At the risk of gross understatement, investing is an inexact science. I guess if it was straightforward then we’d all be experts.

This piece is prompted by the appearance in our inbox – on the same day – of these two opinions on the Aussie investment outlook from people in high places.

The first is from a high-profile speaker, Grant Williams, at an international investment conference currently being held in Dallas, Texas:

“Australia’s natural resources and proximity to China have helped it go almost 30 years without a recession. But the country also has something deadly: a staggering amount of mortgage debt.

The amount of leverage in Australian housing is just plain silly. Grant explained why it is unravelling quickly. Some 31% of Australian households are experiencing mortgage stress already, even without a recession.

A recession, which will come at some point and probably soon, will threaten Australian housing, employment, banks, politics, and more. Grant thinks the country has grown complacent after its long winning streak and will soon learn a hard lesson”.

The second view is from Sam Sicilia, the Chief Investment Officer of a large Australian industry super fund:

“Australian equities are currently undervalued, and price-to-earnings multiples will climb dramatically, but institutional investors should be ramping up their exposure to shares even as prices rise…

…it follows that equities are currently very, very cheap.

[The Fund in question] has 53 per cent of its assets allocated to equities with zero asset allocation to cash and bonds.

To Sicilia, bonds don’t even rate as a risk management tool any more. “They’re not doing the job. People who are buying bonds for downside protection are wasting their time.””

Well, that makes it easy! Both are well-credentialed operators who should know what they’re talking about, with views that could hardly be more diametrically opposed. And we won’t know who’s right until after the event, whatever that turns out to be. What to do?

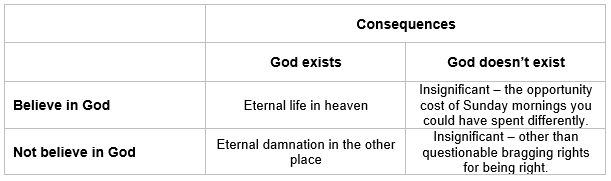

Maybe it’s time to channel our inner-Blaise Pascal, he of “Pascal’s Wager” fame. Pascal was a 17th century French mathematician and theologian, and his wager is a philosophical argument he used to demonstrate that you’re best off believing in God, even in the absence of physical evidence one way or the other. You’re in the game, whether you like it or not, so what’s the best way to play it?

- You can believe, or not believe

- You can be right, or wrong.

What are the consequences?

Believing not only exposes you to the best possible outcome, but importantly, it also avoids the worst one, the intolerable outcome.

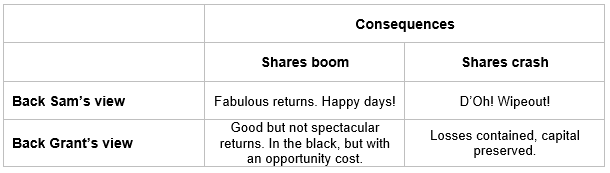

Let’s try the decision-making technique on our present-day dilemma.

In this case neither option gives you the best of both worlds. But if your concern is avoiding the intolerable outcome, Grant’s your man. Following his view insulates your financial future from the worst-case outcome, the cost being that if things boom you do all right but could have done better. It’s like paying for insurance.

As it happens, we’re currently in Grant’s corner…

May 16, 2019