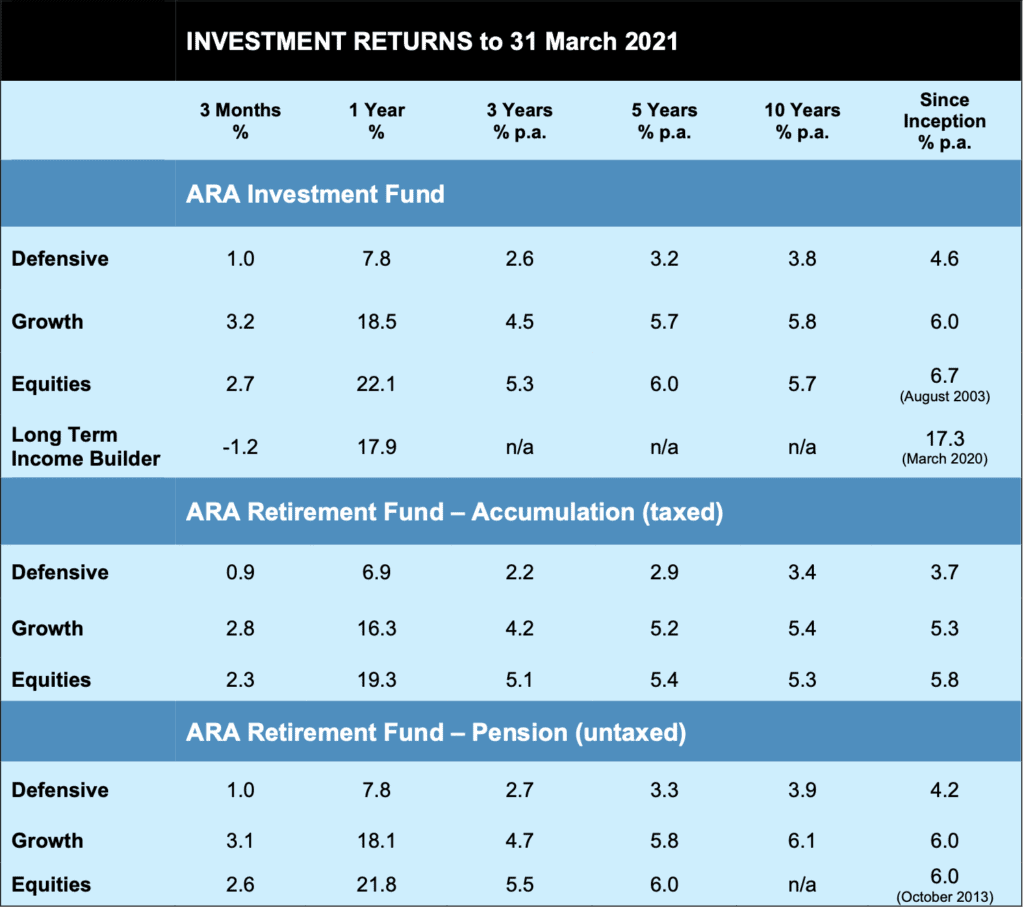

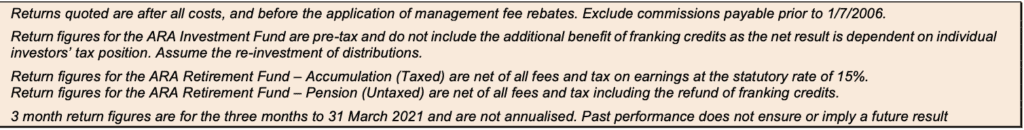

Nice to see some big numbers in the 1-year column of the returns table above. To be fair, of course this reflects the somewhat rapid recovery after the battering that investment markets received in February and March last year, which have now dropped off the 1-year stats. Even so, if we add those two months back in, these are the returns since the end of January 2020:

So, all portfolios have gained back the losses incurred in the downturn and are showing healthy positive returns for the period. Just by the way, the Australian sharemarket did 2.6% in the same period, including dividends, so all the portfolios have done better than the market, with a lot less volatility. We’ll have some more to say about the anatomy of market downturns and the lessons to be learned in a future presentation.

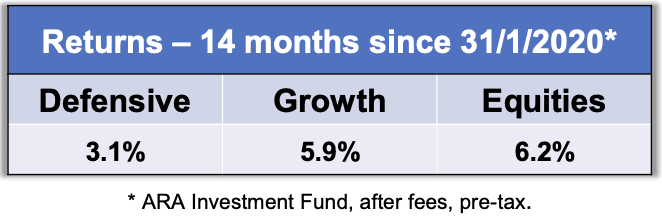

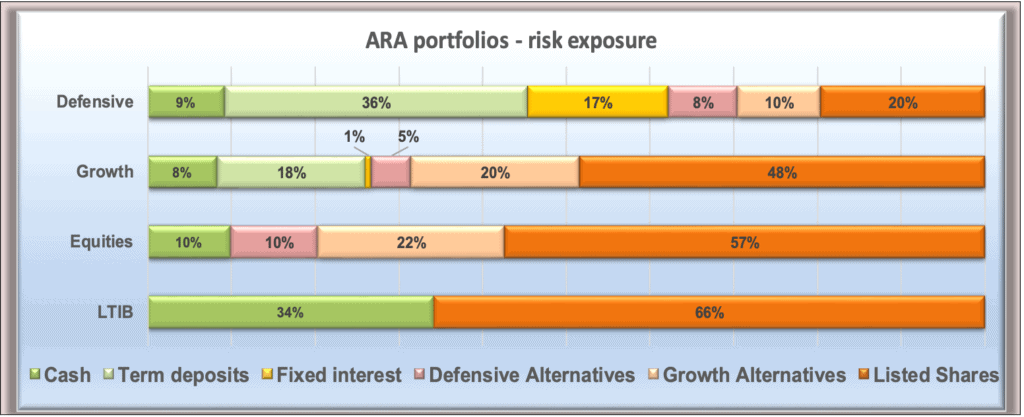

Meanwhile, as usual the list of investments and the spread of funds across the various types of assets are shown below. Alert readers will have noticed a few new names and even new categories, entering the picture. Namely, “Alternatives”, of the Defensive and Growth variety. What’s that all about?

“Alternatives” is a bit of industry jargon that basically means anything other than the more “Traditional” things like listed shares, property, bank deposits and government bonds. This can include things like shares in private companies (private equity), commodities (e.g. gold, silver), derivatives like futures and options, non-government debt strategies, even collectibles like art and old Alfa Romeos.

Some of these have lofty, growth-type return objectives, others aim for stable returns with low volatility – more defensive characteristics. Among the potential attractions of these asset types are:

- Low correlation with the “traditional” asset classes. i.e. they might perform well, or at least provide stability, when stock markets are taking a hiding;

- Greater spread of risk.

ARA has long favoured the inclusion of private equity investments and enjoyed some success with investments like Rafferty’s Garden, Yumi’s, Cobram Estate and others. Of late, in an environment where debt levels are at nosebleed heights around the globe and interest rates have continued their downward spiral, we are also seeking value in some other alternatives, particularly those in the “Defensive” category. Term deposit rates and government bond yields are at historic lows and commit a buyer at current rates to a return that is less than inflation – before tax. No wonder there is a search for alternatives.

Two significant entries to the fund in this category include:

JCB Dynamic Alpha Fund:

Managed by JamiesonCooteBonds Pty Ltd., this fund invests globally in a wide variety of fixed interest and bond markets, and may also use futures and other derivatives plus currency hedging, to target a return of 2.5% above the prevailing cash rate, with a high degree of stability and in a vehicle that is 100% liquid.

JP Morgan Global Opportunities Fund:

Invests in a wide variety of share and fixed interest investments worldwide, but also uses hedging techniques to protect the fund from excessive volatility. As with the JCB fund, its performance objective is “Cash Plus”, rather than equity market-related.

In addition we have added Gold exposure – at this stage only in the Equities portfolio. And we have recently opened an investment with Performance Equity Managers. This is a private equity investment, probably best thought of as a global version of the very successful Anacacia funds which we have supported happily for over a decade.

These additions add to the diversity of the portfolios, and we believe they are a good match with our risk and return objectives.

So, who’s got what?

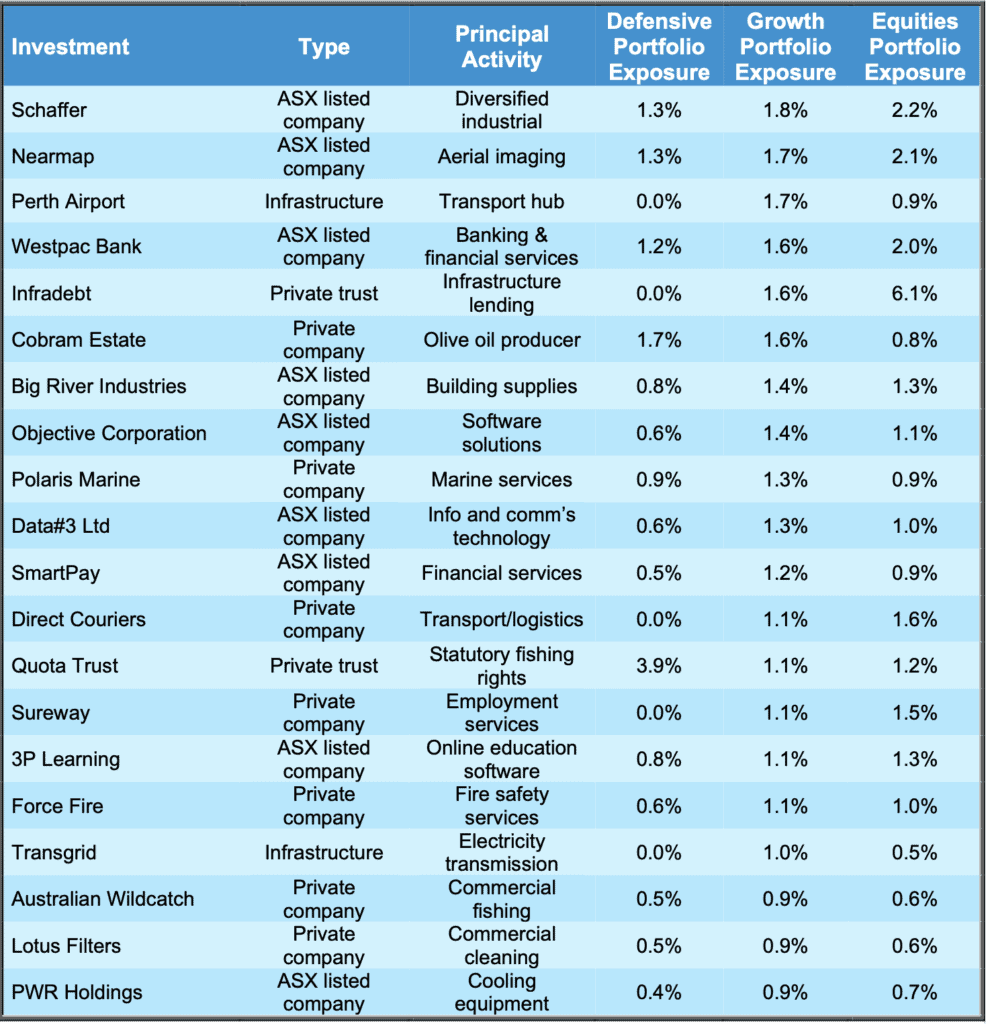

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

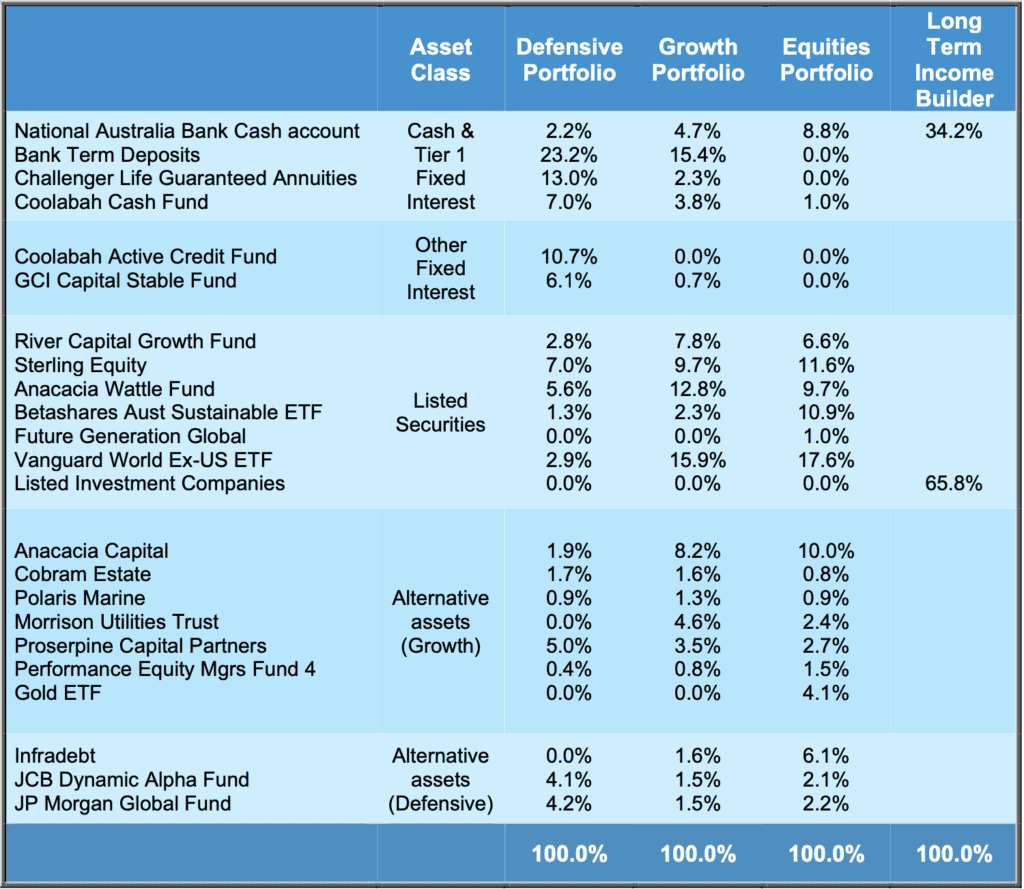

Major Holdings

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

If you would like a pdf version of this update for your files you can download it here: April 2021 Investment Update.