As the world came to realise the awful human and economic toll of COVID-19, the reaction of global investment markets was both brutal and swift.

The Australian sharemarket’s drop of 24% for the March quarter was its worst quarter since 2008. In fact March (down 21%) was the worst month since October 1987. Around the globe the story was much the same. And interest rates have been cut again as governments rush economic stimulus packages into being.

For those who may not be aware, or not had the chance to view them yet, after cancelling our usual Investor Update evenings we have prepared a couple of video presentations to keep you abreast of the rapidly changing situation. They can be viewed here:

https://www.araconsultants.com.au/ara-investor-update-march-2020/

https://www.araconsultants.com.au/ara-investor-update-march-2020-2nd/

In brief, the key messages are:

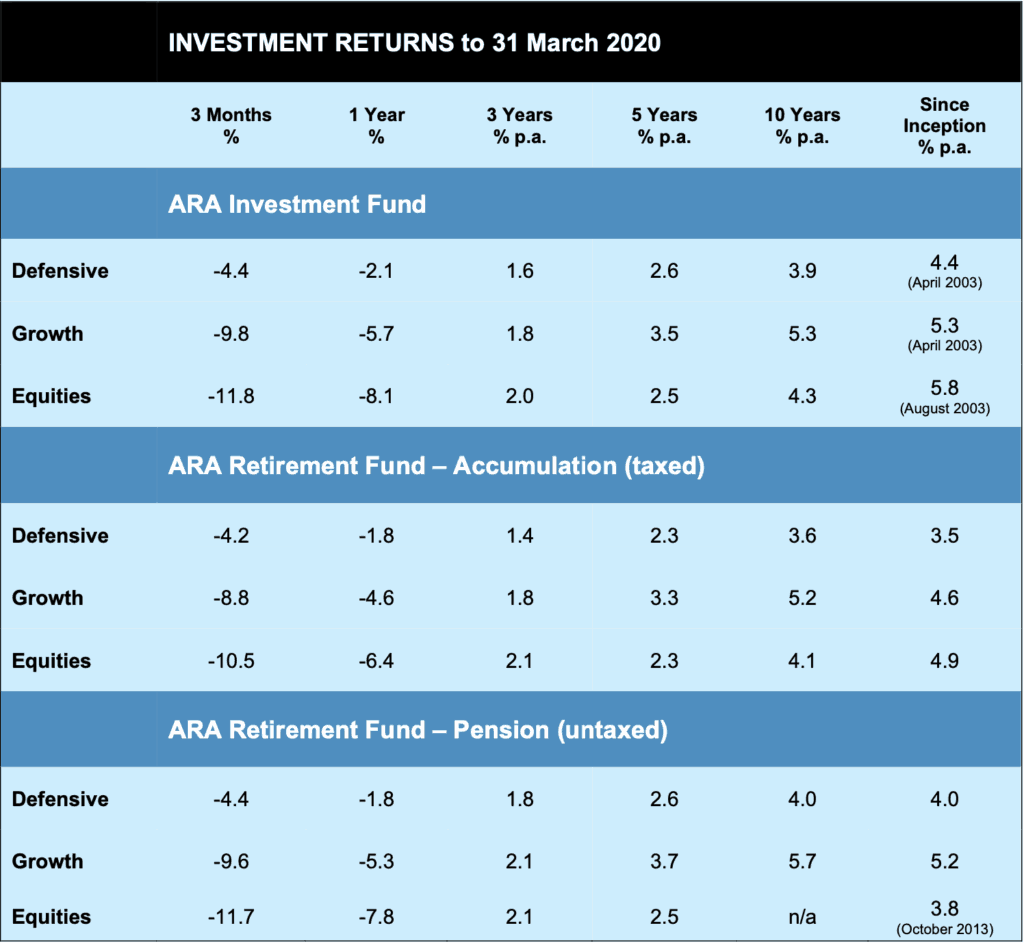

- The ARA funds, while posting negative returns for the quarter, have to date insulated clients from the worst of the downturn, largely through:

- Healthy cash balances at the outset;

- Fund managers generally performing better than market averages.

- We have progressively used some cash to buy assets – Australian and Global (except US) shares at knocked-down prices, which should add value in the event of a recovery;

- The share fund managers we engage all confirm they are doing the same; and

- We have further cash available to do more buying should there be another leg down in the market.

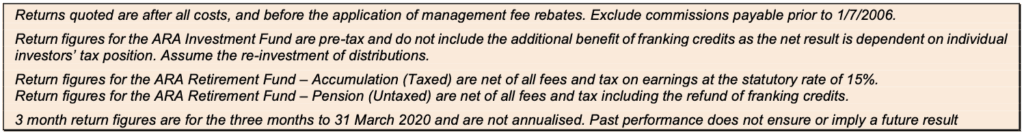

Despite some relief in early April, it would be a very brave call to say the market turmoil is over just yet. However there is some cause for optimism in the much longer term. We refer again to the fabulous Fridge Chart below, which assesses long term return prospects from current price levels and hence whether various markets look attractive to own.

You might recall from prior newsletters that while the US looked expensive, the local market and the World outside the US were already attractively priced before this latest downturn. This update shows that the battering the markets have taken made cheap assets look even better, with the arrows showing the “before” and “after” levels – to date at least.

The chart is not a predictor of short term returns, but is quite an effective guide to whether markets are good value now. It gives some confidence for the outlook from here, and that the purchases we have made to date will add material value over the longer haul.

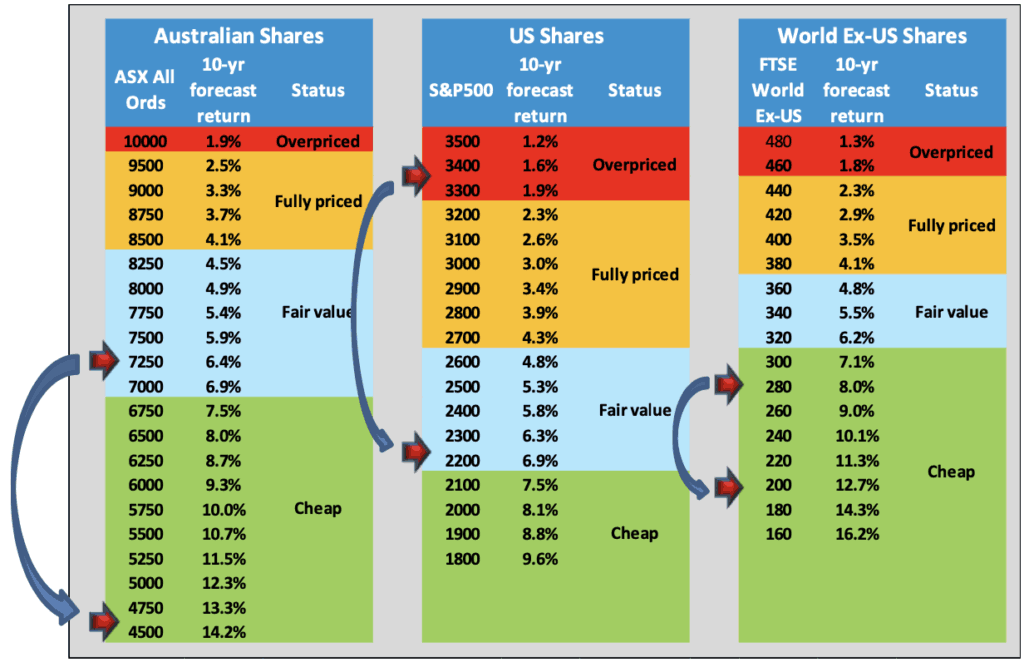

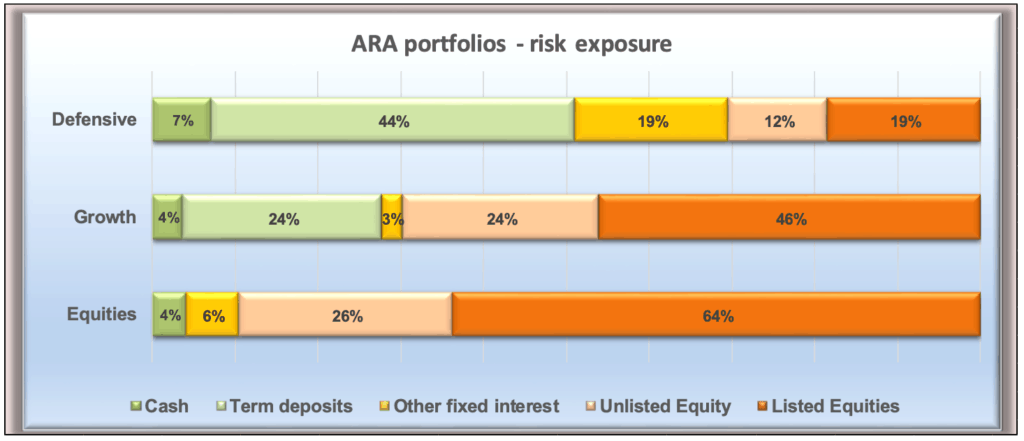

So, who’s got what?

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

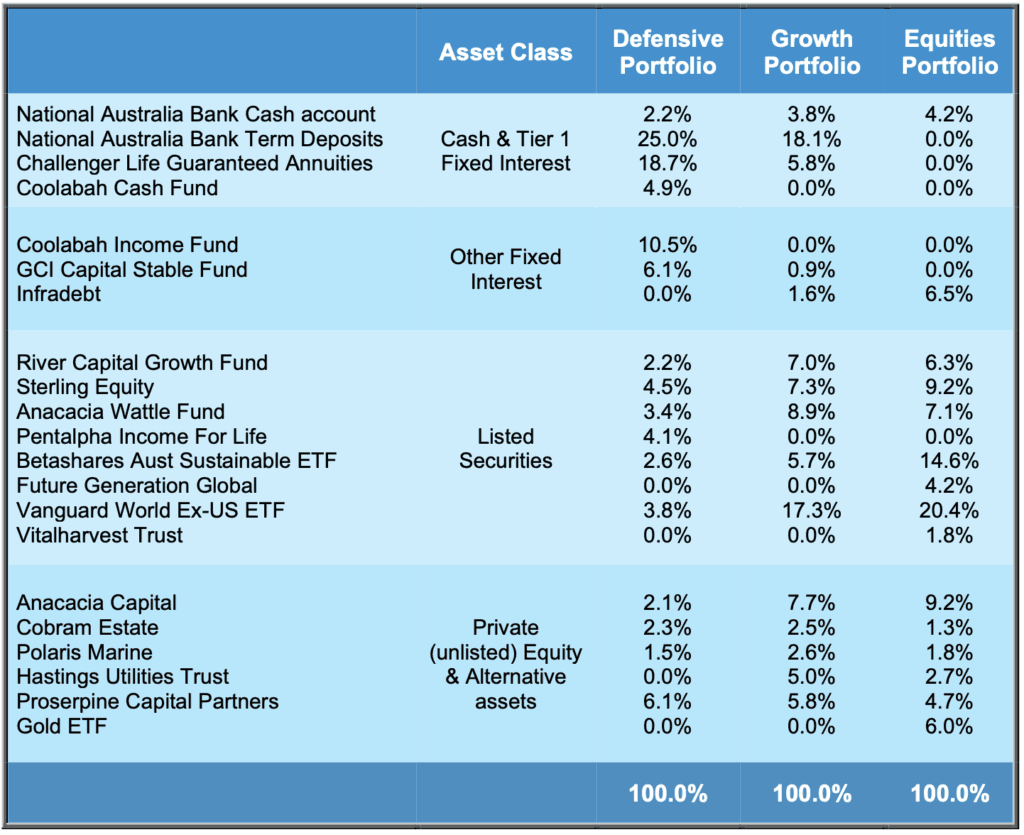

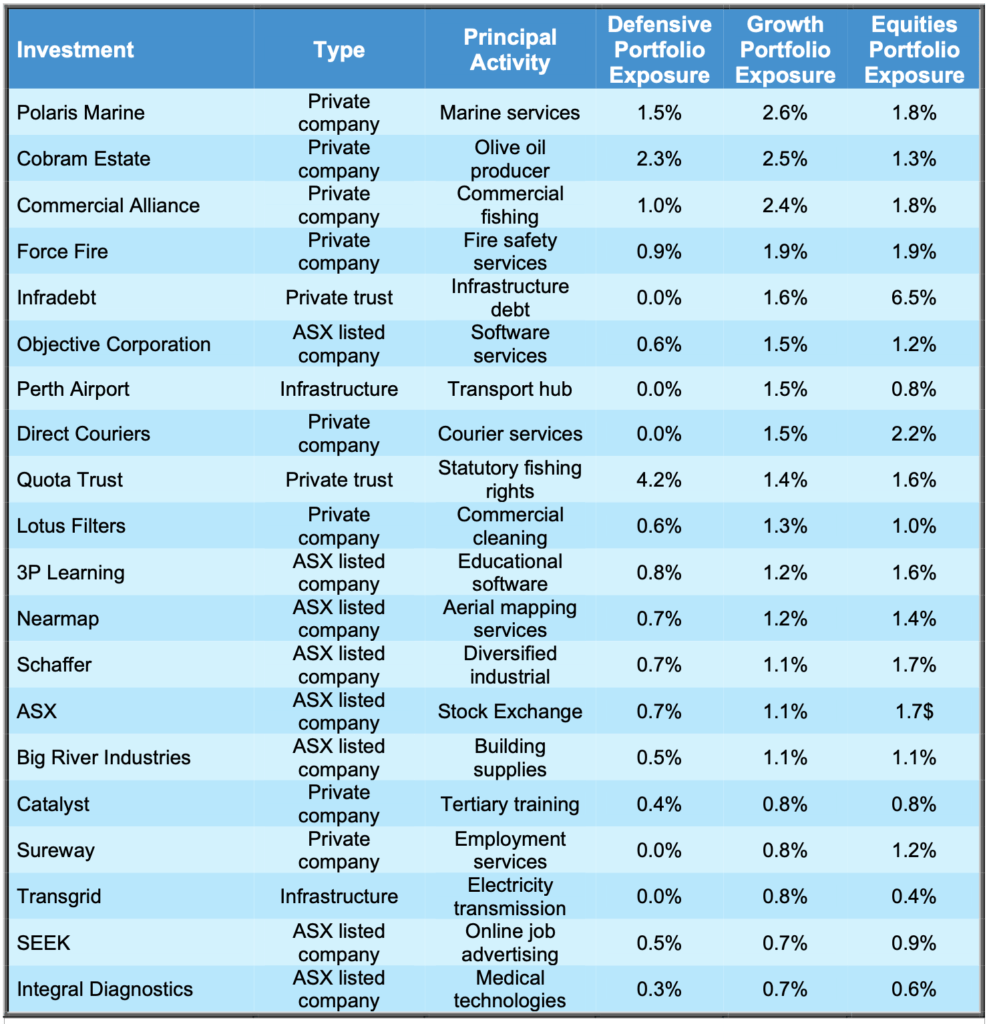

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

If you would like a pdf version of this update for your files you can download it here: April 2020 Investment Update.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). The information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. The PDS is available by contacting ARA Consultants by phone at (03) 9853 1688 or email info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.