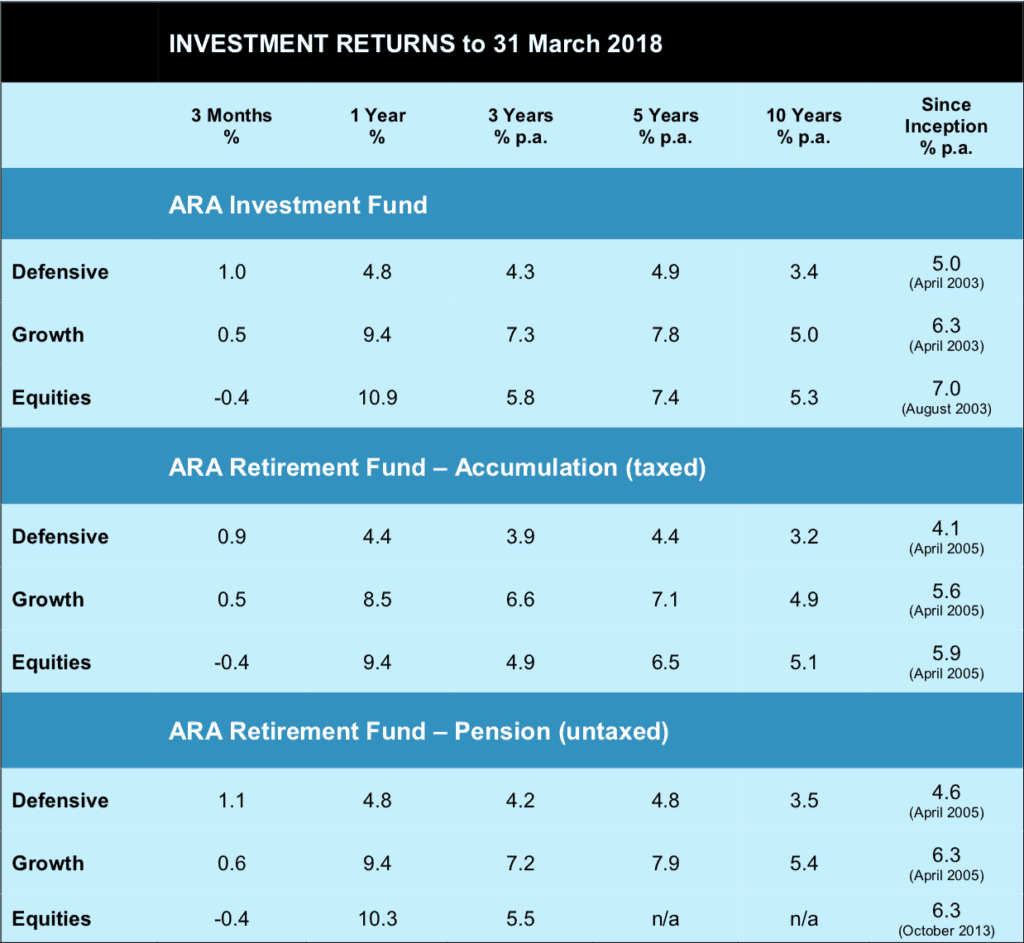

Recent returns shouldn’t cause too much heartburn, although things got pretty tricky in the March quarter. More on that shortly.

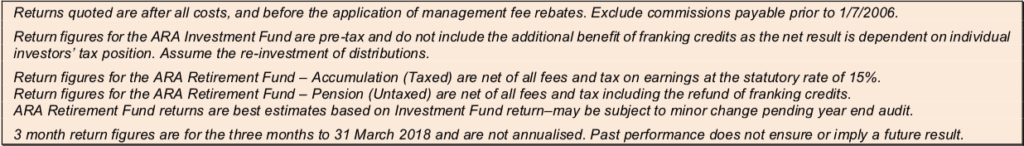

While the local stock market has had an ordinary year, our share fund managers have shone. The table at right shows performance of the three core managers for the year and the March quarter, in comparison with the All Ordinaries Index for the market as a whole. That there is some mighty fine stock pickin’.

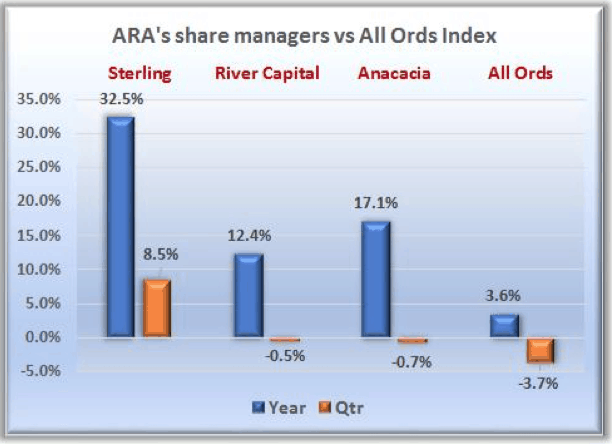

Looking at other major holdings (see below), by way of a brief summary:

Major Holdings

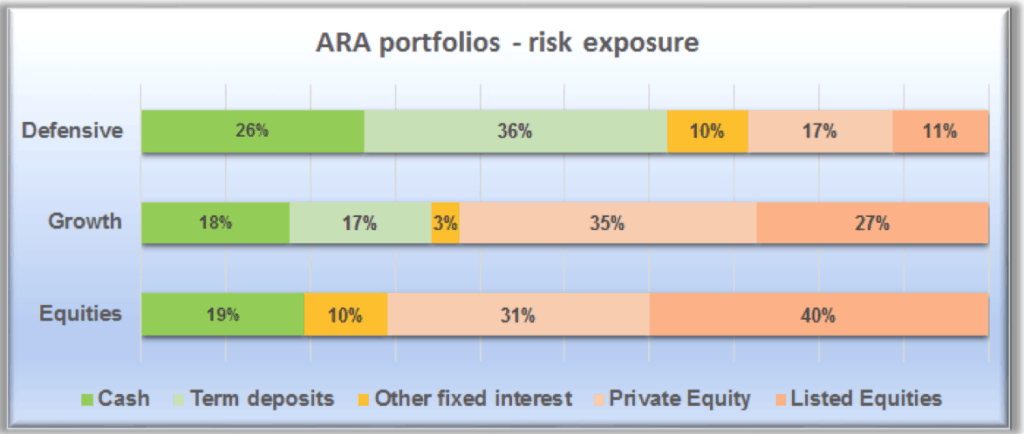

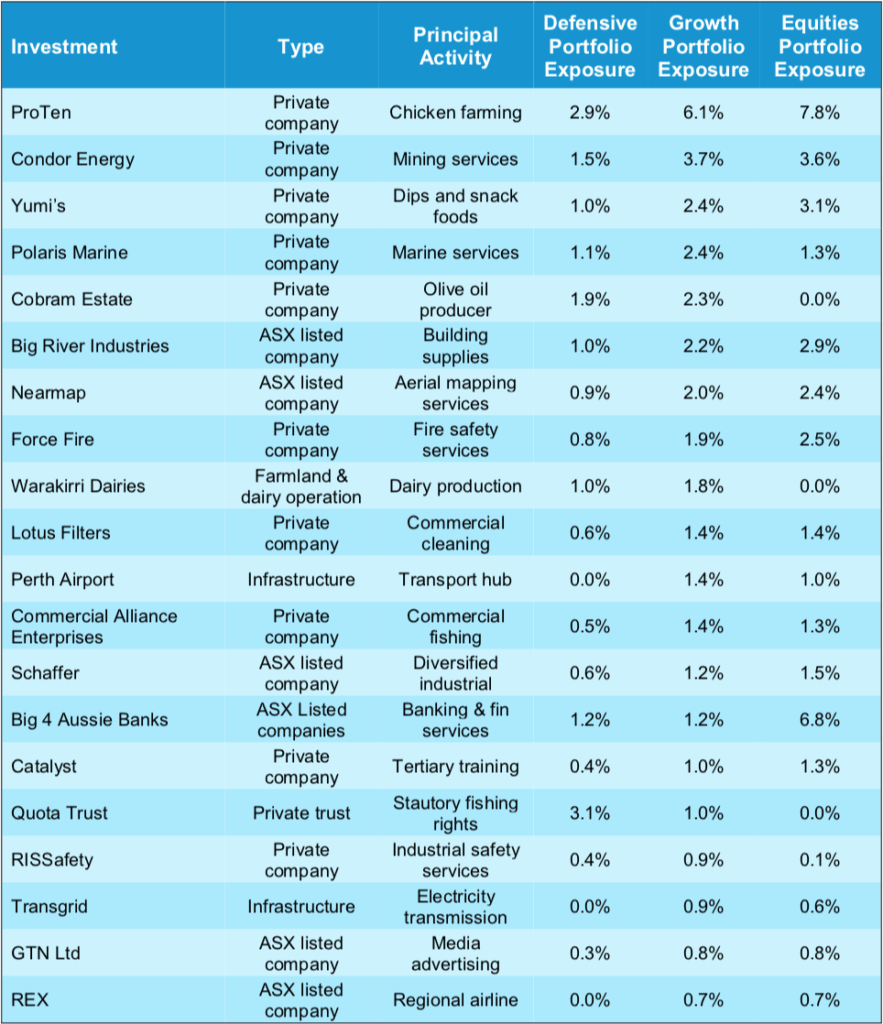

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets, primarily through funds managed by specialist independent firms. If we drill through to the assets selected and overseen by those managers, there are in fact well over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

Matters of Interest

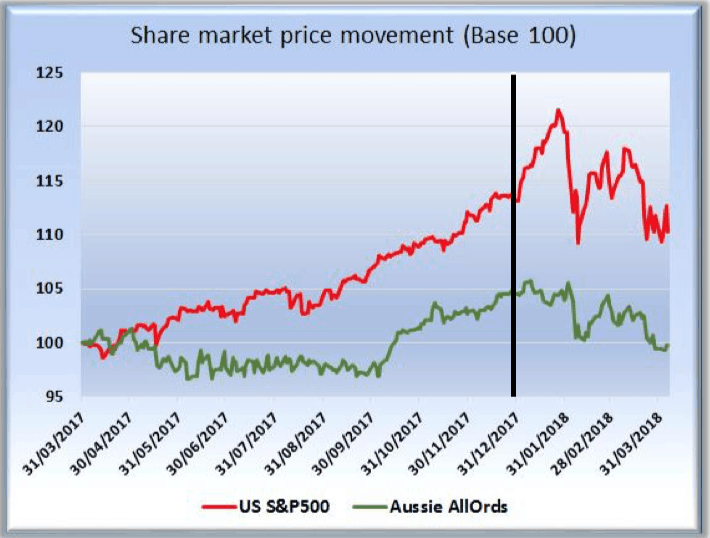

The chart below shows the relative movements of the Aussie and US stock markets over the past twelve months. Note, these are price movements only, excluding dividends.

Apart from the fact that the US market continued to outperform ours, thumbing its nose at the house view that the US market is in nosebleed territory, it’s as if on January 1 someone accidentally hit the volatility switch. After a period of relative stability (that in fact goes back years now), suddenly the short term swings have become quite violent. What gives?

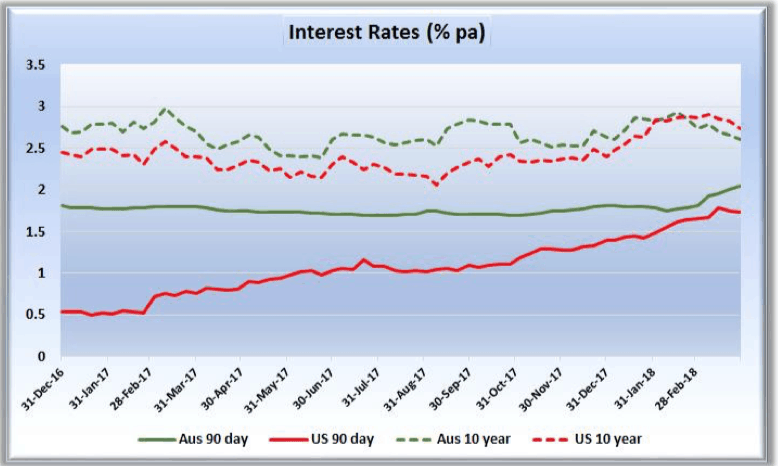

The next chart shows interest rates in the US (red) and Australia (green) since Jan 1, 2017.

Short term rates are the solid lines at the bottom, long term rates are the dotted lines.

Short term US rates are the big mover – in fact have jumped from 0.5% to over 1.5%. Doesn’t sound much, but it’s actually a trebling of rates. Longer term rates haven’t done much, but short term rates in Australia are showing signs of stirring. So what does that mean?

Actually, I have no idea, which is a shame because it was going so well until then. But therein may lie a clue to the short term volatility

As we’ve said before, investment markets as a rule don’t like rising interest rates. It signals an increase in the cost of money and the cost of doing business, and also raises the “risk free” benchmark against which investment propositions are compared for viability.

That need not rule out good market performance if investors feel that the economy, and the government’s management thereof, is still favourable. However, the strong mover – short term US rates – is almost entirely a function of the US Federal Reserve’s determination to raise rates from their recent all-time lows – a stance which they are re- affirming in the Press almost daily.

So we have twin warnings: the prospect of higher interest rates, and the indication that the powers-that-be are no longer going to be so accommodating by prolonging a period of ultra-cheap and easy money. The markets seem to be struggling to accept that the host might really be turning off the beer after such a long and happy party.

So, best to be prepared for a period of elevated volatility, with the likelihood of some quite sharp falls in the mix. Fortunately our portfolios are set up with high levels of cash – at least a partial cushion against volatility, and the means to buy assets at lower prices later. But caution is the order of the day.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. The information contained in this document is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, ARA does not accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs and reviewing the Product Disclosure Statement. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.