So, there we were, three months ago, squirming ever so slightly in the chair trying toexplain a quarter’s performance that was –well – kind of ordinary. Fast forward three months, the story is somewhat rosier, and the reasons are – exactly the same! Just inreverse. Let’s have a look.

ProTen

Everyone’s favourite broiler chook farmerssaw their meteoric share price rise stall and come off the broil in March. Momentarily as it turns out, as the price recovered 9% in the June quarter (not including its healthy dividend).

Condor Energy

After a near-death experience at the hands of plummeting oil and gas prices, Condor’sfortunes look brighter – courtesy of thedomestic gas shortage that ensued. Condor’sNew Zealand operation is now fully booked well into 2018, and it has contracts in the pipeline with Australia’s largest customers –including the likes of Santos.

So Condor’s valuation slide has ceased and the optimists in the room are even talking about valuation uplifts in the second half ofthe calendar year. Let’s not get ahead ofourselves – not out of the woods yet. But certainly the outlook is better than it has been for two years.

The share market?

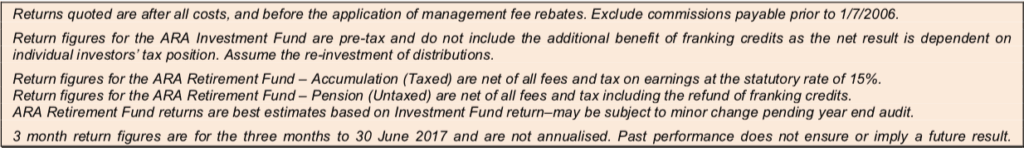

You’ll recall that the local share market had a robust March quarter, led by the big end of town (banks and big miners) in which our share fund managers currently do not invest. Consequently our share exposure lagged. Again, a different story this quarter:

That is, the market on weighted average stalled, weighed down by pretty heavy losses among the banks, which were hit with a double whammy of taxes from the Federal and the odd State Budget. Meanwhile our managers enjoyed a good quarter.

And in other news of note….

Big River – is an asset of Anacacia’s Fund 2and, as we mentioned last time, it was about to list on the Stock Exchange. It finished the quarter a healthy 15% up on its listing price, giving the Fund both a handy uplift and a potentially profitable exit opportunity.

Appen – A technology company which proved so successful for Anacacia’s Fund 1and which since its listing on the Stock Exchange remains a major asset of the Wattle Fund. Appen announced a profit upgrade during the quarter which saw its price rise a cool 50%. It just keeps on giving.

The Wash Up

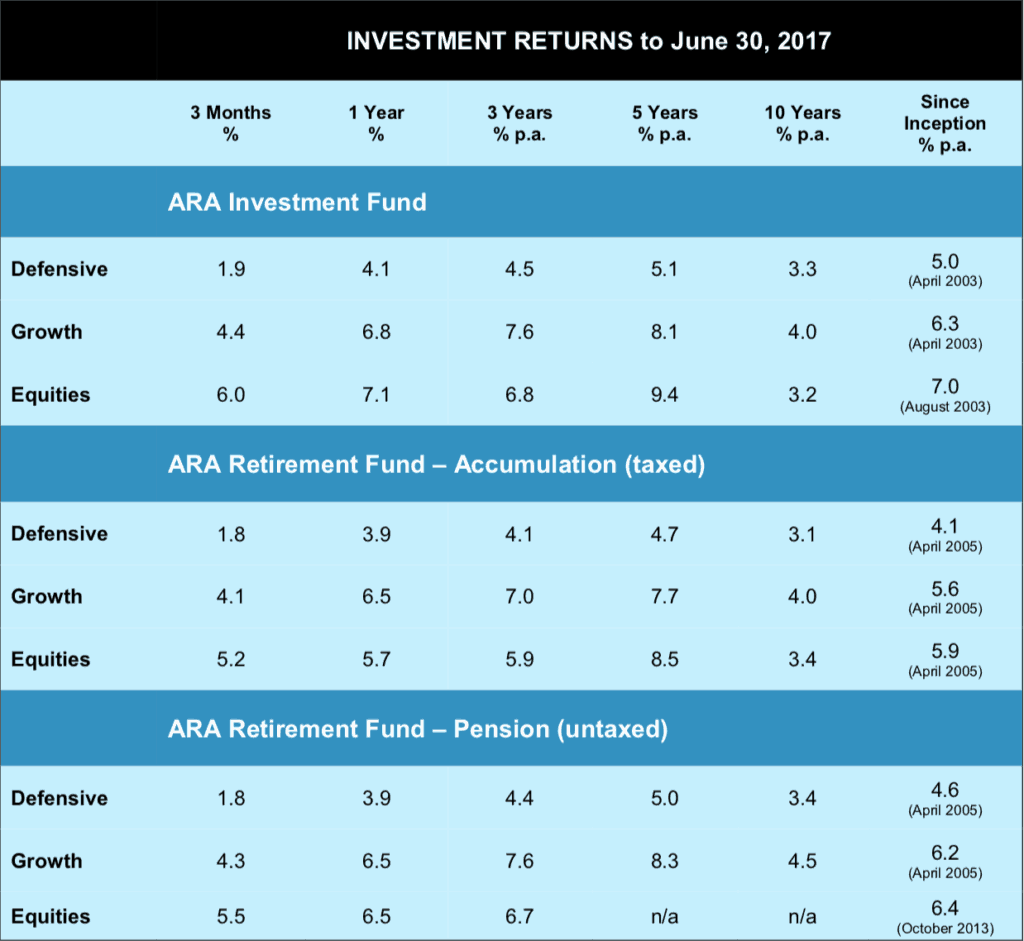

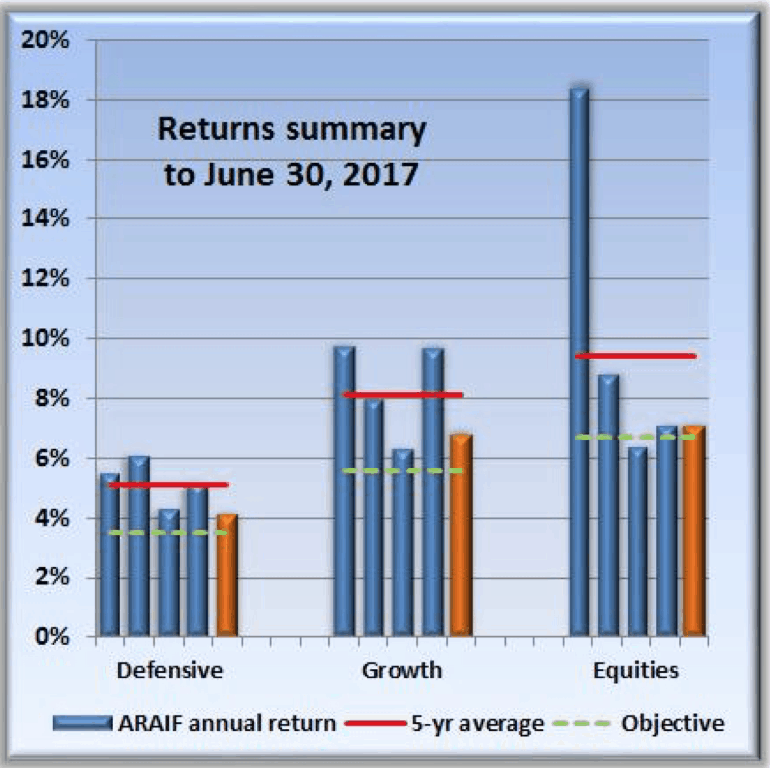

The bars in the chart show annual returns for each of the past five years, along with the five-year average (red lines) and each portfolios’ objective (green lines).

So the annual result for each was a bit under its five-year average, while still above respective targets.

With the wonderful wisdom of hindsight, it is true that 2016/17 turned out to be a good onefor “risk” assets like shares. So beingunderweight in shares and holding the highest levels of low-yielding cash deposits inthe Fund’s history was not the way to be topof the performance tables – lots of funds will have returned better results for the year.

Well, so be it. The results aren’t too shabbyfor portfolios offering the protection of nearly 80% (Defensive) and 50% (Growth) in cash. We remain of the view that years of cheap, easy credit have driven up the prices of most risk asset categories to levels demanding caution, and geo-political risks have rarely been higher. As such, in the eternal compromise between chasing returns and preserving capital, it seems like a good time to err towards the latter.

And so we will.

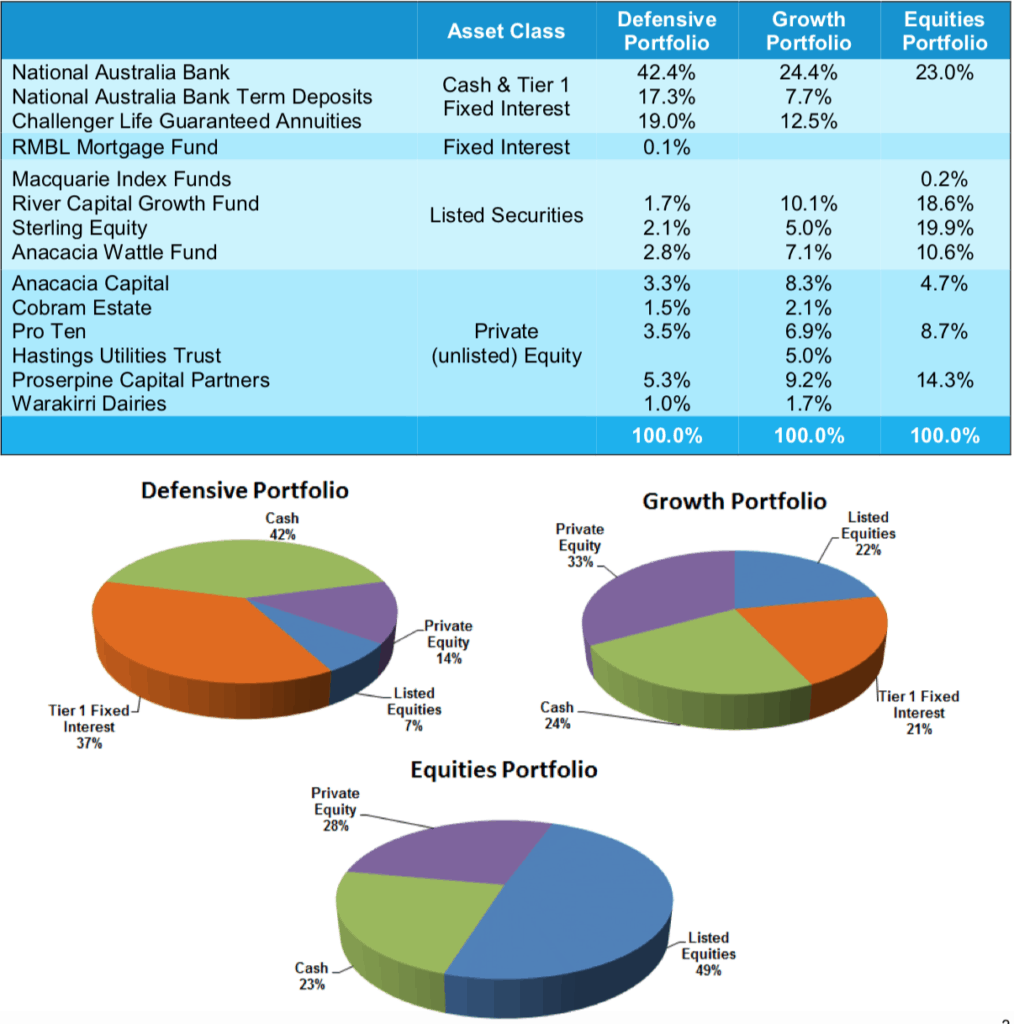

So, who's got what?

The table below shows the ARAIF’s investments as at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings

Apart from bank deposits and other fixed-term interest-bearing accounts, the Fund invests in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

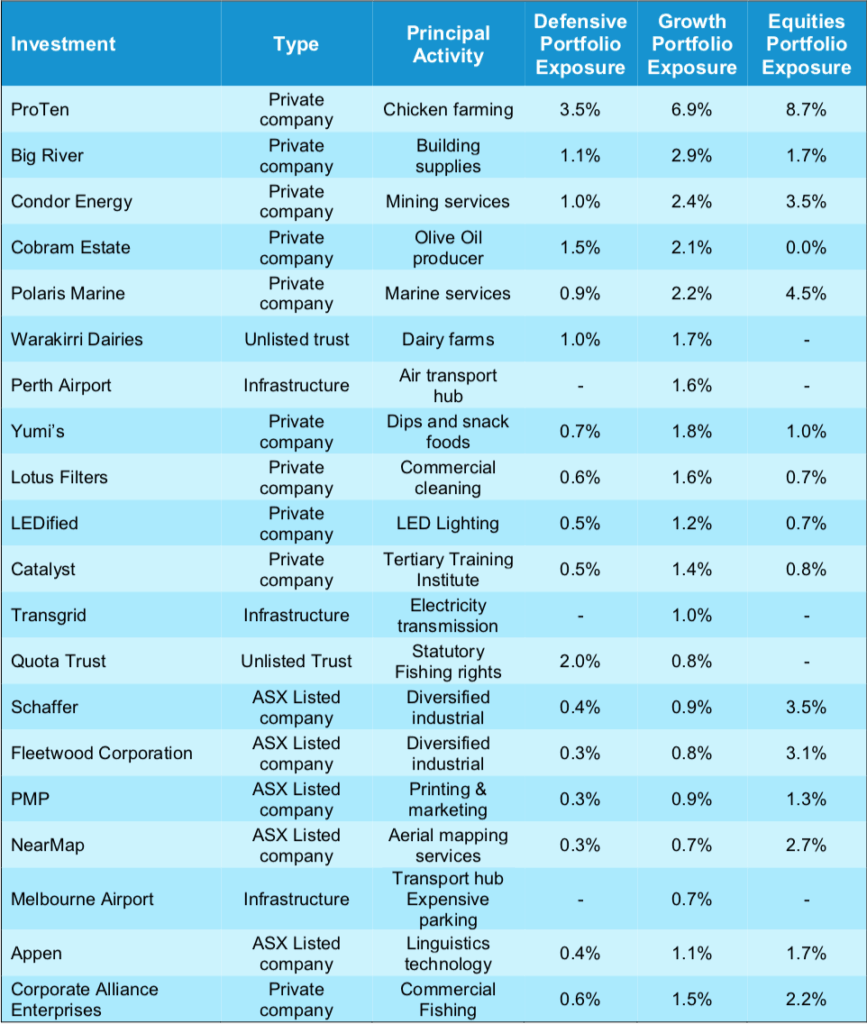

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

Market Musings

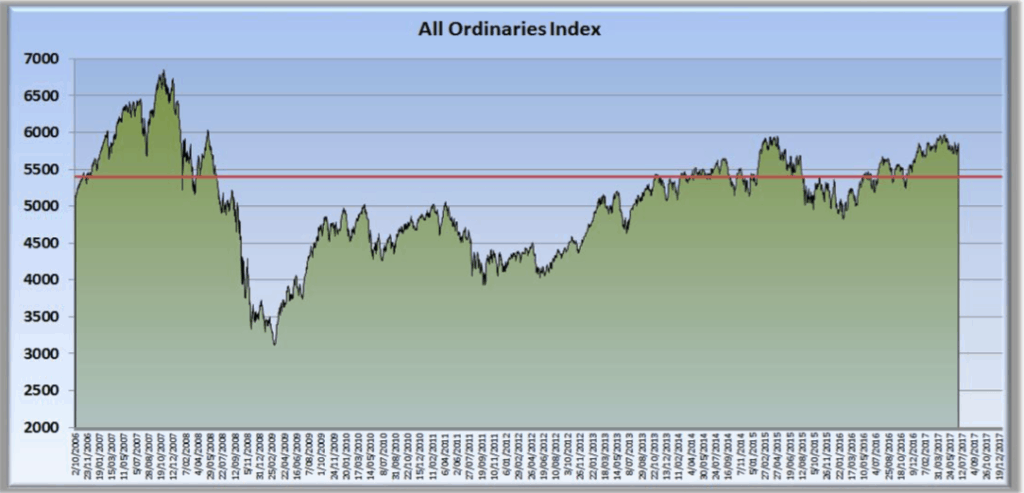

We observed previously that the Aussie share market ended up having a good year. In the process it oscillated between 5238 points and 5976, threatening both the 5000 and 6000 milestones before finishing at 5764.

That sounds familiar. Interestingly, for those of us who need to get out more, the market has now passed through the 5400 point mark a total of 75 times – 38 on the way up and 37 on the way down. The first time was in November 2006, and the 2016/17 financial year added a further nine crossings, ten years after the first.

(Any bets we’ve seen the last one?)

Now that snippet might not be as valuable at the Primary School Trivia night as knowing Wilma Flintstone’s maiden name*, but it begs further thought.

For instance, it implies the market hasn’t done much in ten years. Correct. The rolling ten year period to the end of June 2017 was the worst since at least the period starting in December 1979, which is as far back as our data goes. It remains well short of its previous high of 6853.6 reached on November 1, 2007. If not for dividends the market return would be in the red, even over ten years

Of course, most of the damage was done in the first two years of this period – what was lovingly dubbed the GFC. But these things happen – not infrequently – and must be navigated.

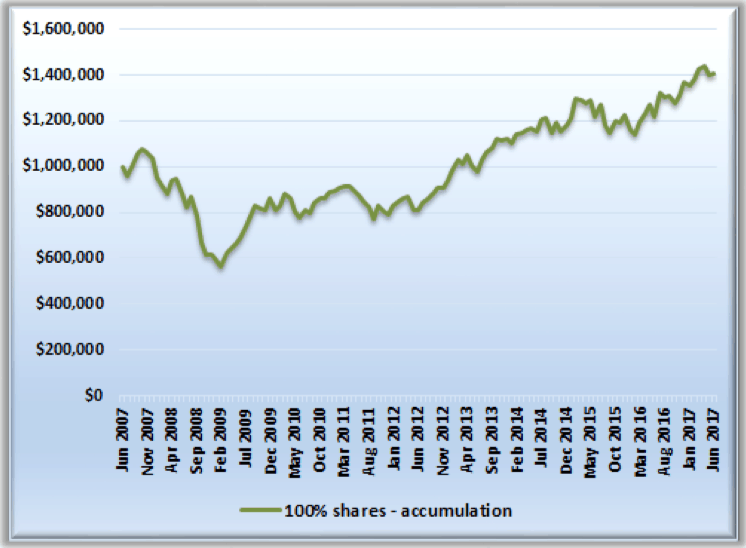

If you’re a long term investor with no immediate need to access your investment, the conventional wisdom is just leave it alone and “she’ll be right” in the long run. The first chart below, showing how an investment of $1,000,000 made on July 1, 2007 and left alone for ten years, suggests that even after such a lacklustre decade, maybe that would do – no great harm done.

However, at the risk of stating the bleeding obvious, that’s not always the case. Many people, including the majority of our clients, rely on their portfolio now, or in the near future, to provide an income.

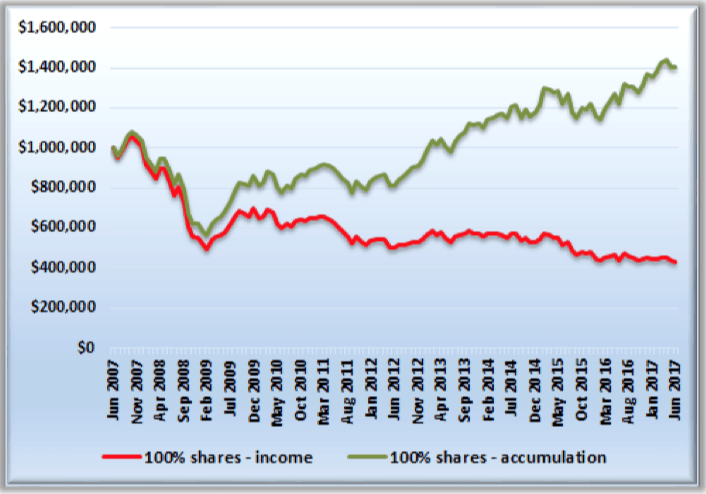

The second illustration shows the outcome if that investor was drawing an income of $5,000 each month – i.e. $60,000 per year, or a starting income of about 6% of their capital – indexed each year for cost of living increases of, say 2.5% per year.

Clearly the act of drawing an income changes things – maybe more than would be intuitively obvious. In the income case:

– Obviously there is a lower balance left to benefit from the recovery when it comes;

– More importantly, after a fall of, in this case, about 40%, the same level of income payments from the portfolio represents about 10% of the remaining balance, rather than the original 6%. It’s a much bigger ask for the portfolio to consistently replace the income drawn.

There’s hope from an unlikely source – namely the safe haven of bank deposits.

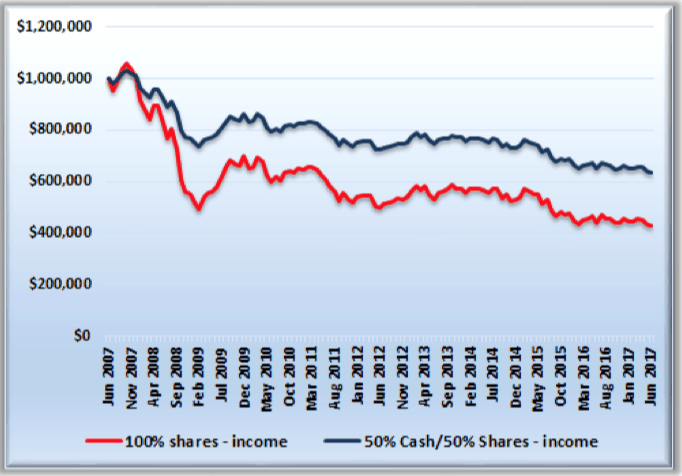

The next illustration assumes the investor holds half of the portfolio – equivalent to about eight years’ worth of income payments, in “safe” assets like bank deposits or equivalent. Income payments are drawn from this part of the portfolio, while the balance remains invested in the share market.

Then once a year in July, the investor balances the portfolio back to 50/50 cash & shares. If the market had a bad year, that means buying some more, if it had a great year it means cashing in some. The result is the dark line below, compared with the “All shares” option.

It may not look much, but in fact at the end of ten years the investor has over $600k remaining rather than $400k – about 50% more capital – by adopting what on face value is a far more conservative strategy. This comes about because:

- The damage from the market downturn early on was limited;

- The investor avoided having to sell assets after market downturns – and in fact bought more at cheaper prices;

- Also sold assets after periods of strong returns, thereby locking in profits, replenishing cash assets and ensuring limited damage in the event of the next downturn.

Of course if everything always went up there’d be no need to think about things like this, but clearly that’s not the case. Using low volatility assets like bank deposits, (even though they may be low-yielding), in appropriate combination with long term assets targeting the higher return, is a useful means of managing the short term risk in what is a long term game such as investing for a comfortable retirement.

This is at the heart of discussions we are currently having with clients about how their portfolios are structured. We look forward to seeing you soon.

Movement at the station

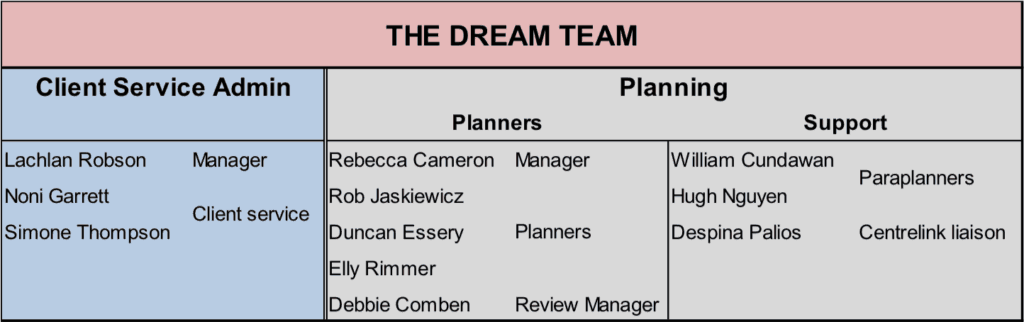

In recent times we’ve made a fair fewadditions and changes to our service team, and thought it might be timely to update you on who’s who and who does what.

Our Planning team, is responsible for the provision of financial advice, reviews etc. and are the ones to contact when the matter is advice or investment-related. We recently recruited two more planning assistants (or paraplanners), William Cundawan and Hugh Nguyen. And Despina Palios (Desi) has been with us for some time demonstrating extraordinary resilience in the role of Centrelink liaison.

We have also put Debbie Comben in charge of managing our client review function, to make sure it happens properly and that everyone is getting the service to which they are entitled. You will be hearing more from all of them.

The Client Service Admin team looks after the nuts and bolts behind the scene, account management, liaison with fund administrators, and can be contacted with any account queries, to make changes to account details such as address changes, to request forms and the like. Some of you may have met Simone Thompson, who joined the team on reception duties a few months back.

So who’s missing? Oh, yeah – Alan. As the business has grown in direct proportion to his hair loss, the demands of business planning & management, investment responsibilities and client communications dictate that Alan steps back from planning duties to focus on these. Keeping up with regulations and financial planning intricacies is without question a full-time commitment these days,

and both the business and its clients will be better served with the delivery of advice being in the hands of the Dream Team. But we’re not getting rid of him that easily, he still looks forward to catching up with clients and friends around the office and at functions.

Speaking of which:

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. The information contained in this document is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, ARA does not accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs and reviewing the Product Disclosure Statement. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.