners, a job which involves doing all the work while the planners take the credit.

Both are tertiary qualified in accounting and finance related disciplines, Hugh having also completed the Diploma of Financial Planning, which Will is about to start.

William Cundawan

Hugh Nguyen

Will has two years’ paraplanning experience in Perth before moving to Melbourne with his wife Audrey.

Hugh has five years’ experience in the industry.

Both are keen to pursue financial planning careers. Both are also keen followers of the round ball game, while Hugh professes a passion for Collingwood in the AFL.

serious flaw in our recruiting methods.

We welcome Will and Hugh to the team. It’sgreat to bring new folk with fresh ideas to the business, and it helps to grow the prize pool in the footy tipping comp.

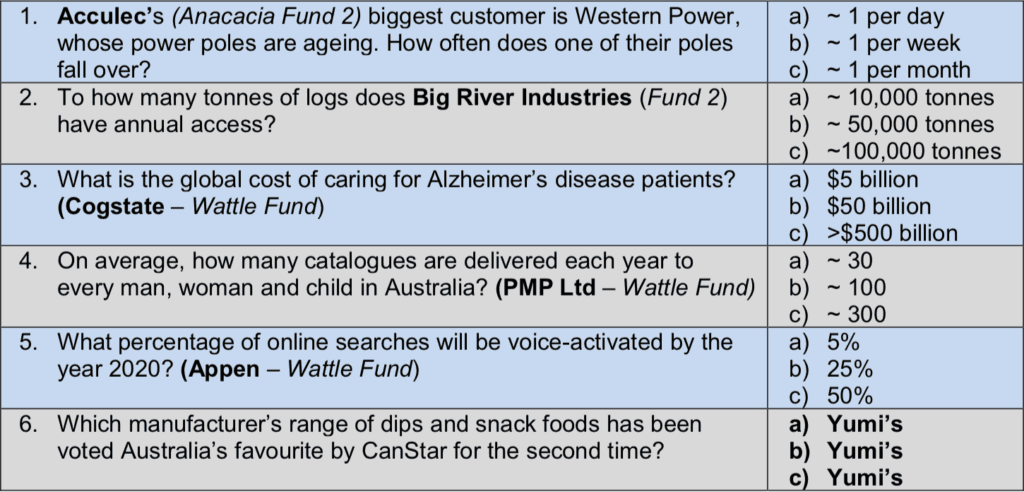

Quiz

And finally, a test of your knowledge of portfolio companies, courtesy of Anacacia Capital. The beneficiary company for each fact is in bold.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. The information contained in this document is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, ARA does not accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs and reviewing the Product Disclosure Statement. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.

Answers: 1. A, 2. C, 3. C, 4. C, 5. C, 6. D – all of the above