December Quarter 2022

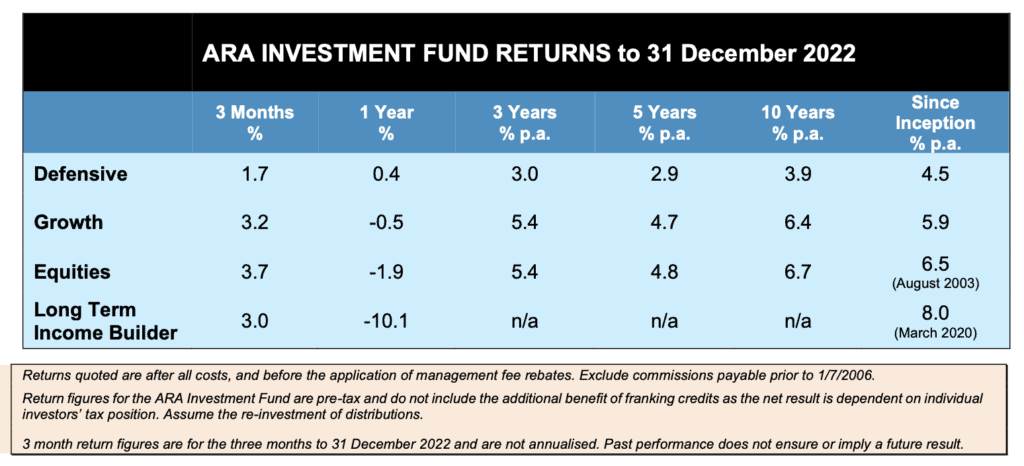

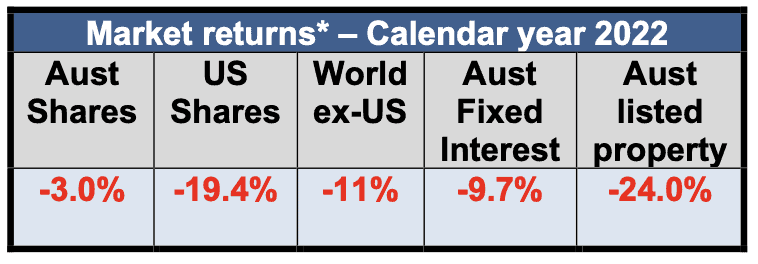

2022 was not an easy year in which to eke out a return. On top of the ongoing Covid impacts we saw a simply awful war unfold in Europe, bringing economic hardship on top of the human toll. Supply issues saw a sudden hike in inflation, along with the end of the period of easy credit and very low interest rates.

Not too many investments will thrive in those conditions, and consequently most major markets were dipped in red this year.

So breaking even, or close to, in the diversified portfolios wasn’t an awful result – sometimes capital preservation is the name of the game. It came about via a combination of asset allocation decisions that saw us avoid the worst of the trouble spots, and strong relative results from a number of fund managers.

Nearmap

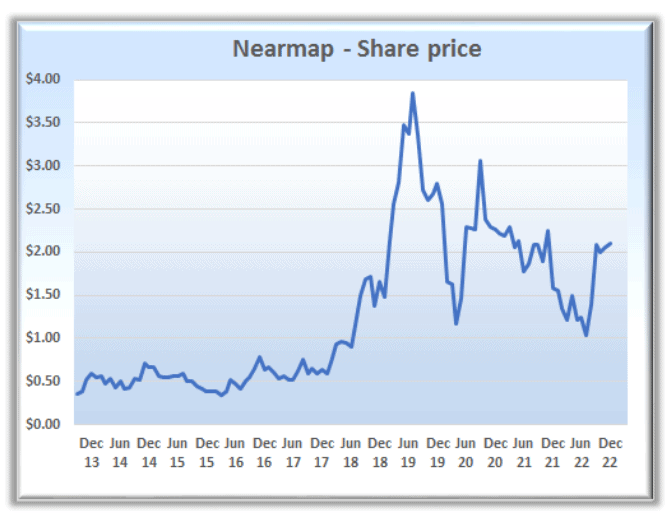

Alert readers will note that an old favourite, Nearmap, has gone from the table of major holdings later in this report. Nearmap is an Australian success story that’s had quite a bit of airplay in these pages and at our investor evenings over the years. The company is a leader in the aerial imagery business (Google Earth on steroids), and in so doing has changed the way whole industries work.

Nearmap was unusual in that it was one stock that was a major holding in two of our managers’ portfolios, Sterling and Anacacia. In our manager selection process we try to achieve a variety of management styles such that the blend provides genuine diversification. As a result, duplication of assets across, for example, our Australian share investments, is rare. Nearmap was an exception, and fortuitously it has been a standout investment.

We first gained exposure to the stock in late 2013, when it was trading at about $0.35 and Sterling Equities began to buy it. Over time the exposure was increased, then pulled back a little when the stock ran hard in 2019, and opportunistically re-built again over the volatile period in 2020-22. Then late last year an offer from US based firm Thoma Bravo at $2.10 a share (6 times its 2013 price) was accepted and the holding was cashed in. A bumpy ride at times, but a fine result overall.

A Retrospective

New Year is a popular time for the media to revisit the year that was. And typically it’s fairly gruelling reading. You could be forgiven for thinking it’s all one-way traffic straight to the scrapheap.

Then lo and behold, in The Age on Boxing Day, right down the bottom of page 35 after all the Harvey Norman ads, was a piece headed “Leaps in space, medicine, equity, energy give us all reasons to be hopeful”. It cited major advances made during the year in vaccine availability for children, reduction in child poverty, advances in cancer cures, clean energy and more. A breath of fresh air!

If you’re looking for another counterpoint to the dramatic worldview that dominates the media, you could check out the work of the late Hans Rosling and his family, online or via his book “Factfulness – Ten Reasons We’re Wrong About the World – and Why Things Are Better Than You Think”. A fun read, and quite uplifting.

So, who’s got what?

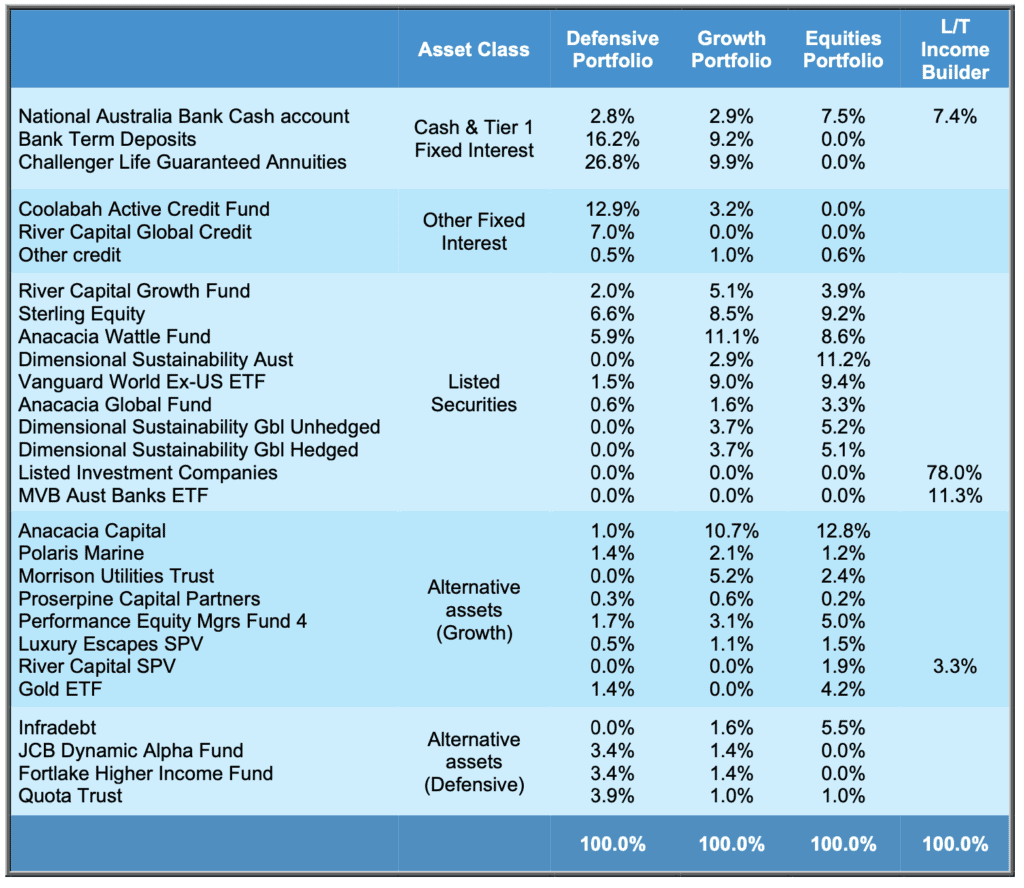

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings – diversified portfolios

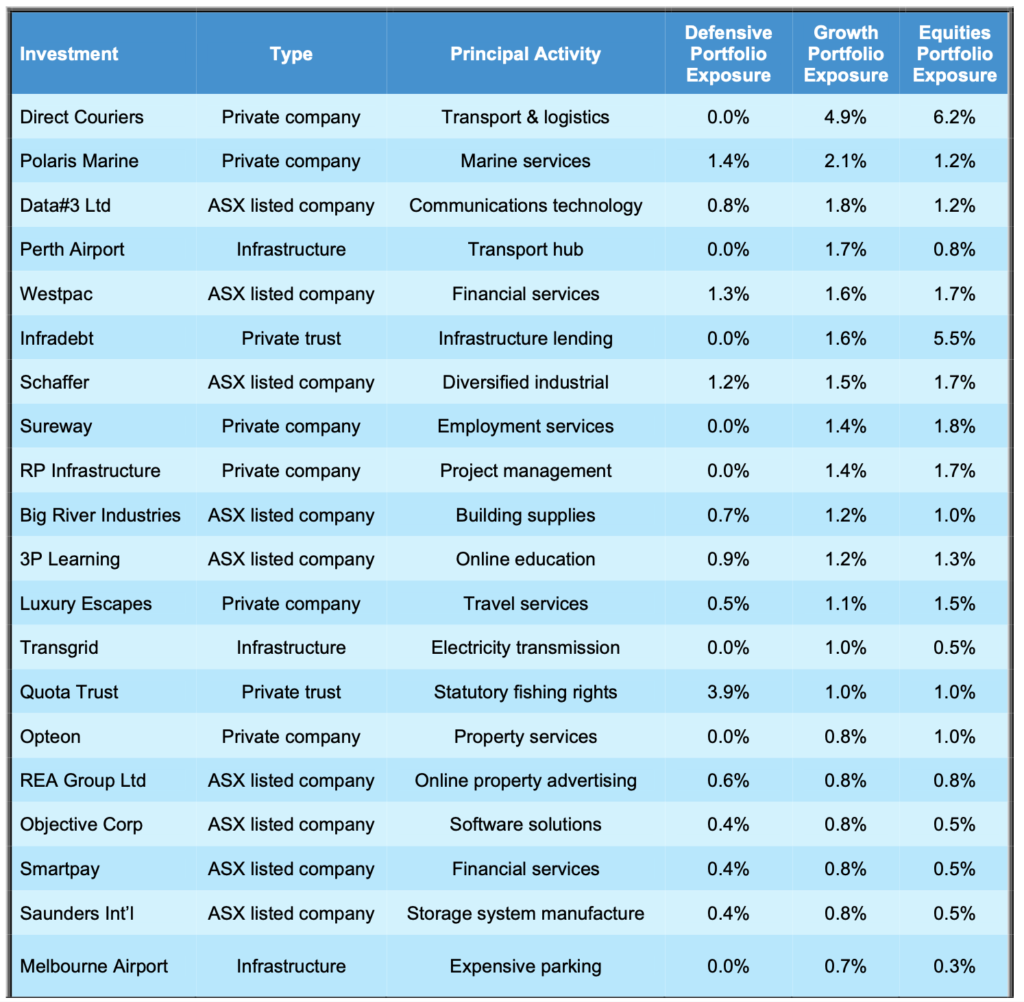

Apart from bank deposits and other interest-bearing accounts, Defensive, Growth and Equities portfolios invest in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the portfolios’ returns.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). Information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. You should also refer to the relevant Target Market Determination (TMD) for the product. The PDS and applicable TMDs are available at www.araconsultants.com.au or by contacting ARA by phone on (03) 9853 1688 or by email at info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: January 2023 Investment Update.