It turned out to be quite a good (calendar) year. A handy Santa Claus rally in November and December pushed returns in some cases into double figures. Happy days.

A dose of perspective may be in order. It comes off the back of a tough prior year, so there might be a bit of a rebound thing happening. It’s perhaps instructive to look at the two years together – what investment markets did, and how the portfolios fared by comparison.

Looks like a living example of the benefits of selective diversification, and of trying to limit volatility and the impact of market downturns. Take the US case for example:

Year 1: $100 – 19.4% = $80.60

Year 2: $80.60 + 24.2% = $100.10.

Total return = $0.10, or 0.1%.

Those big falls take a disproportionate amount of recovery time and effort. Fortunately it is quite possible to target a decent average return over time while limiting the damage of downturns – even if it means foregoing a little in the strong years. Put more simply – the tortoise won!

So, what will happen now? The honest answer is the same as it is every year – “No idea, really”. Expensive investments can still go up, cheap things can go down further. The best you can do is back the probabilities, and diversify your market exposure and asset choice accordingly.

And so…….?

- After a strong 12 months, some sharemarkets, the US in particular, are looking expensive again.

- Unlisted shares (i.e. private equity) are less susceptible to market shifts as they are not valued according to what’s in the daily news.

- From here interest rates look more likely to come down than go up, so locking in attractive rates on good quality loans seems like a good idea.

Against that backdrop, our key moves (more like portfolio tweaks really) look like this:

- We’ve taken some profits from Australian listed shares. We remain invested, but in what we might call the Goldilocks zone. Not too hot, not too cold.

- We have re-instated some mild hedging against US shares – i.e. investments designed to profit if the US market underperforms.

- We have made a significant commitment to the next of Anacacia’s private equity funds. As usual this will be progressively drawn down over the next several years as attractive, well-priced opportunities arise.

- We have also committed to a new investment with infrastructure lender Infradebt. Their new fund provides loans for the development of large-scale battery facilities. Whatever your persuasion, one thing’s for certain – given the current state of the energy market in Australia there is a need here and now for large scale storage to underpin base load power, as old coal mines get de-commissioned. And there are very few reliable sources of finance for such undertakings. The traditional banks are not functioning in this space at the moment, whereas Infradebt, who we know well by now, is one of only two main lenders, and they know this market well. A timely opportunity. We’ll have more to say on this investment as it develops.

So, who’s got what?

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings – diversified portfolios

Apart from bank deposits and other interest-bearing accounts, Defensive, Growth and Equities portfolios invest in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the portfolios’ returns.

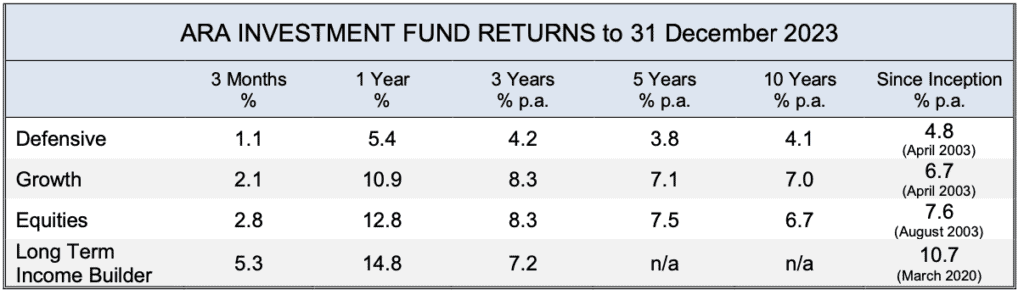

Returns quoted in this report are after all costs, and before the application of management fee rebates. Return figures are pre-tax, and include the value of franking credits from franked dividends. Total return figures assume the re-investment of gross distributions including franking credits. 3-month return figures are for the period to 31 December 2023 and are not annualized.

ARA Consultants Limited provides this update for the information of its clients and associates.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). Information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. The PDS and applicable Target Market Determinations are available at www.araconsultants.com.au or by contacting ARA by phone on (03) 9853 1688 or by email at info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved previously does not guarantee or imply that they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: December 2023 Quarter Investment Update.