Happy New Year everyone, best wishes for a safe and prosperous(!) 2018.

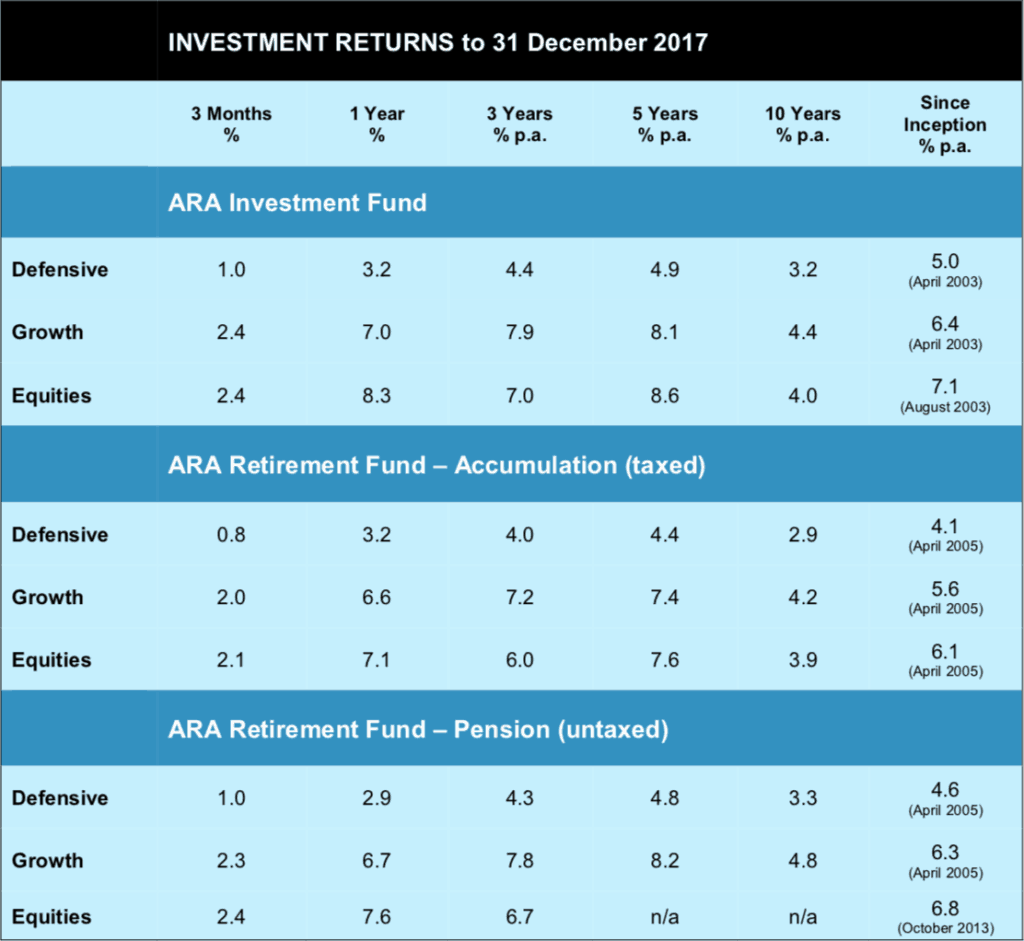

The December quarter proved to be solid and uneventful, allowing the portfolios to round out the year with a respectable result given that, by design, all are holding lots of cash.

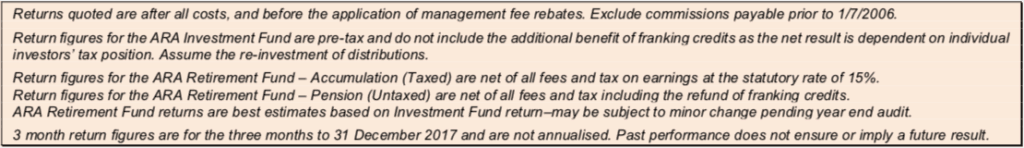

Over the year, on average Defensive held 75% in cash and term deposits, Growth 40% and Equities 25%. This is intentionally on the high side, reflecting a reluctance to wade into risk assets when markets seem on the frothy side. While they keep going up, yes there’s some opportunity cost. That’s the insurance premium for trying to limit the damage if things turn sour.

The fact that the portfolios have all comfortably outperformed their targets for the year means that on the whole the risk assets must have done their job, without too many problem areas.

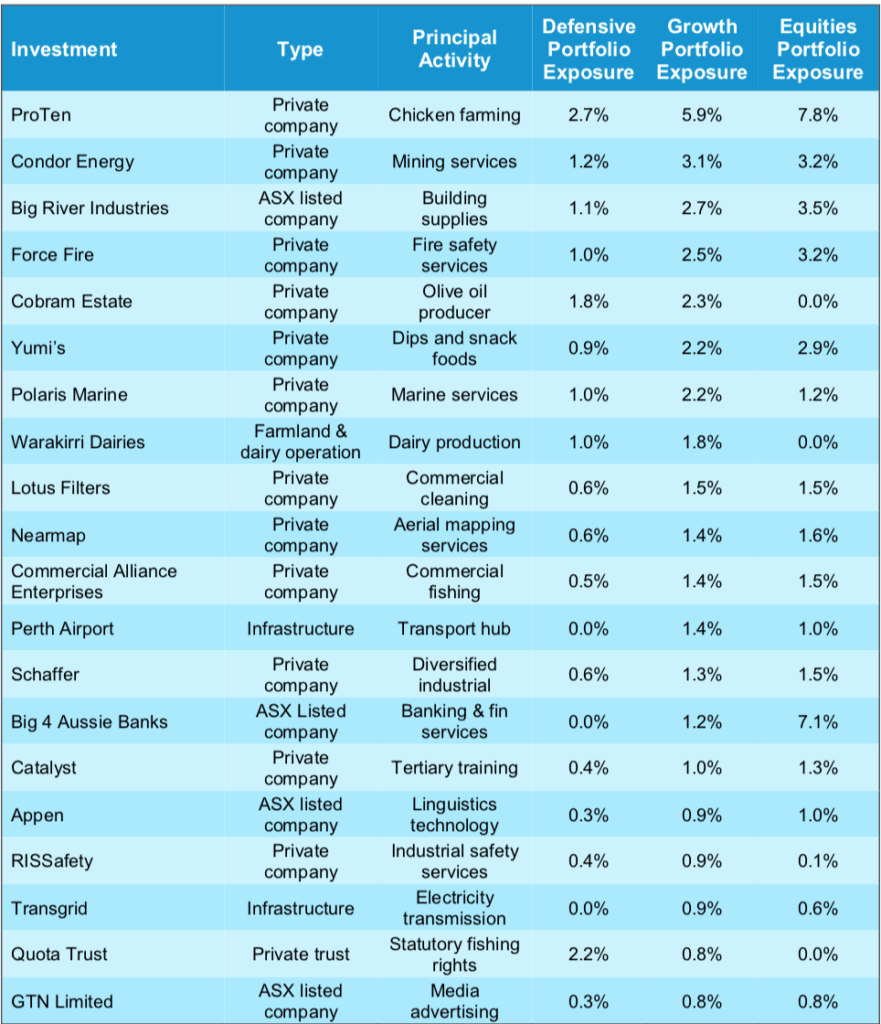

Alert readers will see a new name or two in the table of major holdings on page 4. In particular:

Force Fire

Force Fire designs, installs, maintains and repairs fire safety systems, mainly for commercial clients such as shopping centres, nursing homes and day care centres. The company has about 100 employees, and sales last year of approx. $50 million.

The fire safety industry is worth about $2.4 billion in annual sales and is highly fragmented, so offers great opportunity for growth and consolidation for a committed player. As is Anacacia’s typical approach, it has taken a large stake in the business, co- investing alongside the previous owners and senior management team.

Client Night - Heads Up

And there is a neat segue, to an early notice of the next Investor Update.

The last couple of times we’ve run multiple sessions in our new office in Kew. This time it’s back to Leonda for the big show approach.

And speaking of Anacacia, we’re very pleased to advise that Anacacia CEO and founder Jeremy Samuel has agreed to join us for the evening.

For more than ten years now Anacacia funds have been core investments of the ARA Investment suite, and rank among the most successful investments we’ve made.

The stories of Rafferty’s Garden, Appen, Yumi’s and others belong in the textbook of successful investing. No wonder he’s smiling!

Mark the date: Monday March 5 at Leonda in Melbourne. Invitations forthcoming.

We will also come to Shepparton in early-Mid March, unfortunately without Jeremy. Details TBA.

So, who's got what?

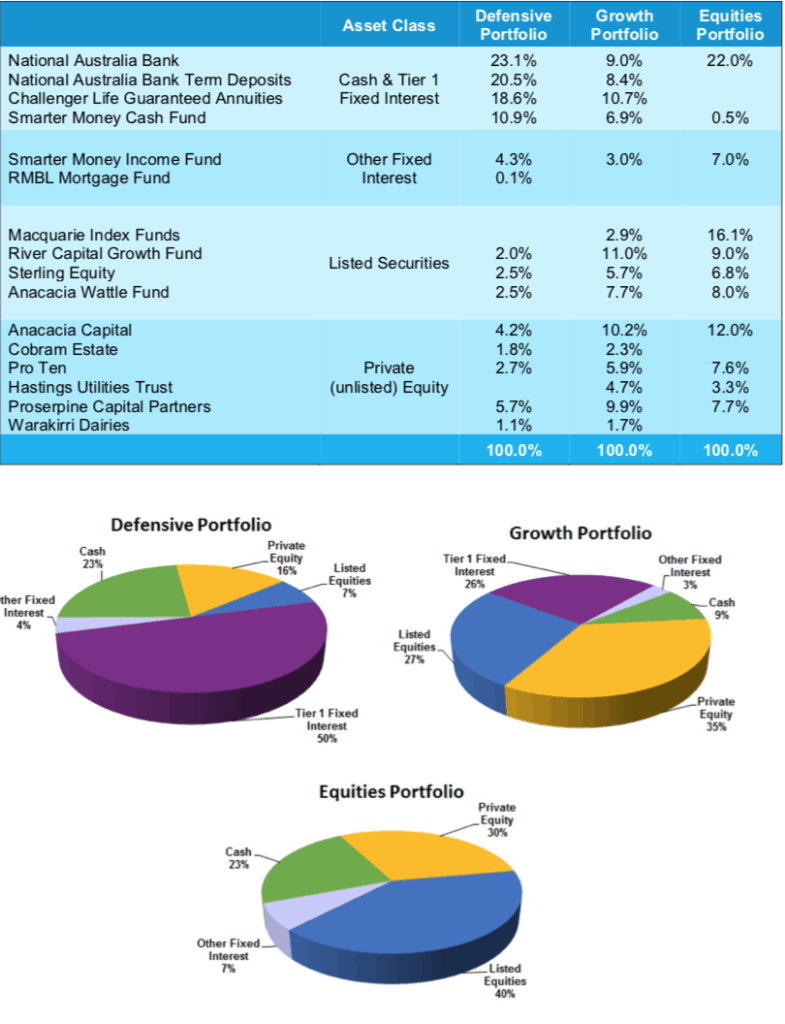

The table below shows the ARAIF’s investments as at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings

Apart from bank deposits and other interest-bearing accounts, the Fund invests in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the return of your portfolio.

Market Musings

Scene: Coffee shop in Kew, having a breakfast meeting with one of the fund’s investment advisers. A McLaren sports car drives past in the peak hour traffic – half a million dollars’ worth, give or take a couple of Corollas. My colleague’s comment: “The market must be near its peak”.

Now we don’t want to sound like people whosee a market crash around every corner, but there are some weird goings on out there. In fact the last eight years or so have been characterised by extremely loose monetary policy, accompanied by ultra-low interestrates, driving “investors” into all sorts of otherassets and creating what it’s hard to interpretas anything other than distortions.

Exhibit One

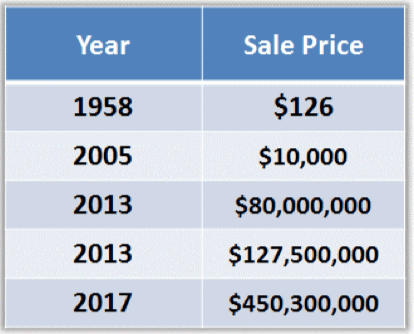

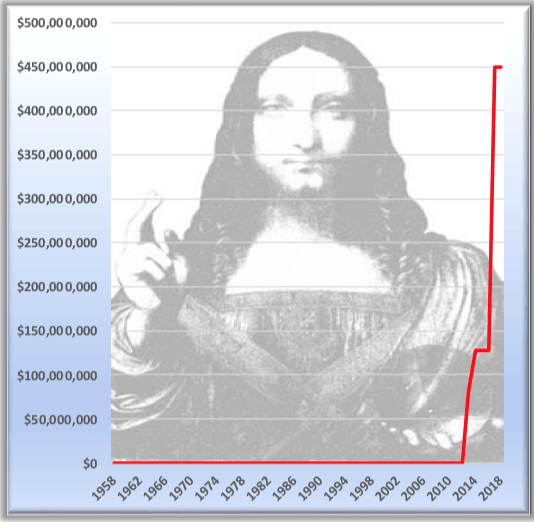

You may have read about the painting, supposedly the only privately-owned Da Vinci work outside of museums or institutions, that sold last year for a record $450,300,000.

What is less well-known is that in 1958 (admittedly when the painting was credited to a Da Vinci student), the same painting sold for $126. The table below shows its history of sales since then.

Even allowing for inflation, and the fact it’s now credited to old Leo himself, that’s a fancy pricerise in the last five years. Someone reallydoesn’t want to be holding cash.

Bitcoin

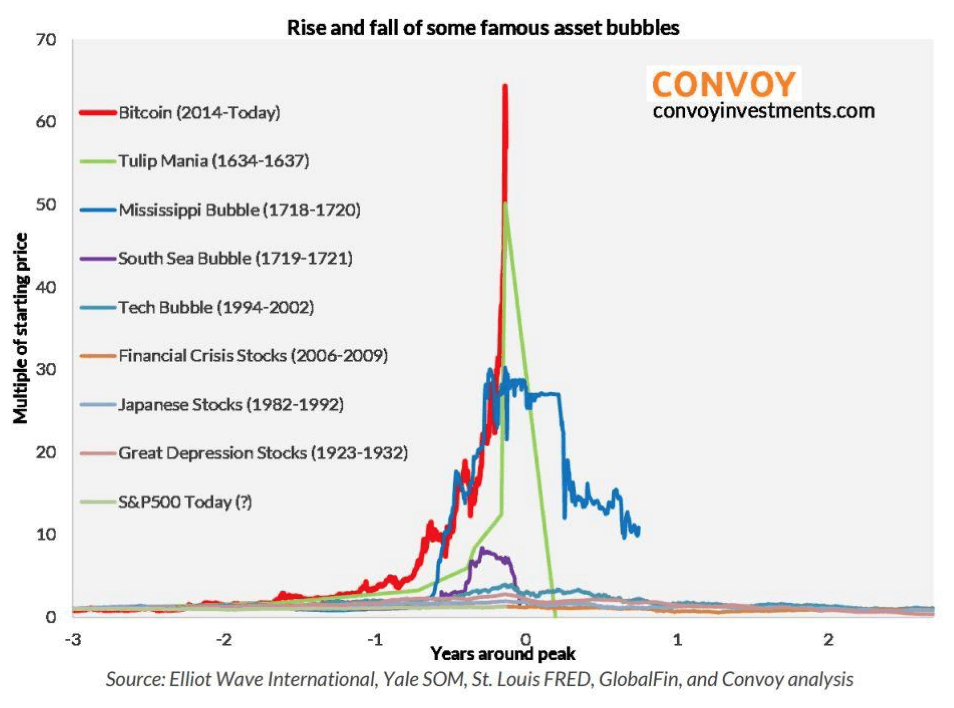

The most well-known, if not well understood, of the crop of crypto-currencies. These are virtual currencies not backed by paper promises or hard assets such as gold, and which allow transactions to take place withoutinvolving a bank. (Who’d have thought thatwould catch on?).

Anyway, learned opinion now ranks Bitcoin’srise as the greatest asset price bubble in history, eclipsing celebrated mania such as Dutch Tulips (yes, tulips!) and the South Seas bubble.

“South Seas” was a British public-private partnership which among other things conferred monopoly rights to the company to trade with South America. Its boom and bust bankrupted many citizens at the time, including the otherwise somewhat brainy Sir Isaac Newton, prompting his famous quote:

From the sublime to the …??

Late last year French company Veolia Environment SA, a former water and wastewater treatment facility turned global media conglomerate, successfully raised 500 million Euros from investors (perhaps using the term a little loosely). Briefly,

- Veolia is rated BBB or less by Moodys and S&P, putting it lower than investment grade but slightly above “junk” status.

- The investment is in 3-year interest bearing notes that are unsecured and pay a yield of minus a quarter of a per cent.

That’s right – investors to the tune of half a billion Euros (or about 1,600 McLarens) have taken up the once-in-a-lifetime offer to give their money to a sub-investment grade company, unsecured, knowing that if the investment proceeds according to plan they will at best lose a quarter of a per cent per annum.

These snippets started out as a bit of fun, inan “Odd Spot” sort of way, but there is aserious side. Be careful out there.

In other news for the December Quarter…

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. The information contained in this document is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, ARA does not accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs and reviewing the Product Disclosure Statement. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.