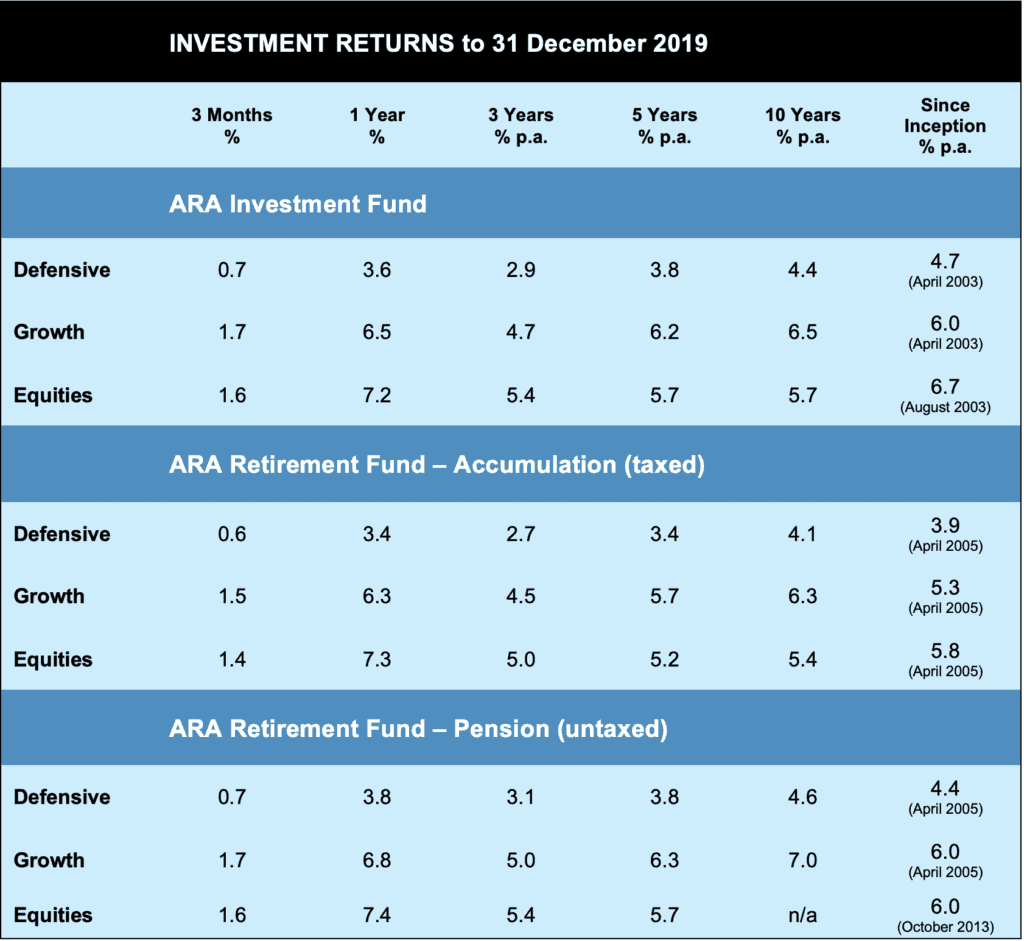

Returns improved this year, as world stockmarkets bounced back from an ordinary 2018. Let’s look at what helped and what hindered returns.

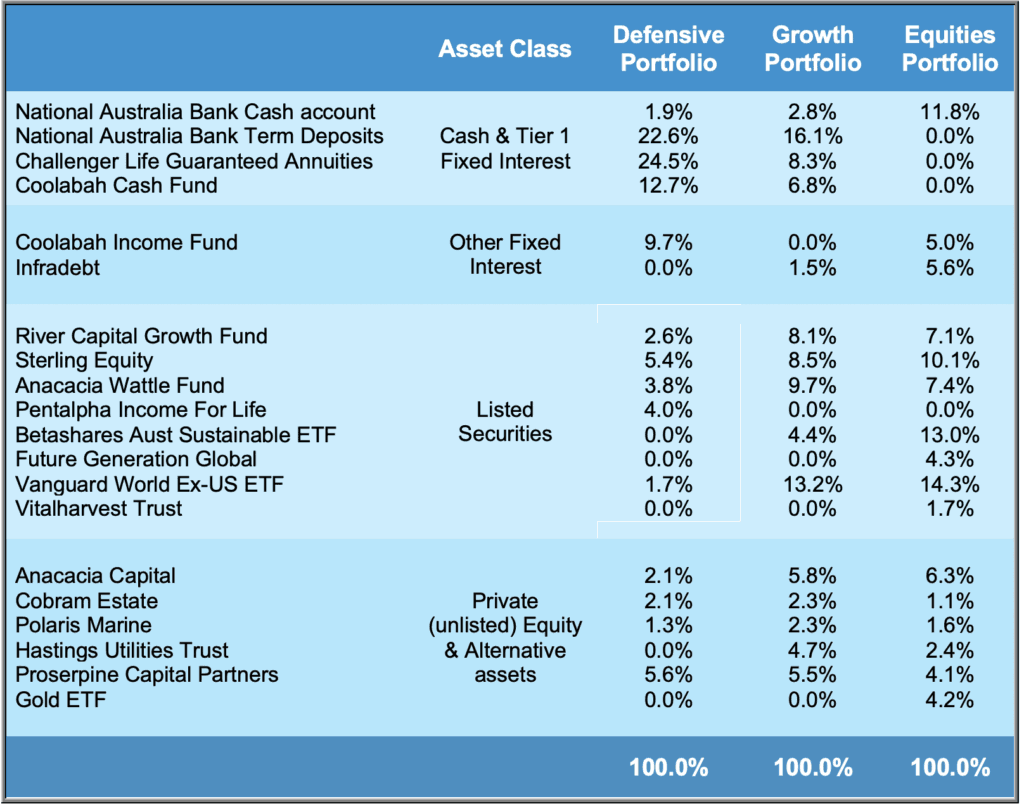

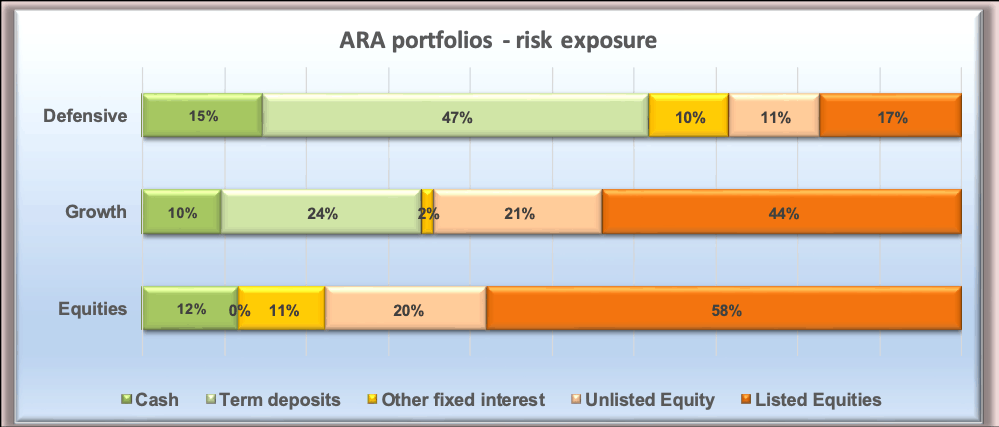

As you may know, and as is evident from the risk exposure chart further below, there are three main categories of investment driving the risk and return characteristics of the ARA portfolios :

Cash & bank deposits

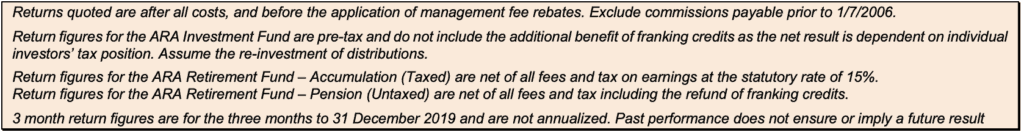

Falling interest rates are making life difficult here. By using longer-dated term deposits and getting in before the recent interest rate cuts we’ve been able to shore up returns to some extent, but each time a term deposit matures it is simply not possible to replace it at the same rate.

The charts below show the interest rate and the remaining term on each of the term deposit contracts in the Defensive & Growth portfolios. The weighted average rate in both is still around 3.25% p.a. It will hold up OK for a while but is gradually coming down.

As a result we are looking at alternative sources of fixed-interest investments. We have already included the Smarter Money investments managed by Coolabah Capital, and will shortly be investing in another fixed interest fund managed by local boutique firm GCI Australia.

But note, as we have said many times, it is not the role of this component of the portfolio to shoot the lights out with high returns. Its job is capital preservation, consistent with the targeted risk characteristics of each portfolio. While we would always like to eke out extra return where possible, there are no free lunches and we will not compromise on capital safety with this section of the portfolio.

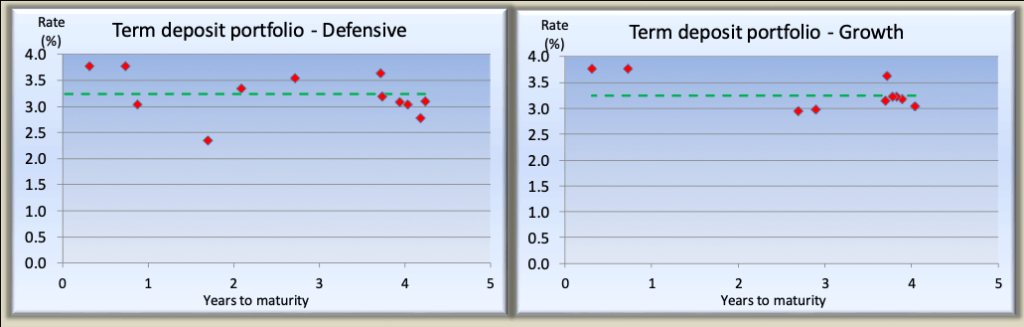

Listed equities

That is, shares in companies that are listed on stock exchanges, locally and offshore.

Our major investments in this space all did quite well for the year, as per the chart opposite. Note that the Betashares and Vanguard investment were not held for the full year as we were building positions in each, but this gives an idea of the recent performance of each of the underlying investments. Listed equities did their bit for the year.

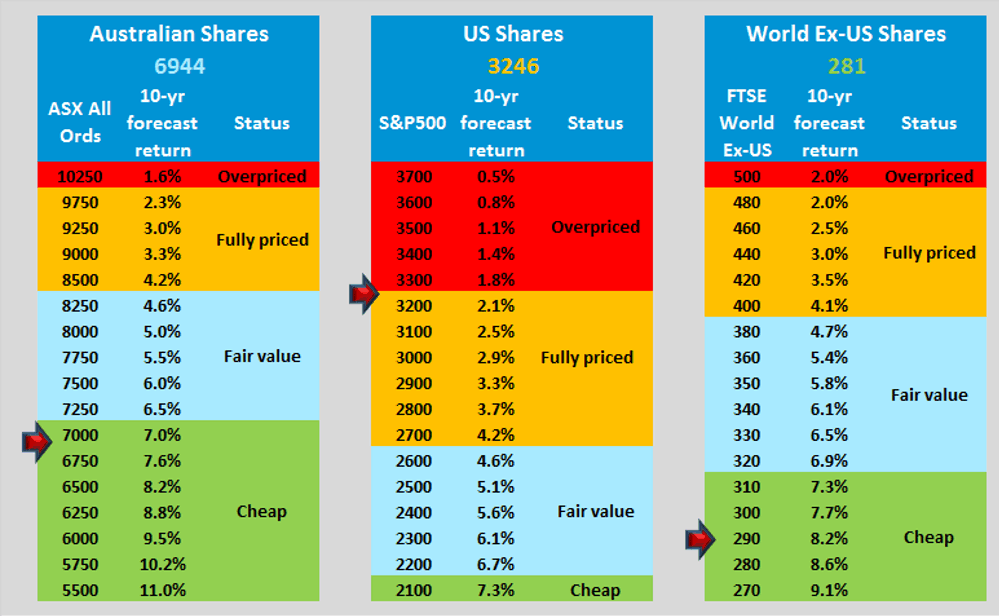

As we noted in our last update, our analysis is that the US stock market is looking very fully priced – whereas the local market looks reasonable value at current level, as do most global markets except the US. That situation has not changed. The updated chart is shown below. The red arrows show where each market sits at the time of writing.

While a significant fall in US shares would most likely have short-term repercussions in other markets, the far more attractive valuations of local and other markets ex-the US gives a buffer of comfort. At these levels we will continue to hold a full allocation to domestic shares and World-ex-US, while our direct exposure to the US is effectively nil.

Unlisted Equity

These are shares in privately-owned companies, i.e. those that are not listed on public stock markets. You will see from the tables below that about 20% of the Growth and Equities portfolios and 11% of Defensive is in unlisted equities.

Whereas the listed shares are valued every day by the activities of traders on the Stock Exchange, shares in unlisted companies are not actively traded. So the valuation process is periodic, say every quarter, according to valuation formulae or guidelines – typically a function of profit performance.

On the one hand, this means unlisted companies are not subject to the sometimes volatile short-term fluctuations that listed companies are – they are less influenced by the short-term mood swings of investor sentiment. On the other hand it means that there can be times when there is not much movement in prices. Valuation policies in the absence of a liquid market tend to be conservative and price movements generally reflect a significant change in profit outlook, or the sale of the business.

As it’s happened, the last sale of one of our unlisted holdings was the successful exit from the ProTen investment which is now over twelve months ago. In the meantime there has been little or no net movement in the valuations of other unlisted assets in the portfolio – what positive movements there have been were offset by negative movements in others.

That has been a drag on the performance of the portfolios as a whole – frustrating, yes but it can change at any time. It’s just the nature of the beast.

So, who’s got what?

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings

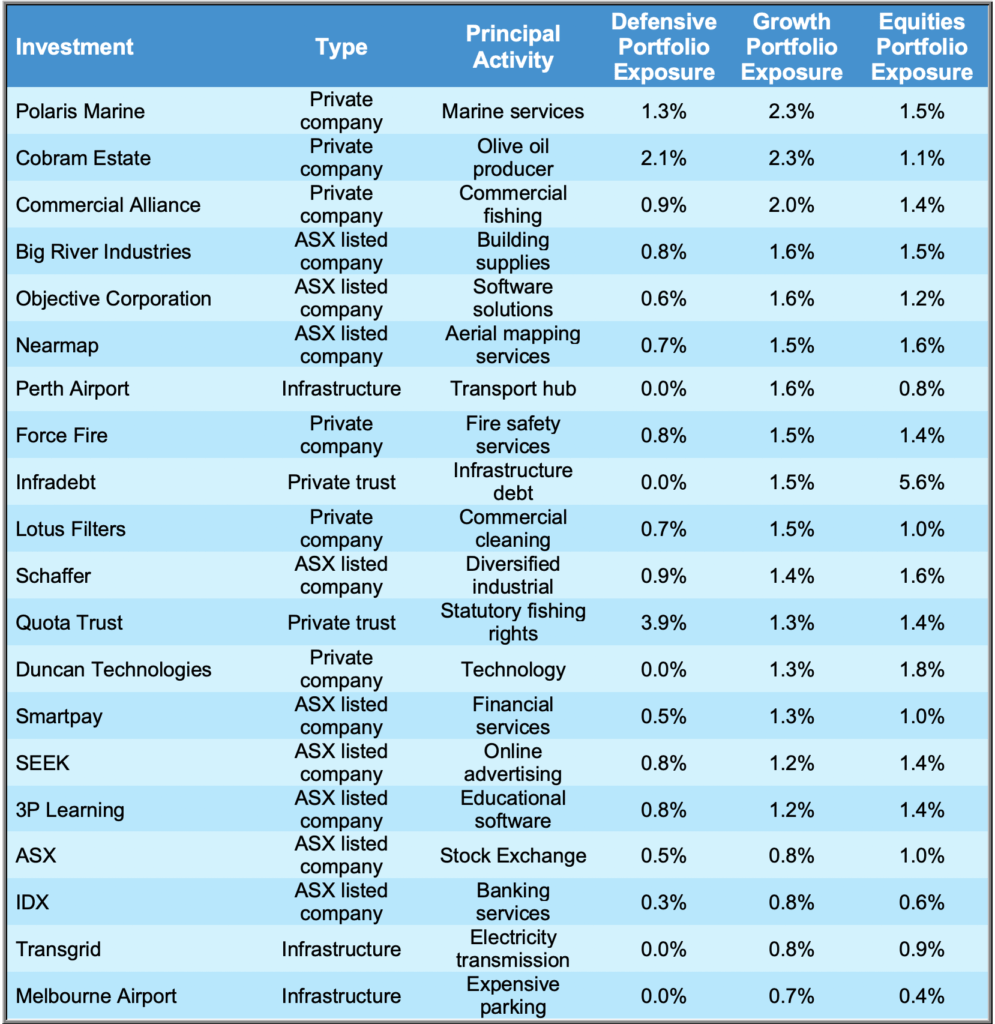

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

STOP THE PRESSES!

In what’s shaping up as a big year for ARA and our clients, a couple of things to watch out for:

The ARA Vault

As advised before the holiday break, we are now in the process of rolling out our new web portal.

The ARA Vault is way more than a replacement for the (ageing) facility whereby you could look up your ARA fund balances online. Yes of course it can do that, but in addition you will be able to:

- See transaction history;

- Record all your assets and liabilities in the one place, updated by real-time data feeds;

- See personalised reports tracking long term movement in your financial position;

- Upload and store key documents;

- Receive communications such as statements in respect of your ARA funds;

- Send transaction requests and other forms online with electronic signature function;

….and much more.

This will dramatically improve the way we can provide service to you. We can’t wait to help get you set up – watch this space!

The Long Term Income Builder

In the last update we made reference to the impact that falling interest rates have on those who rely on their investments for income, particularly retirees, and that we were developing a fourth portfolio option to address this concern.

We are pleased to advise the addition of a new portfolio option for the ARA Investment Fund, which we call the Long Term Income Builder.

The LTIB’s primary focus is to generate an attractive, sustainable and growing income stream, the main source being sustainable dividends paid by high quality, cash-generative Australian companies.

For those whose primary focus is income, dividends have proven to be stable even in volatile markets. Investors must be able to tolerate the swings in share prices and have a long term view of the investment. For those who do this may be an attractive proposition.

We will write to you shortly with more information – stay tuned!

A New Year Hint

Gotten used to writing the new year date yet? It’s extra-challenging this year now that we’ve clicked over into 2020.

Our favourite legal eagle, Emily Spall, has a hint – or more particularly a piece of advice. And that is to write the date out in full – e.g. 5/8/2020. Leaving it at 5/8/20 leaves open the possibility for the unscrupulous out there to add two more digits and thereby falsely pre-date or post-date important documents.

Here to Help

We recently met with a client on Centrelink’s Newstart Allowance, with parents both in receipt of Age Pensions. His parents were selling their home and moving in with him, but the surplus sale proceeds would have resulted in a significant drop in their Age Pension rates.

We were able to devise a strategy which involved the parents paying their son (our client) for the right to live with him for life, and him subsequently applying for a Carer Payment and two Carer Allowances (one for each parent) for looking after them.

This resulted in the parents keeping their full Age Pensions, approx.. $36,000 p.a., and our client’s Centrelink benefits increasing by about $17,000 p.a.

No wonder we love our work!

If you would like a pdf version of this update for your files you can download it here: January 2020 Investment Update.