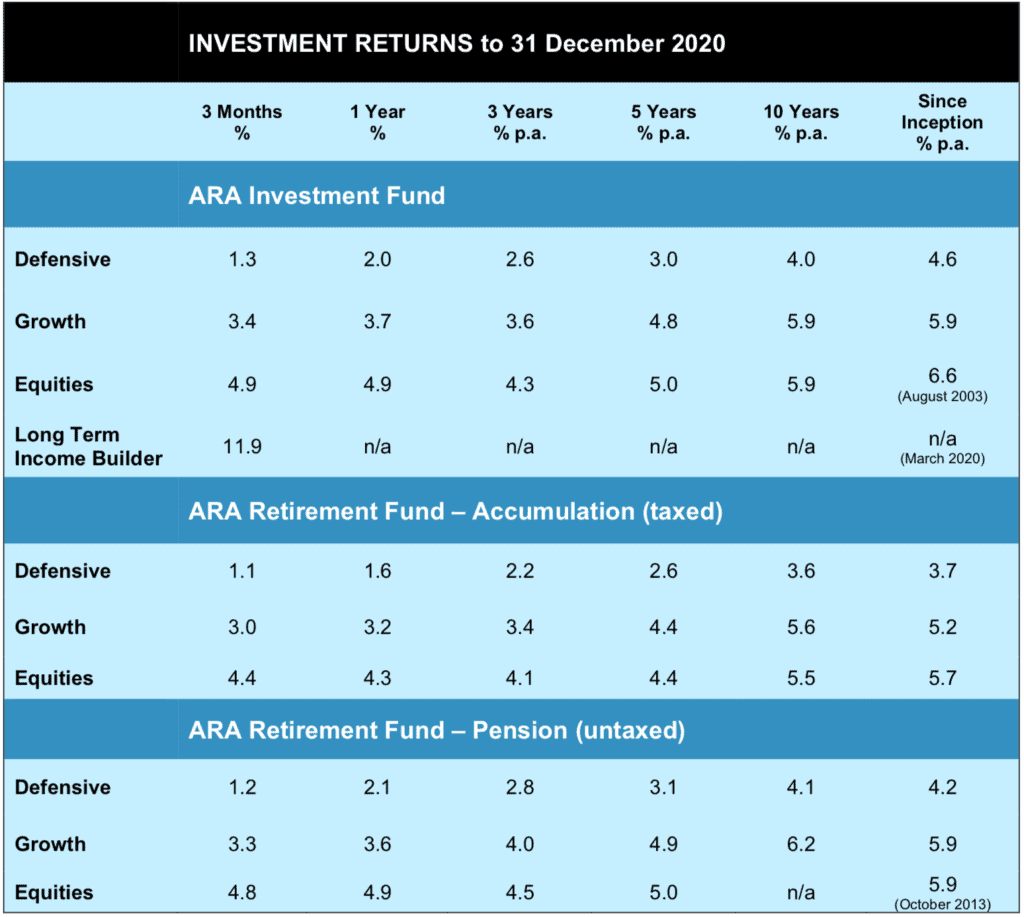

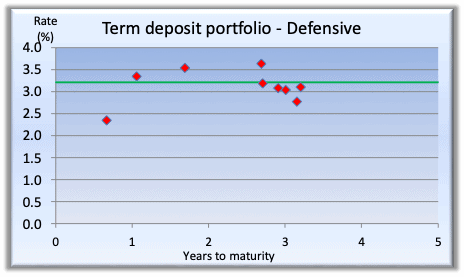

Solid returns continued for the last quarter of the calendar year, such that all portfolios posted positive results for a tumultuous 2020.

To look at the year in two halves (table below) it doesn’t look nearly as bumpy as it felt at the time. Although the comparison with the stock market (All Ords Accumulation Index) gives some sense of how the portfolios arrived at their destination via a much smoother route.

So that’s last year, what of 2021? It would be a brave call to say that the political, economic and health issues that distinguished 2020 are behind us. Notwithstanding Australia’s successes thus far in containing the spread of Coronavirus, there is a very real chance that the pessimistic scenarios will prevail elsewhere in the world if not here, with disastrous humanitarian and economic consequences. Investment portfolios may well be severely tested again this year.

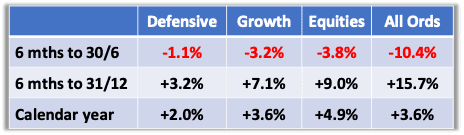

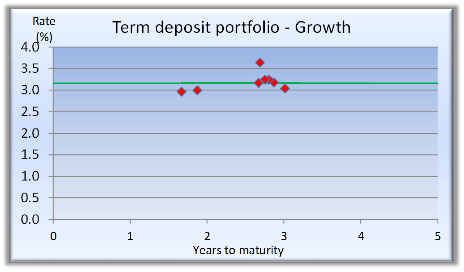

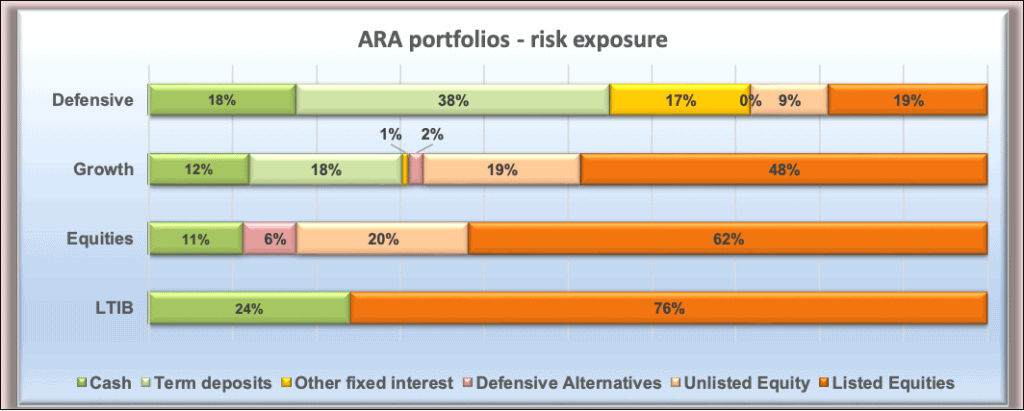

Looking at the “safe” assets section of the ARA funds, the part that plays the key role in capital protection, close to 70% of Defensive and 30% of Growth are still in securities with bank safety or similar. Having locked in some long term deposits a couple of years ago before the bottom fell out of the interest rate market, most of our term deposits still have around 3 years to run at or around interest rates of 3% or more, and very little will roll off in the coming year. In the charts below each dot represents one such deposit, with the interest rate on the vertical axis and years left to run on the horizontal.

As for risk assets, those that are supposed to do the heavy lifting and generate returns above the safe rate, the key theme is still the anomaly whereby the US sharemarket looks by many measures startlingly expensive, while markets elsewhere remain relatively attractive. One example quoted to illustrate this “irrational exuberance”, particularly in large tech-oriented stocks in the US, is a statistic concerning the Tesla company, which has only recently begun turning a profit. It is now valued at $1,250,000 per car sold annually, while “old school” General Motors is valued at $9,000 per car.

So, notwithstanding the positives of a new administration and the multi-trillion dollar stimulus plans in the US, heady valuations call for caution.

Our market, even after the strong rebound since March, looks fair value still, if largely on the back of the attractive dividend yield. And similarly global stocks outside the US still trade on attractive terms.

So our strategy here is pretty simple. Profitable businesses remain a sound investment provided you don’t pay too much for them. Hence we hold effectively nothing in the US market, and our exposure to shares is limited to Australian companies and the World outside the US.

And introducing Dulani Goonawardena

We are delighted to welcome Dulani to our service team. You will no doubt be hearing from her.

So, who’s got what?

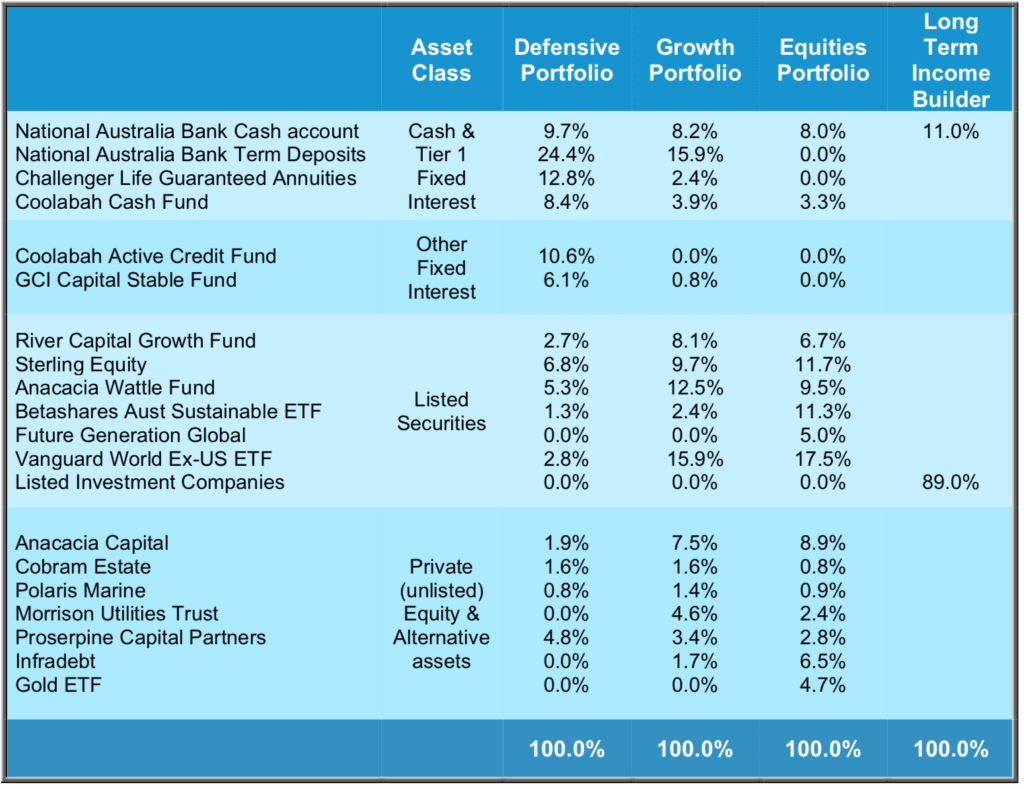

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings

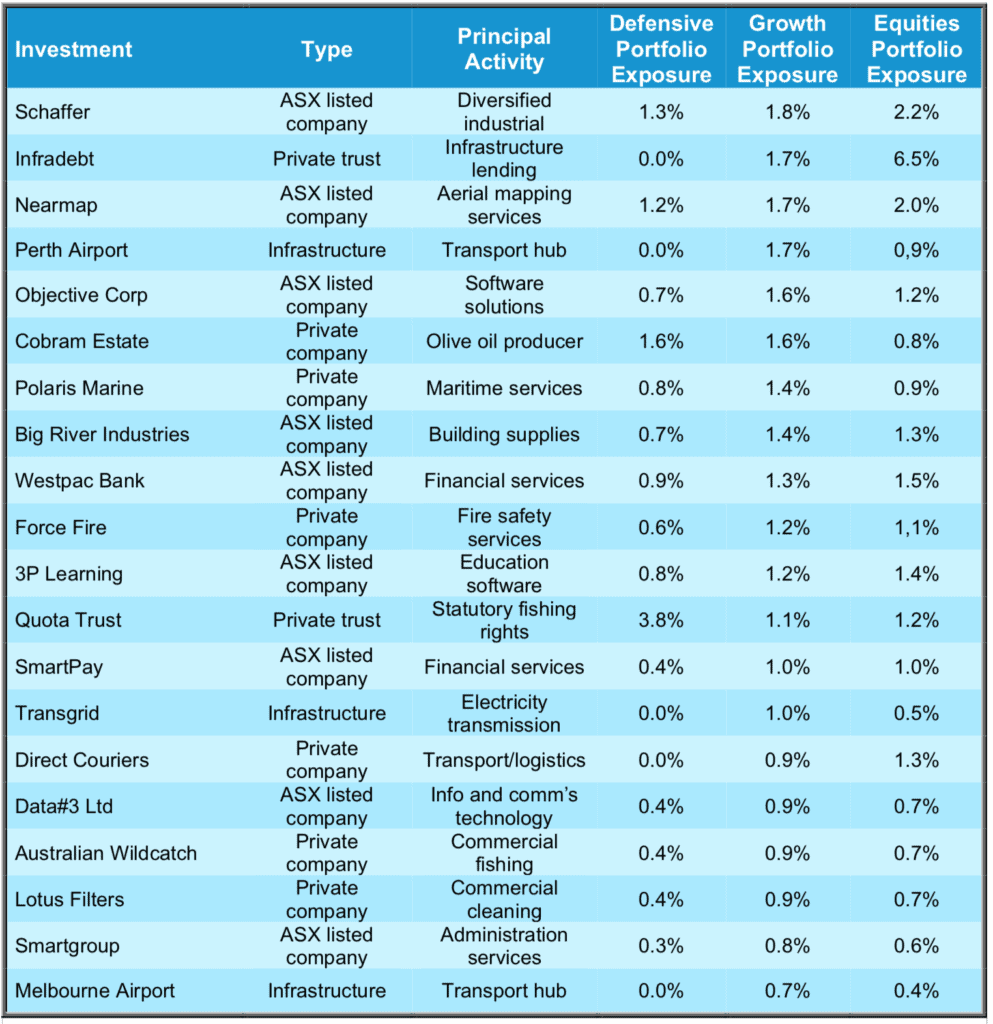

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). The information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. The PDS is available by contacting ARA Consultants by phone at (03) 9853 1688 or email info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: January 2021 Investment Update.