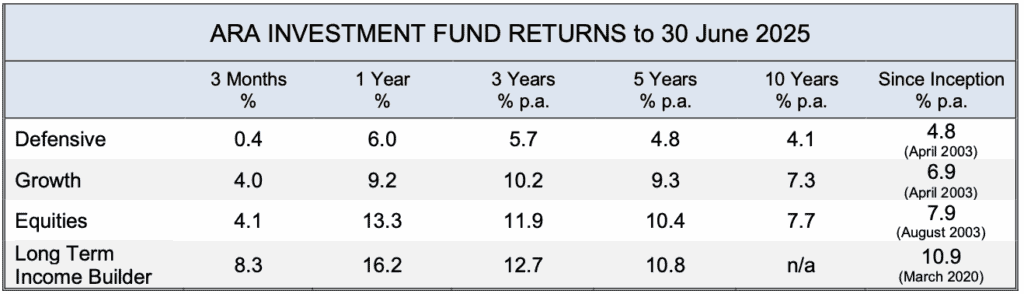

Looking back on what’s gone on this past year, it’s a pleasant duty to report another year of solid returns.

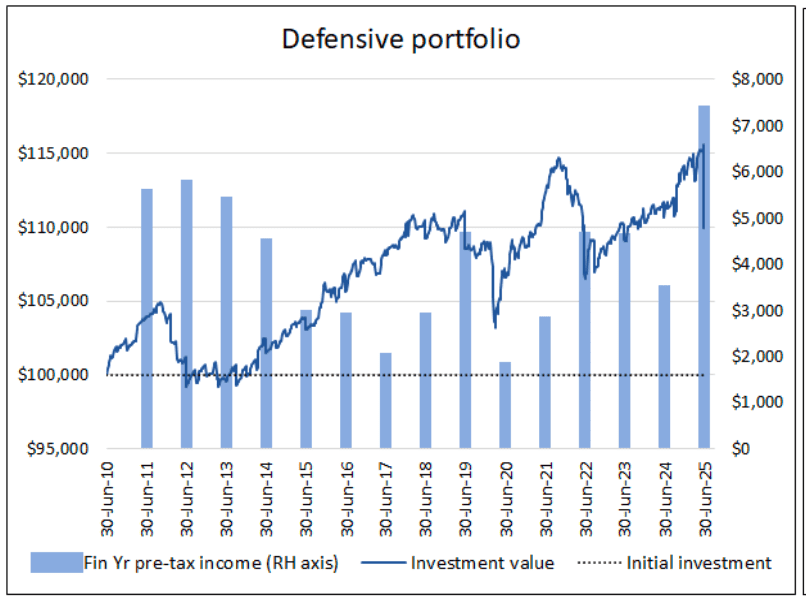

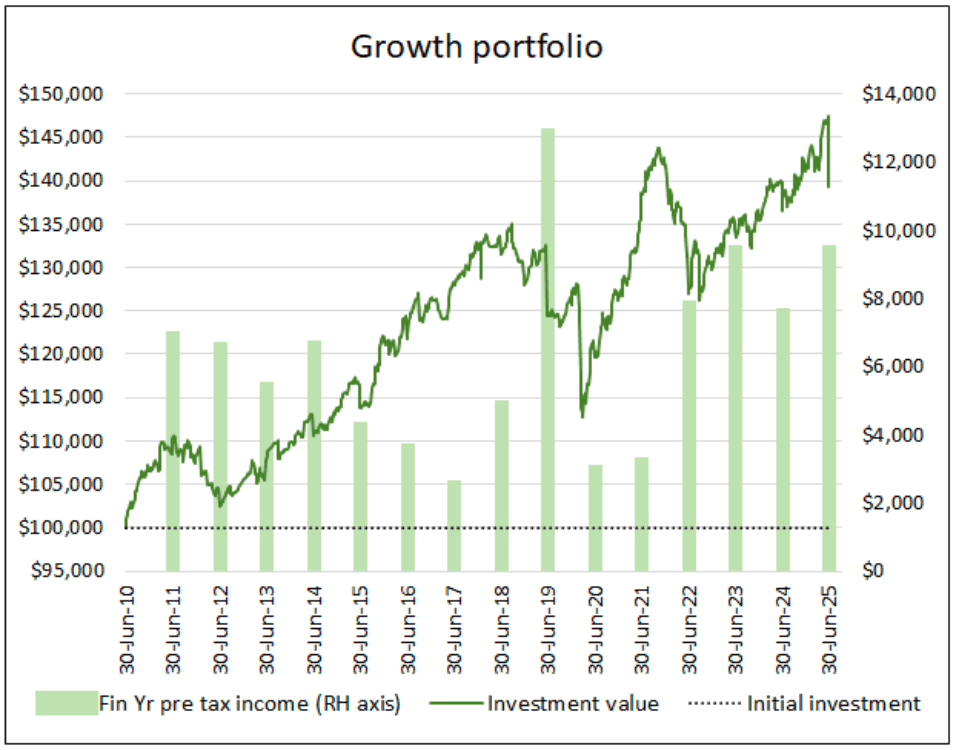

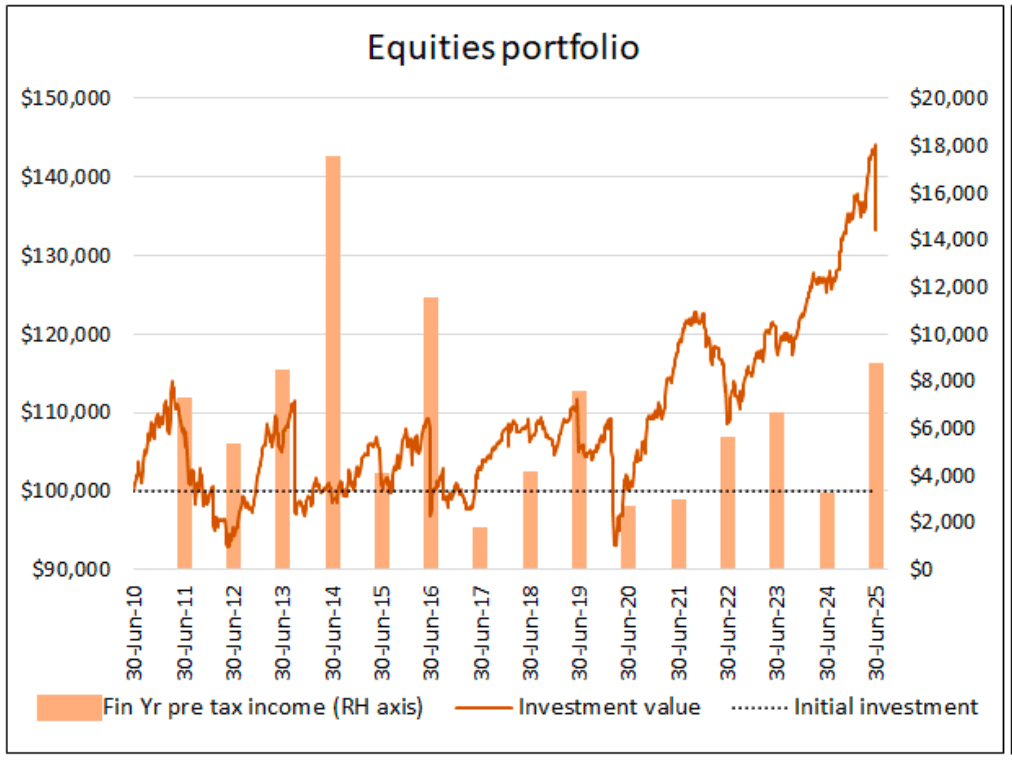

Alert investors will also notice that income distributions, particularly the June distributions from Defensive, Growth and Equities portfolios, were healthy and that therefore the income component of the return made up a pretty high proportion of the year’s total. This reflects some profit-taking and rebalancing of portfolios – prudent risk management in portfolios that are being actively managed, after a period of strong growth.

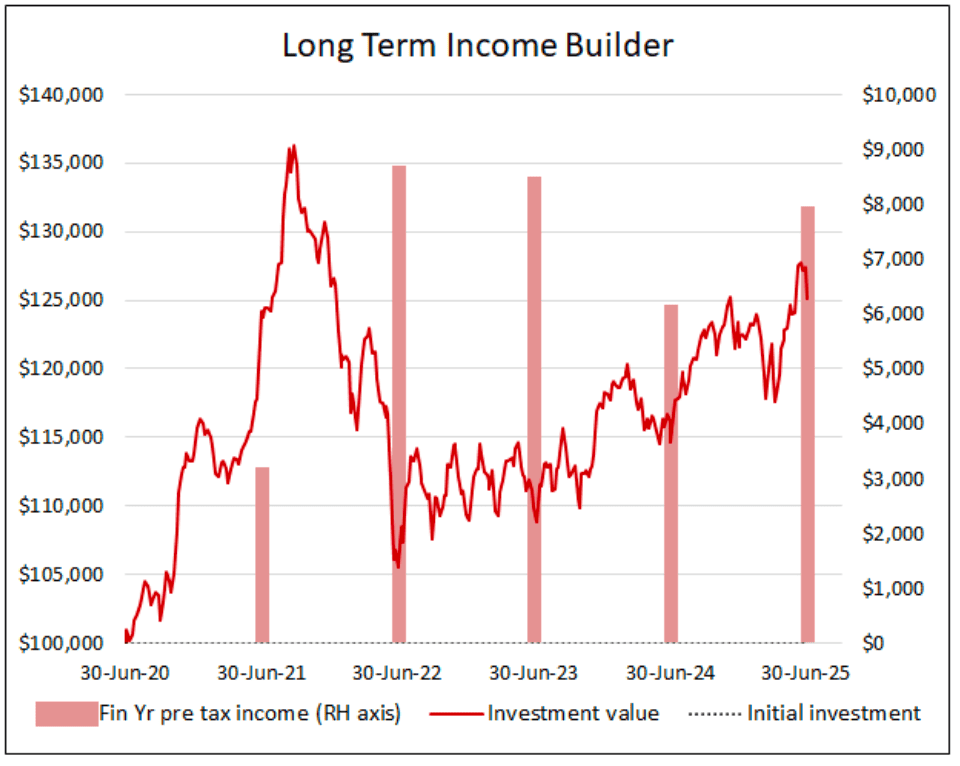

The Long Term Income Builder looks to be resuming its expected pattern of long term income building, after the distorting effects of COVID interference – whereby dividends were curtailed for a year or two, then there was a catch-up phase. The past year’s income return was well ahead of its 5% target, coming in at almost 7% gross. Happily, its value is also growing. In its now five-year history, in addition to the income yield, underlying growth in value has averaged 5.1% per annum, well ahead of inflation for the same period.

Having said all that, we’d also be somewhat surprised if investors weren’t looking over their shoulders, wondering what might happen when the ship hits the sand. Are we ready for……whatever?

So let’s go back a step. At ARA the key to investment and risk management is the integration of advice and investment. Market volatility is comfortably manageable if you fully understand an investor’s immediate and longer term cash needs. Advisers familiar with a particular investor’s situation can devise, demonstrate and recommend an appropriate mix from a suite of portfolios designed and built for specific purposes.

A fundamental aim is to avoid having to cash in an investment at a bad time, when its market price is down. That’s a surefire way to erode and permanently destroy your wealth. But if you can wait it out comfortably, market price fluctuation – a fact of life in investment markets – need not be such a problem.

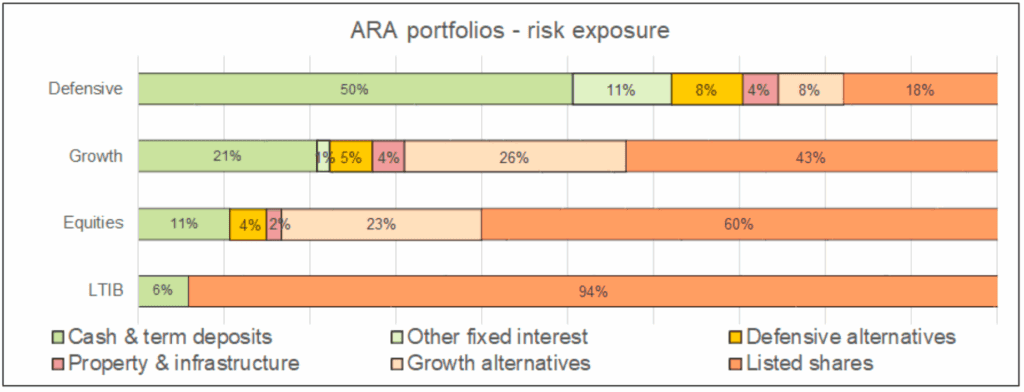

So your first line of defence is the right mix of investment options. Cover the short-medium term cash needs from the income thrown off by the portfolio itself, supplemented if necessary by withdrawals from the portfolio option(s) least susceptible to market risk. The longer term investments, which offer the best return prospects but are likely to be the most volatile, need only be cashed if and when it suits you. Not when the ship has run aground.

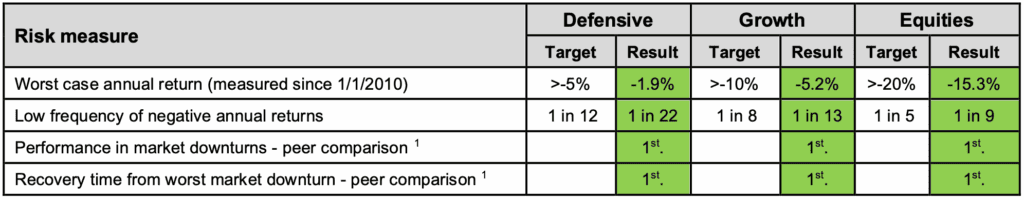

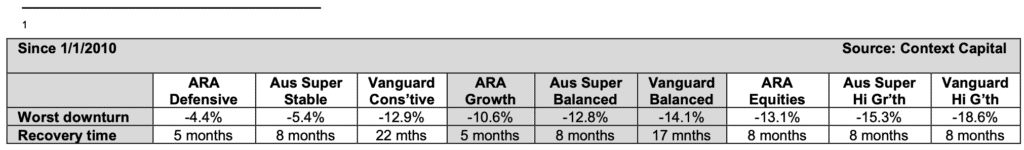

The second line of defence is an active style of management that aims to achieve given return targets but with high tolerance to market risk and quick recovery times. To that end as a matter of course we continually monitor both the risk and return outcomes across the board. Edited highlights are in the tables below – we’ll look at the full scorecard in more depth in our forthcoming Investor Updates.

Clearly, with each option designed to serve a particular purpose within a broader portfolio, the risk targets are stricter at the Defensive end of the spectrum. But in a nutshell, green is good, and as it happens all the diversified options have been meeting their risk targets while also delivering on the return front.

So, who’s got what?

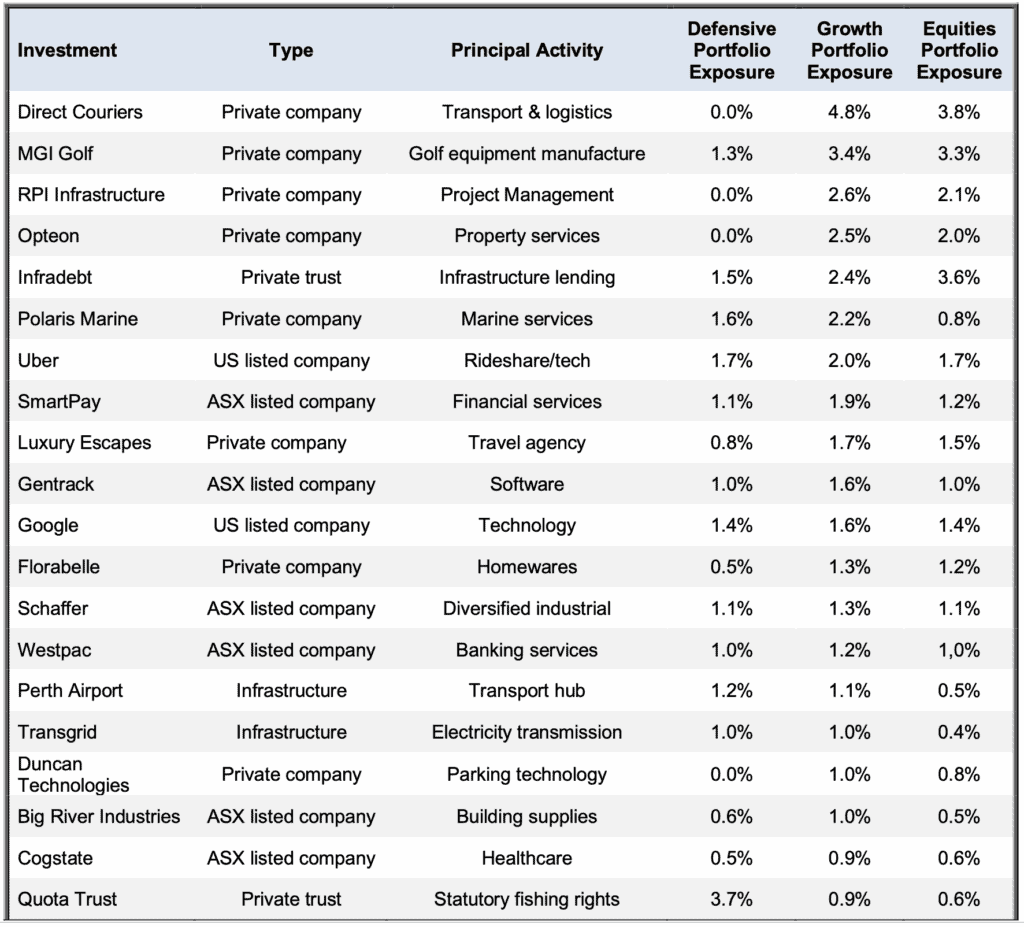

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings – diversified portfolios

Apart from bank deposits and other interest-bearing accounts, Defensive, Growth and Equities portfolios invest in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the portfolios’ returns.

Returns quoted in this report are after all costs, and before the application of management fee rebates. Return figures are pre-tax, and include the value of franking credits from franked dividends. Total return figures assume the re-investment of gross distributions including franking credits. 3-month return figures are for the period to 30 June 2025 and are not annualized. Data source ARA Consultants Ltd & Context Capital (except where indicated)

ARA Consultants Pty Ltd provides this update for the information of its clients and associates. If you do not wish to receive this or other information about ARA in future, please contact us on (03) 9853 1688.

This document has been issued by ARA Consultants Pty Ltd for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). Information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. The PDS and applicable Target Market Determinations are available at www.araconsultants.com.au or by contacting ARA by phone on (03) 9853 1688 or by email at info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved previously does not guarantee or imply that they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: June 2025 Quarter Investment Update.