At the risk of understatement the story of the past year is dominated by the Covid_19 pandemic. Aside from the tragic impact on human lives and families worldwide, the economic toll is difficult to fathom and will take years, if not decades, to work through.

Investment markets worldwide went into free fall in the March quarter with losses typically of the order of 35% plus. But then things came roaring back as if nothing had happened. OK, many governments moved quickly with massive relief and stimulus packages, to their credit. But is everything really OK?

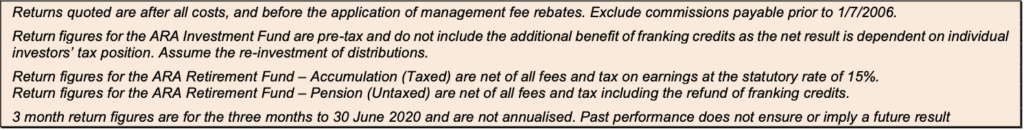

For our part, the portfolios weathered the downturn reasonably well. The chart shows the progress of the portfolios from the end of January to June 30, with the movement of the Australian stock market (in red) as a point of reference. So falls were contained to some extent and all portfolios are close to recovering their losses in full.

This was helped along by generally good performance from our share fund managers in difficult times. Also we were able to buy some additional share exposure in late March at depressed prices, and sold those holdings down in late May/early June, thereby crystallising some additional profit and taking some risk off the table.

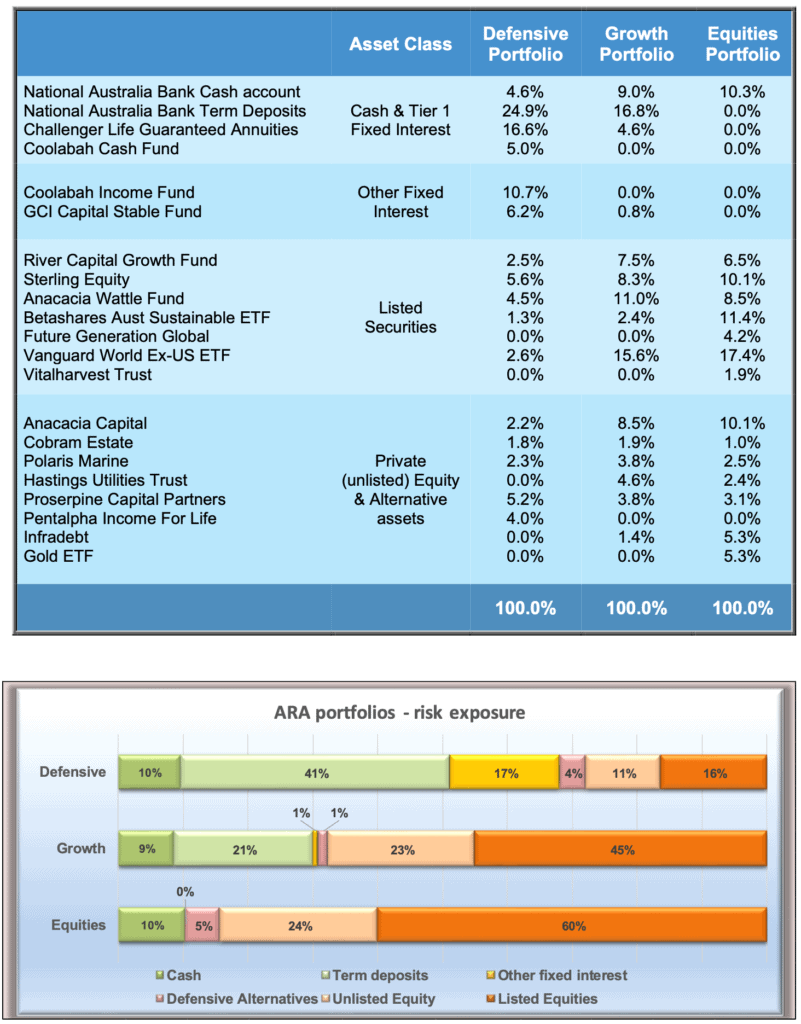

Among the many factors that have to be negotiated in these times, two key things are of particular concern. Firstly, in the immediate short term, what is the right level of exposure to share markets? Analysis continues to suggest that Australian shares and global shares excluding the US are good value and we need to be invested. But enormous uncertainty exists still, and so our exposure (see chart in the “So, who’s got what” section) is about neutral – no more, no less. It’s no longer attractive to buy more, but the value model says don’t sell any more.

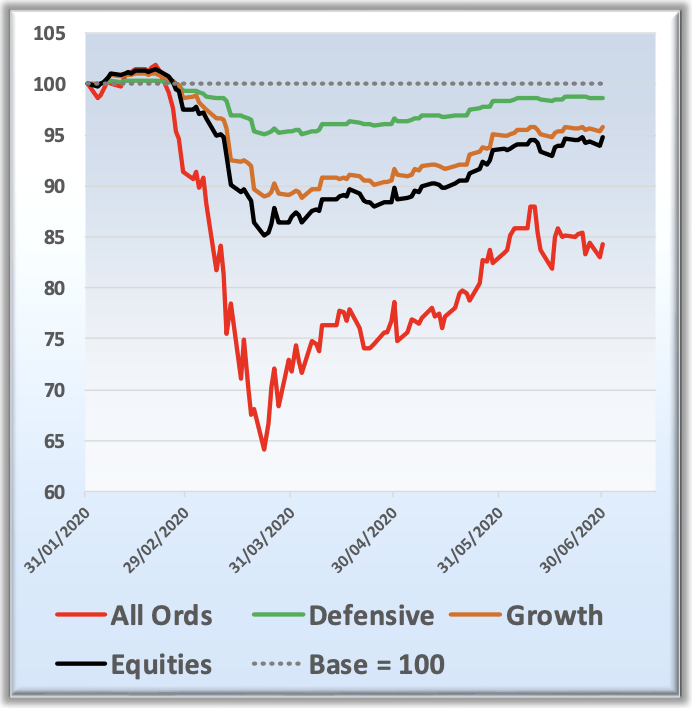

The longer term problem, one which has gotten lost in the noise, is interest rates. The chart below shows movement in interest rates as measured by 6-month bank bills in red, compared with inflation since the start of 2000.

Whereas for most of the time interest rates have provided a positive “real” return – that is, comfortably above inflation – clearly the world has changed, and is probably not changing back any time soon.

Our strategy has long been underpinned by a core of bank and term deposits, providing a buffer of safety for the portfolios while generating positive real returns. That now requires a re-think, as it seems unconscionable to condemn investors to negative real returns for large slabs of their portfolio.

We have some time up our sleeve as we are still holding many millions in long-dated deposits taken out in the good old days. But a major challenge will be what to replace them with on maturity that does not seriously compromise investors’ risk exposure.

So, who’s got what?

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

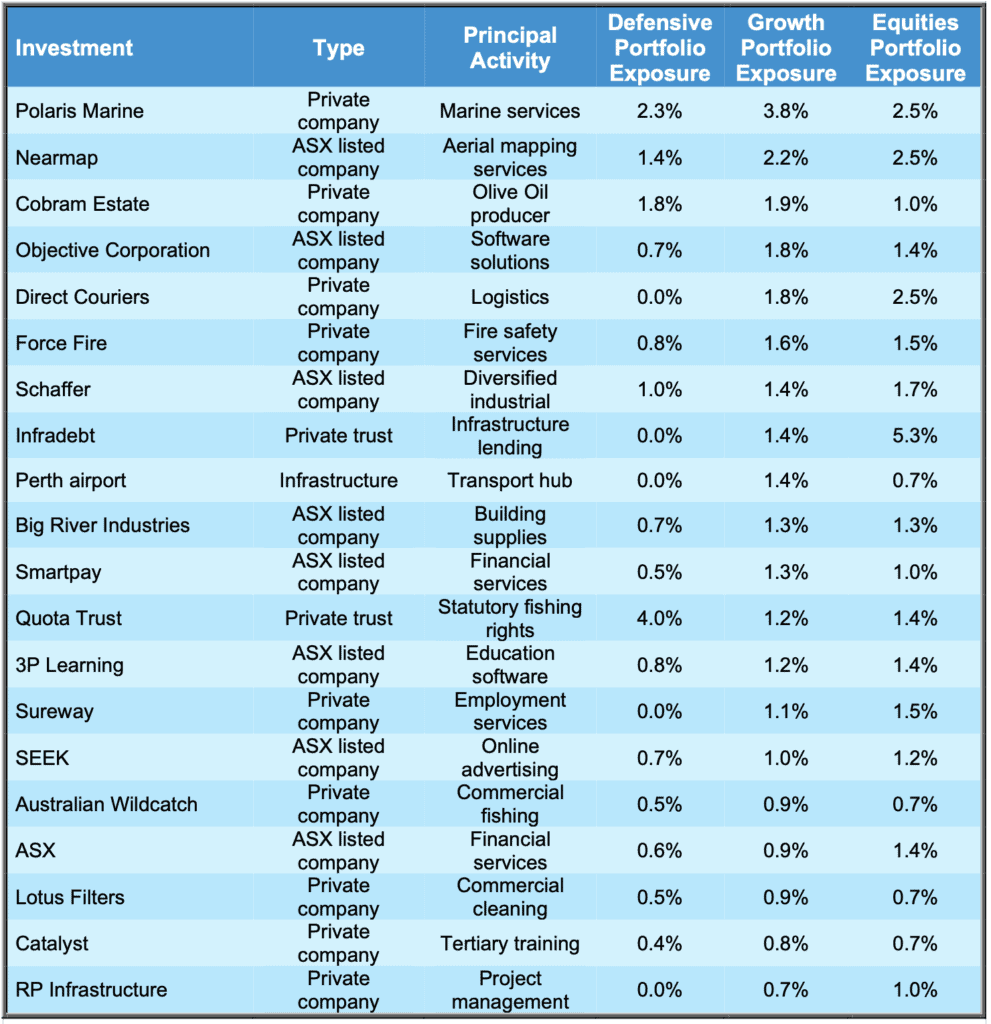

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). The information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. The PDS is available by contacting ARA Consultants by phone at (03) 9853 1688 or email info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: July 2020 Investment Update.