“Buckets” is our nickname for one of the tools in our kit of risk management strategies for retirees.

The issue is this.

Typically, so called risky or “growth” assets like shares and property earn a better total return over the long term than safe assets like bank accounts. However, they exhibit much more price volatility in the short term, and so have the reputation for being high risk. Unfortunately in many sections of the finance industry, managing this risk is achieved by simply reducing the investor’s exposure to shares and the like to some pre-determined level, like 50% or 60%. This by definition reduces the long term return the investor achieves, possibly far more than is really necessary.

As noted above, price volatility is typically short term in nature. Furthermore, if you don’t have to sell while the price is down, then the price volatility is of no particular concern. On the other hand, if you do sell at a bad time, you turn what was a loss on paper into a real one, and also reduce the amount you have in your account to participate in the price recovery, when it arrives. This destroys wealth, pure and simple.

Now it is very common, in fact quite normal, for retirees who are living off their nest egg to have to systematically draw down on their assets to support their lifestyle, so this is a very real issue to manage. The imperative therefore is to have investment affairs arranged so that you never have to sell at a bad time and thereby crystallise damaging losses.

We have written extensively on this in our Retirement Hub, but as a brief summary of how to manage the problem:

- Firstly, understand your cash flow requirements, not just for the next month or two, but years ahead. This is to understand if, when, and in what quantity it will be necessary to sell assets to meet your spending requirements. Armed with that insight, you can make a sensible, logical decision as to how much you should allocate to the different types of investment.

- You should keep enough in stable assets like bank deposits and conservative investment options to ensure you won’t have to sell any growth assets for at least the next three to five years. For added safety, a backup allocation should go into another bucket in a medium risk portfolio.

- You can then feel confident in allocating the remainder to the heavy lifters, i.e. Growth assets like shares. During those intervening three to five years, monitor the performance of the portfolio, choosing good times (rising markets) to top up the safe bucket, while sitting tight and riding out the market lows in the Growth bucket.

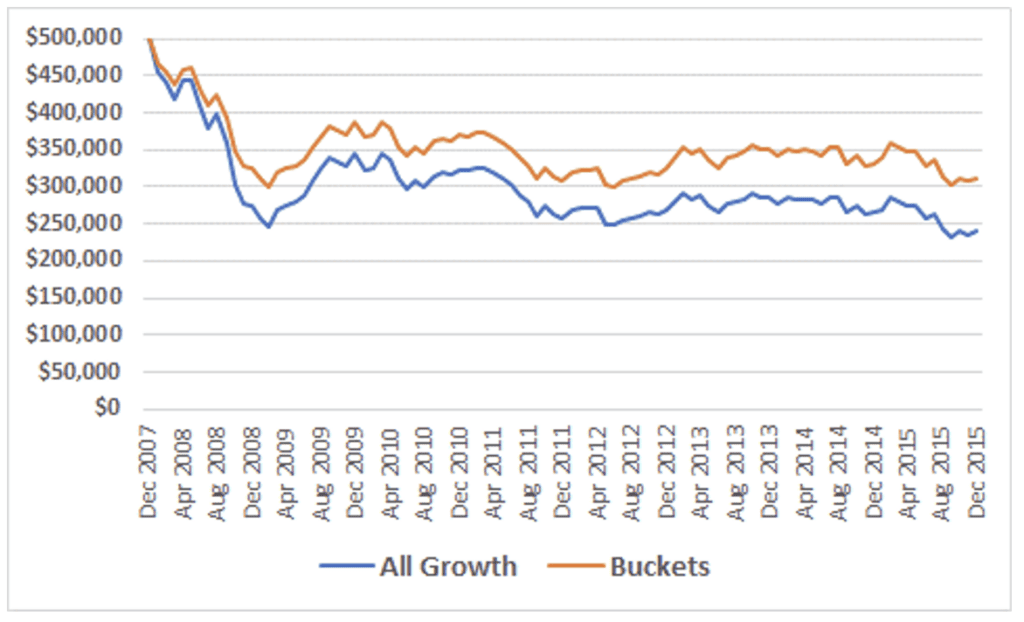

Does it work? The answer is “It does when it needs to”. For a simple example to illustrate the point, let’s backtest a scenario, in which at the beginning of 2008 a retiree with $500,000 is drawing an income of $2,500 per month. In hindsight we now know that 2008 saw the onset of what came to be called the Global Financial Crisis, and growth assets like shares exhibited a classic case of the short term volatility in question.

The chart below illustrates two approaches to handling the crisis.

- The “All Growth” example assumes the investor has all their money in shares, backing the theory that in the long term they produce the best return. Monthly income payments are met simply by cashing in enough Growth units to realise $2,500.

- In the “Buckets” example, initially four years worth of income payments, $120,000, is invested in a secure portfolio, represented by a portfolio paying the banks’ cash rate at the time plus 1% p.a., and monthly income payments are taken entirely from this secure account. It will therefore gradually run down, but is topped up at opportune times, i.e. after a period of good performance in the Growth assets, to re-establish the “4-years of payments” buffer.

There are a few things happening here:

- The Buckets portfolio is not as impacted by the initial downturn

- Consequently there is a larger balance left earning a return when things turn around

- Growth assets are sold at selected, appropriate times, rather than automatically regardless of recent events.

After eight difficult, volatile years, the Buckets portfolio is more than $72,000 better off, a balance 30% higher than the All Growth portfolio.

If you’re not drawing on your portfolio, none of this really matters. And if markets only ever went up, ditto. But that is generally not the case, and like any insurance policy, when you need it, you’re glad you had it.

Of course there’s more to it than this simple example, used to illustrate a point. You need to have an understanding of other factors like the cash actually generated by the portfolio itself over time, and inputs from other sources like maybe part time work or age pension entitlement. That’s where tools like our Retirement Income Projector are extremely useful, to help strike that happy medium between maximising exposure to the best performing assets long term, while protecting yourself against the risks of the short term.