We hope you had a chance to view the interim update posted online in early March. If you missed it (or just like re-visiting the classics) it’s right here.

To recap, as if there weren’t enough headwinds already, the sudden and shocking escalation of geopolitical and military tensions in Europe has further heightened the short term volatility in investment markets. Late March saw some improvement, although not quite enough to lift the quarter’s returns out of the red, and at times like these things can turn in an instant.

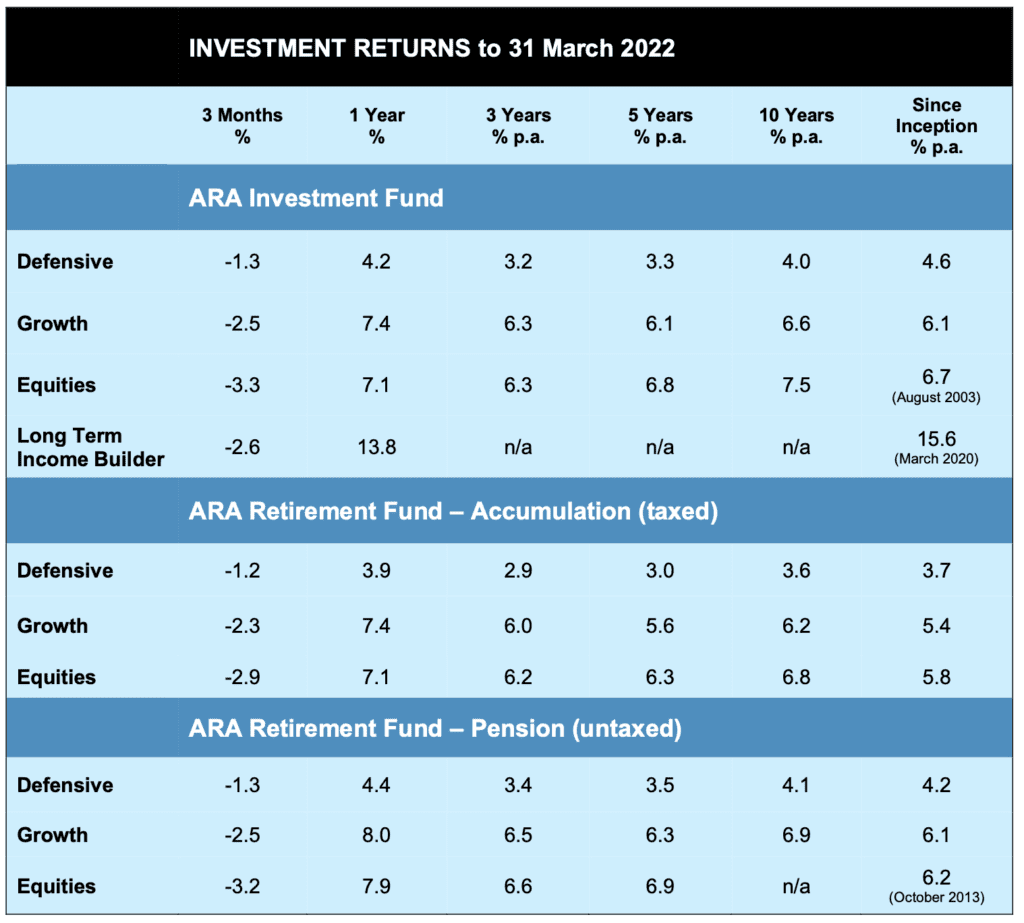

No-one likes those negative signs, least of all us. But it doesn’t pay to get too hung up on short term outcomes in what is a long haul exercise. It’s true that the major investment themes we have been on about for some time now did not pay off in the March quarter, but with an eye to the future let’s take a closer look.

USA vs Rest of the World

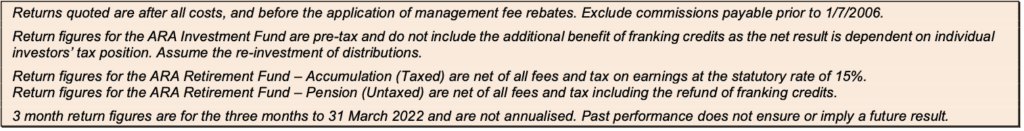

In terms of stock market exposure we have noted for some time the apparent dislocation between market valuations in the US (which look stretched) and the World ex-US (inc Australia) which still appear to represent reasonable value. As a result we have greatly skewed our portfolios accordingly.

On balance, it didn’t hurt to be largely out of US stocks in the quarter. On the other hand, the biggest drag on the quarter’s performance – based on level of exposure and sector performance – was our World ex-US investment, which fell about 7.5%.

There was a double-whammy here. Markets reacted to the military conflict as might be expected, particularly in Europe, while the Australian dollar has strengthened. It seems we’re seen as a safe haven down under, being so far from the epicentre. This is not a bad thing per se, but a rising $A does have a negative impact on the value of international holdings in the local currency.

If we look at an extract from the Fridge chart as to where that leaves world stock markets outside of the US:

In addition we have an Aussie dollar now sitting at recent highs particularly against European and Asian currencies.

None of which points to this being the time to abandon the “World ex-US” investment theme. If anything it reinforces it.

Australian shares

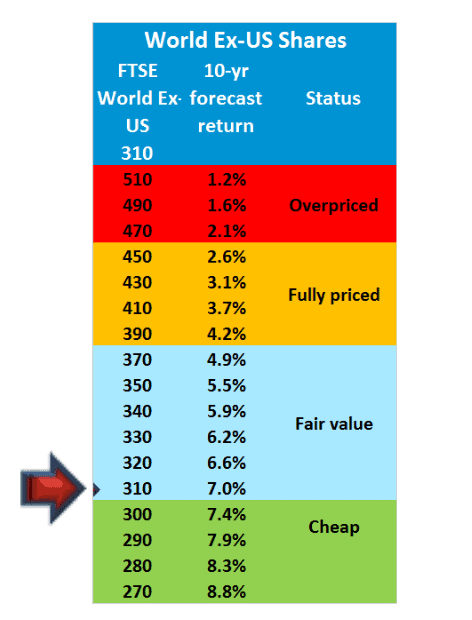

On balance our Aussie shareholdings finished the quarter slightly in the red. It might be instructive to see how the top 10 listed shareholdings as per the December 31 report fared over the quarter.

While it’s a bit of a mixed bag, clearly there are several which got hit pretty hard mid-quarter, but recovered strongly. So again, no cause to think “Gee we’d better change tack here!” Rather, a couple of our fund managers commented that they retain a high level of conviction in their major holdings, and took the opportunity during the quarter to buy more on the cheap!

Fixed interest and Defensive investments

Stock markets tend to dominate the news, so it’s flown under the radar somewhat that this past quarter was the toughest for fixed interest and bond fund managers for a long time.

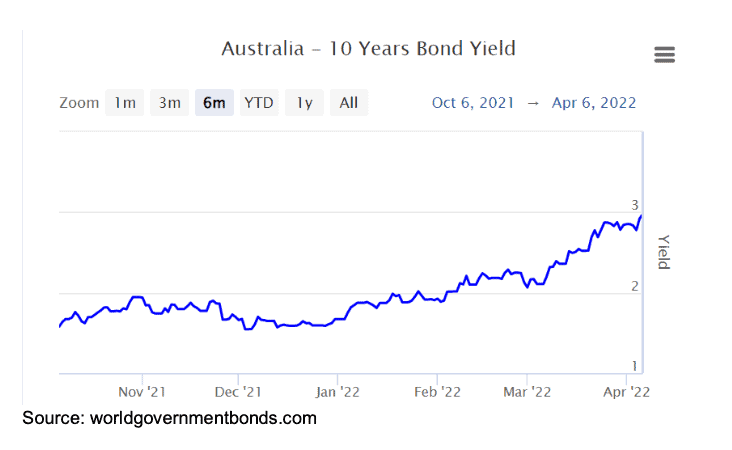

Somewhat counterintuitively, this was because interest rates went up! Not so much the cash rates and very short term deposits, but 10-year Australian government bonds for example started the quarter at 1.67% and finished at 2.84%. That’s an increase in the interest rate of 70%!

Why should that matter, and why does it make life tough for fixed interest investors?

Well, let’s say six months ago you bought a ten-year bond that pays a rate of 2% per annum. That is, you hold the bond, get paid your 2% interest each year, then in ten years time you get all your money back.

But then, the government issues a new series of bonds paying 3% per annum. If you were to try to sell your bond, you’d struggle. Buyers would be far more interested in the new bonds paying three per cent, than yours that pays two. The value of your bond has been reduced by the impact of the rising interest rates in the market.

You might say you have no intention of selling your bond, you’ll hold it to maturity and get the full amount back. Which is fine, however the powers-that-be require that portfolios are valued according to the market price of the day. No different to shares – if your shares go down in value that’s what they are required to be valued at, regardless of whether you intend to sell them or not.

So a sudden 70% hike in interest rates has given holders of long term fixed rate interest- bearing bonds a huge headache. Fortunately, in the main our investments in this sector are skewed towards floating rate and shorter term securities, and so are weathering the storm pretty well.

Investment markets generally don’t like rising interest rates. Increased borrowing costs impact on company profits (and hence share values) and returns from property where gearing is often involved. Furthermore, when assessing investment opportunities it is quite normal and appropriate to compare the expected returns with what can be achieved by investing in low risk deposits. If that benchmark comparison rate goes up (with rising interest rates) it requires a corresponding increase in the expected return from taking a risk on the investment opportunity, i.e. a lower price.

Eventually though, higher interest rates lead to new opportunities, and already we are seeing rates on longer term deposits and annuities start to creep up and catch our attention.

In conclusion:

No-one likes it, but negative quarters happen. Expect about 1 in 8 quarters to be negative in the Defensive portfolio, 1 in 5 for Growth and 1 in 4 for Equities. Yet all are comfortably ahead of their return benchmarks over 1,3,5 and 10 years. So it’s important to keep a sense of perspective.

Things are likely to remain highly volatile for some time to come. But the key investment themes and strategies we have been discussing for some time remain entirely appropriate in our view, so we will be holding the line. In fact some new opportunities are starting to present.

So, who’s got what?

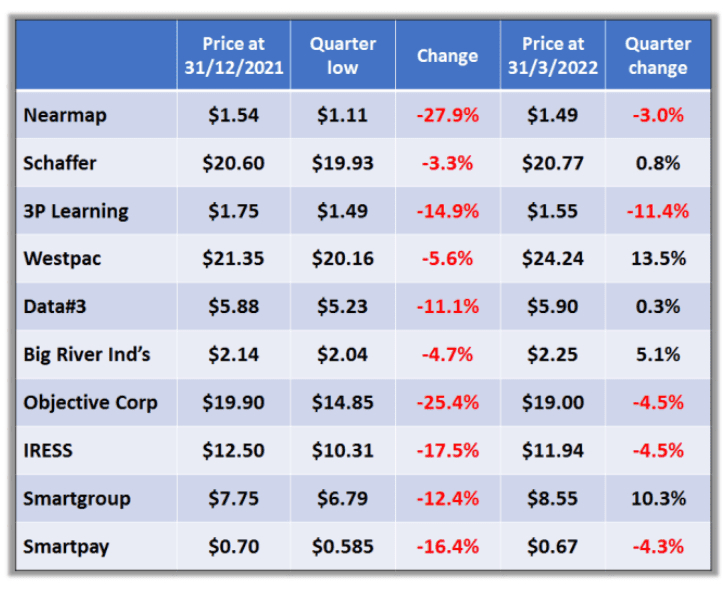

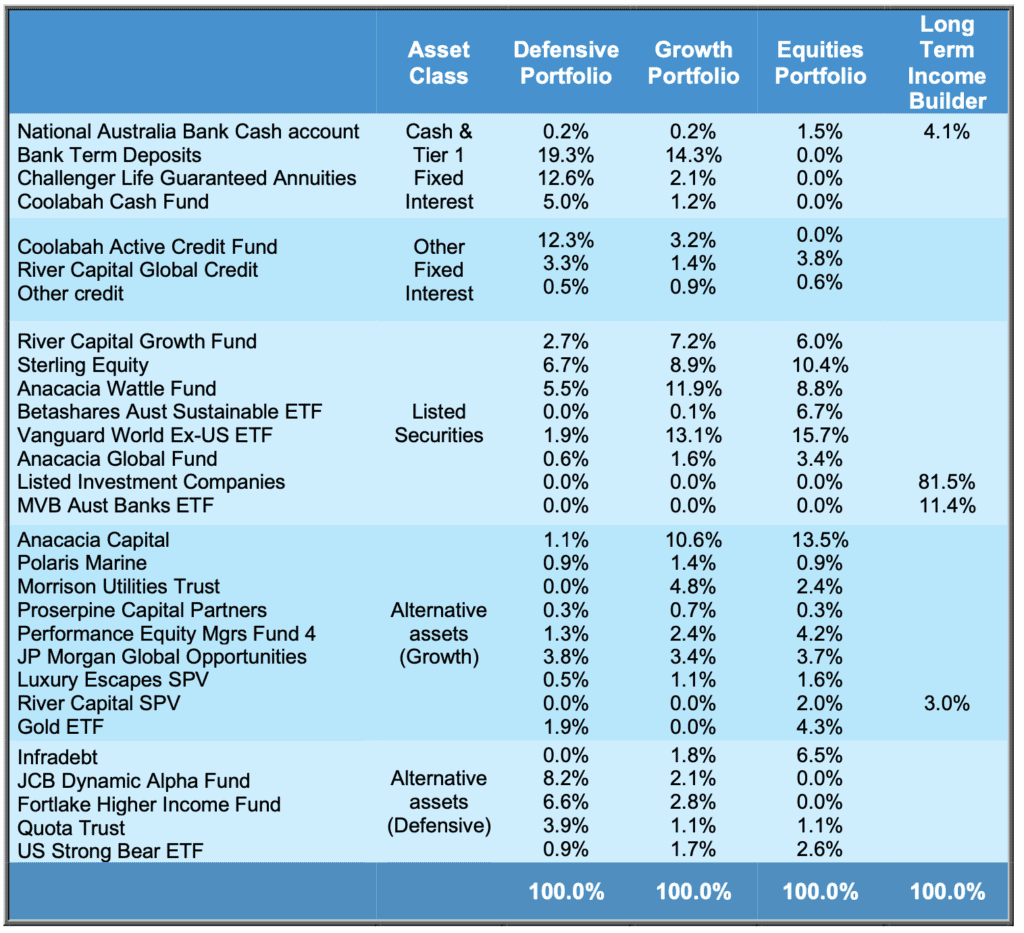

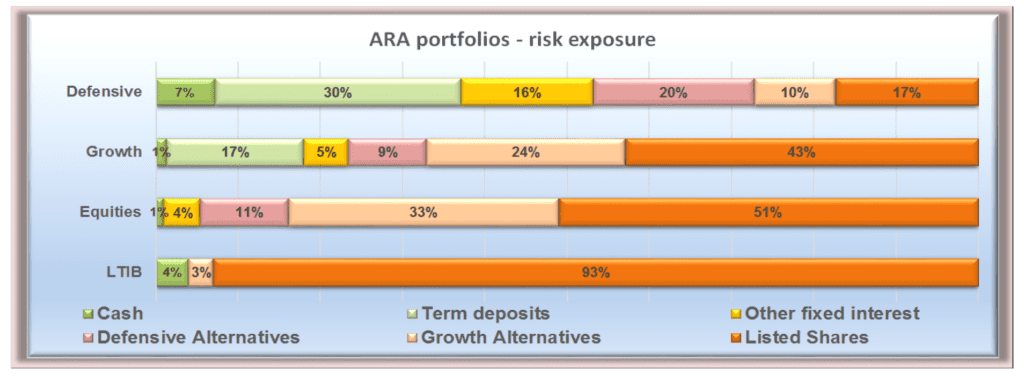

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings – diversified portfolios

Apart from bank deposits and other interest-bearing accounts, Defensive, Growth and Equities portfolios invest in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

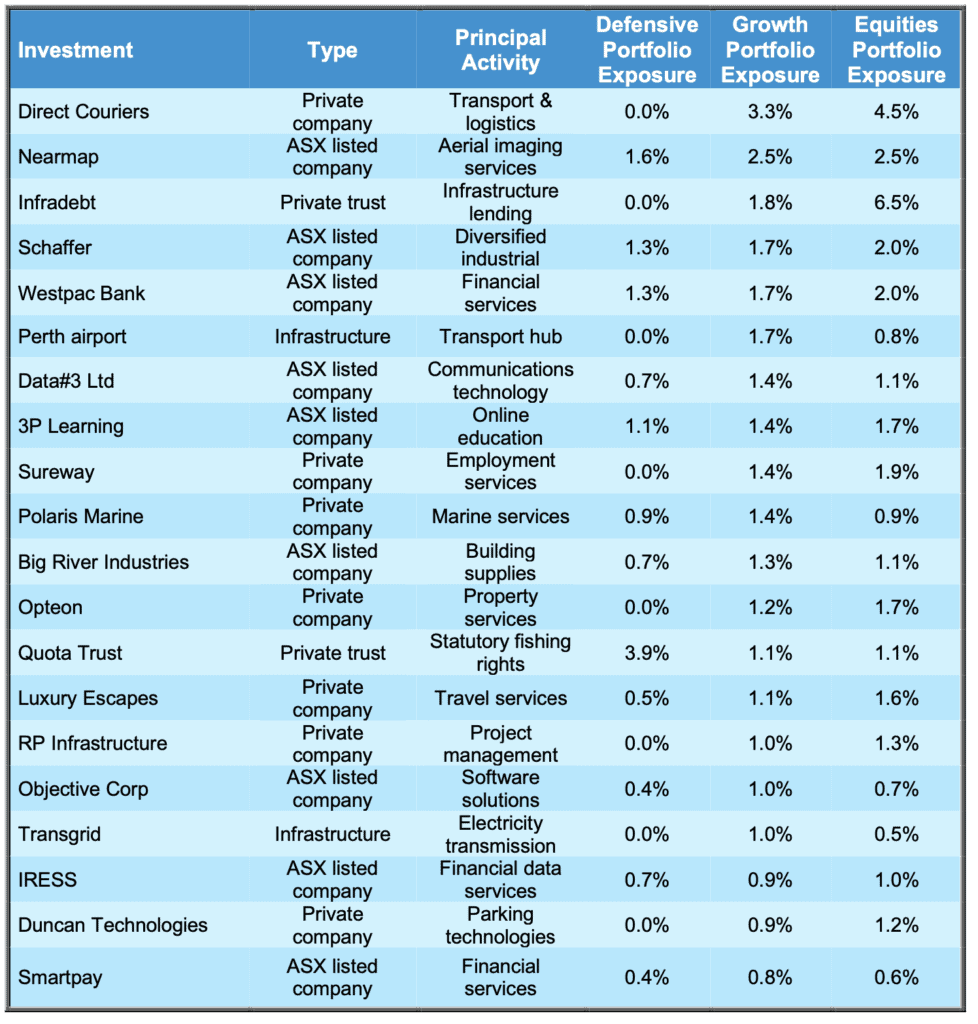

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the portfolios’ returns.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). Information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. You should also refer to the relevant Target Market Determination (TMD) for the product. The PDS and applicable TMDs are available at www.araconsultants.com.au or by contacting ARA by phone on (03) 9853 1688 or by email at info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: April 2022 Investment Update.